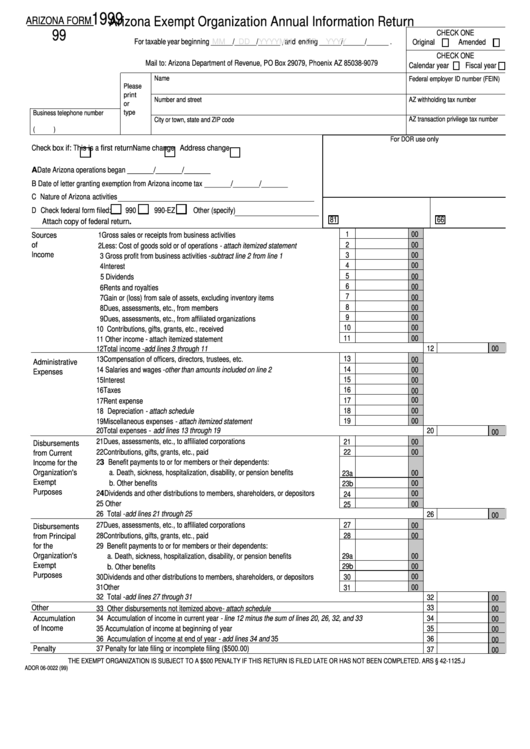

Form 99 - Arizona Exempt Organization Annual Information Return - 1999

ADVERTISEMENT

1999

Arizona Exempt Organization Annual Information Return

ARIZONA FORM

99

CHECK ONE

For taxable year beginning ______/______/______ , and ending ______/______/______ .

Original

Amended

MM

DD

YYYY

MM

DD

YYYY

CHECK ONE

Mail to: Arizona Department of Revenue, PO Box 29079, Phoenix AZ 85038-9079

Calendar year

Fiscal year

Name

Federal employer ID number (FEIN)

Please

print

Number and street

AZ withholding tax number

or

type

Business telephone number

AZ transaction privilege tax number

City or town, state and ZIP code

(

)

For DOR use only

Check box if:

This is a first return

Name change

Address change

A Date Arizona operations began ______/______/______

B Date of letter granting exemption from Arizona income tax ______/______/______

C Nature of Arizona activities

D Check federal form filed:

990

990-EZ

Other (specify)

81

66

Attach copy of federal return.

1

00

Sources

1 Gross sales or receipts from business activities ....................................................

of

00

2

2 Less: Cost of goods sold or of operations - attach itemized statement .................

Income

00

3

3 Gross profit from business activities - subtract line 2 from line 1 ...........................

00

4

4 Interest ...................................................................................................................

5

00

5 Dividends ...............................................................................................................

6

00

6 Rents and royalties ................................................................................................

7

00

7 Gain or (loss) from sale of assets, excluding inventory items ................................

8

00

8 Dues, assessments, etc., from members ...............................................................

00

9

9 Dues, assessments, etc., from affiliated organizations ..........................................

00

10

10 Contributions, gifts, grants, etc., received ..............................................................

00

11

11 Other income - attach itemized statement .............................................................

00

12 Total income - add lines 3 through 11 ...................................................................................................................

12

13 Compensation of officers, directors, trustees, etc. .................................................

13

00

Administrative

14 Salaries and wages - other than amounts included on line 2 ...............................

14

00

Expenses

15 Interest ...................................................................................................................

15

00

16 Taxes .....................................................................................................................

16

00

00

17 Rent expense .........................................................................................................

17

00

18 Depreciation - attach schedule ..............................................................................

18

00

19 Miscellaneous expenses - attach itemized statement ............................................

19

20 Total expenses - add lines 13 through 19 .............................................................................................................

20

00

21 Dues, assessments, etc., to affiliated corporations ................................................

00

21

Disbursements

22 Contributions, gifts, grants, etc., paid .....................................................................

00

22

from Current

23 Benefit payments to or for members or their dependents:

Income for the

Organization's

a. Death, sickness, hospitalization, disability, or pension benefits .........................

00

23a

Exempt

b. Other benefits ....................................................................................................

00

23b

Purposes

24 Dividends and other distributions to members, shareholders, or depositors .........

00

24

25 Other ......................................................................................................................

00

25

26 Total - add lines 21 through 25 .............................................................................................................................

26

00

27 Dues, assessments, etc., to affiliated corporations ................................................

27

00

Disbursements

28 Contributions, gifts, grants, etc., paid .....................................................................

28

from Principal

00

for the

29 Benefit payments to or for members or their dependents:

Organization's

a. Death, sickness, hospitalization, disability, or pension benefits .........................

29a

00

Exempt

29b

b. Other benefits ....................................................................................................

00

Purposes

30 Dividends and other distributions to members, shareholders, or depositors .........

30

00

31 Other ......................................................................................................................

00

31

32 Total - add lines 27 through 31 .............................................................................................................................

32

00

Other

33

33 Other disbursements not itemized above - attach schedule .................................................................................

00

Accumulation

34 Accumulation of income in current year - line 12 minus the sum of lines 20, 26, 32, and 33 ...............................

34

00

of Income

35 Accumulation of income at beginning of year .......................................................................................................

35

00

36 Accumulation of income at end of year - add lines 34 and 35 ..............................................................................

36

00

Penalty

37 Penalty for late filing or incomplete filing ($500.00) ..............................................................................................

37

00

THE EXEMPT ORGANIZATION IS SUBJECT TO A $500 PENALTY IF THIS RETURN IS FILED LATE OR HAS NOT BEEN COMPLETED. ARS § 42-1125.J

ADOR 06-0022 (99)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2