Form Rp-305-P - Agricultural Assessment Payment Calculation Worksheet

ADVERTISEMENT

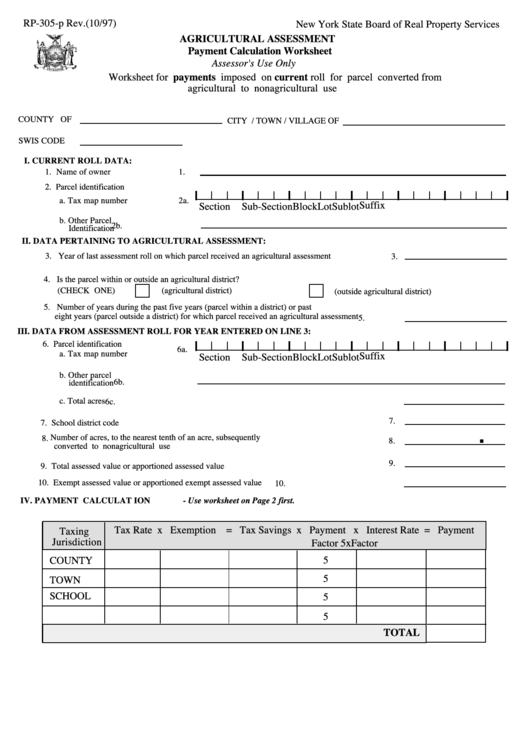

RP-305-p Rev.(10/97)

New York State Board of Real Property Services

AGRICULTURAL ASSESSMENT

Payment Calculation Worksheet

Assessor's Use Only

Worksheet for payments imposed on current roll for parcel converted from

agricultural to nonagricultural use

COUNTY OF

CITY / TOWN / VILLAGE OF

SWIS CODE

I. CURRENT ROLL DATA:

1. Name of owner

1.

2. Parcel identification

a. Tax map number

2a.

Suffix

Section

Sub-Section

Block

Lot

Sublot

b. Other Parcel

2b.

Identification

II. DATA PERTAINING TO AGRICULTURAL ASSESSMENT:

3. Year of last assessment roll on which parcel received an agricultural assessment

3.

4. Is the parcel within or outside an agricultural district?

(CHECK ONE)

(agricultural district)

(outside agricultural district)

5. Number of years during the past five years (parcel within a district) or past

eight years (parcel outside a district) for which parcel received an agricultural assessment

5.

III. DATA FROM ASSESSMENT ROLL FOR YEAR ENTERED ON LINE 3:

6. Parcel identification

6a.

a. Tax map number

Suffix

Section

Sub-Section

Block

Lot

Sublot

b. Other parcel

6b.

identification

c. Total acres

6c.

7.

7. School district code

Number of acres, to the nearest tenth of an acre, subsequently

8.

8.

converted to nonagricultural use

9.

9. Total assessed value or apportioned assessed value

10. Exempt assessed value or apportioned exempt assessed value

10.

IV. PAYMENT CALCULAT ION

- Use worksheet on Page 2 first.

Tax Rate x Exemption = Tax Savings x Payment x Interest Rate = Payment

Taxing

Jurisdiction

Factor 5x

Factor

5

COUNTY

5

TOWN

SCHOOL

5

5

TOTAL

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2