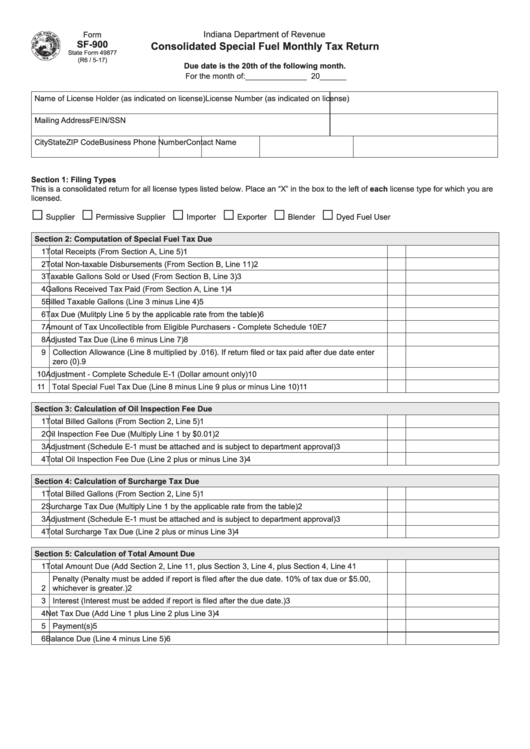

Indiana Department of Revenue

Form

SF-900

Consolidated Special Fuel Monthly Tax Return

State Form 49877

(R6 / 5-17)

Due date is the 20th of the following month.

For the month of:______________ 20______

Name of License Holder (as indicated on license)

License Number (as indicated on license)

Mailing Address

FEIN/SSN

City

State

ZIP Code

Business Phone Number Contact Name

Section 1: Filing Types

This is a consolidated return for all license types listed below. Place an “X” in the box to the left of each license type for which you are

licensed.

□

□

□

□

□

□

Supplier

Permissive Supplier

Importer

Exporter

Blender

Dyed Fuel User

Section 2: Computation of Special Fuel Tax Due

1 Total Receipts (From Section A, Line 5)

1

2 Total Non-taxable Disbursements (From Section B, Line 11)

2

3 Taxable Gallons Sold or Used (From Section B, Line 3)

3

4 Gallons Received Tax Paid (From Section A, Line 1)

4

5 Billed Taxable Gallons (Line 3 minus Line 4)

5

6 Tax Due (Mulitply Line 5 by the applicable rate from the table)

6

7 Amount of Tax Uncollectible from Eligible Purchasers - Complete Schedule 10E

7

8 Adjusted Tax Due (Line 6 minus Line 7)

8

9 Collection Allowance (Line 8 multiplied by .016). If return filed or tax paid after due date enter

zero (0).

9

10 Adjustment - Complete Schedule E-1 (Dollar amount only)

10

11 Total Special Fuel Tax Due (Line 8 minus Line 9 plus or minus Line 10)

11

Section 3: Calculation of Oil Inspection Fee Due

1 Total Billed Gallons (From Section 2, Line 5)

1

2 Oil Inspection Fee Due (Multiply Line 1 by $0.01)

2

3 Adjustment (Schedule E-1 must be attached and is subject to department approval)

3

4 Total Oil Inspection Fee Due (Line 2 plus or minus Line 3)

4

Section 4: Calculation of Surcharge Tax Due

1 Total Billed Gallons (From Section 2, Line 5)

1

2 Surcharge Tax Due (Multiply Line 1 by the applicable rate from the table)

2

3 Adjustment (Schedule E-1 must be attached and is subject to department approval)

3

4 Total Surcharge Tax Due (Line 2 plus or minus Line 3)

4

Section 5: Calculation of Total Amount Due

1 Total Amount Due (Add Section 2, Line 11, plus Section 3, Line 4, plus Section 4, Line 4

1

Penalty (Penalty must be added if report is filed after the due date. 10% of tax due or $5.00,

2

whichever is greater.)

2

3 Interest (Interest must be added if report is filed after the due date.)

3

4 Net Tax Due (Add Line 1 plus Line 2 plus Line 3)

4

5 Payment(s)

5

6 Balance Due (Line 4 minus Line 5)

6

1

1 2

2 3

3 4

4