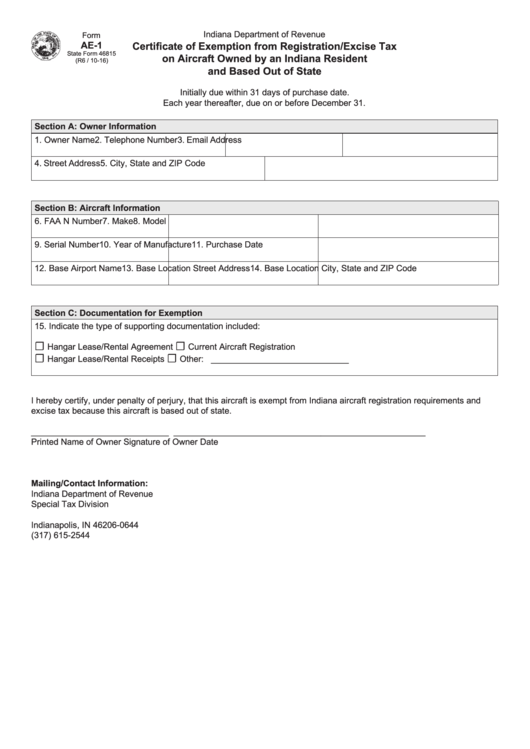

Form Ae-1 - Certificate Of Exemption From Registration/excise Tax On Aircraft Owned By An Indiana Resident And Based Out Of State - Department Of Revenue

ADVERTISEMENT

Indiana Department of Revenue

Form

AE-1

Certificate of Exemption from Registration/Excise Tax

State Form 46815

on Aircraft Owned by an Indiana Resident

(R6 / 10-16)

and Based Out of State

Initially due within 31 days of purchase date.

Each year thereafter, due on or before December 31.

Section A: Owner Information

1. Owner Name

2. Telephone Number

3. Email Address

4. Street Address

5. City, State and ZIP Code

Section B: Aircraft Information

6. FAA N Number

7. Make

8. Model

9. Serial Number

10. Year of Manufacture

11. Purchase Date

12. Base Airport Name

13. Base Location Street Address

14. Base Location City, State and ZIP Code

Section C: Documentation for Exemption

15. Indicate the type of supporting documentation included:

☐

☐

Hangar Lease/Rental Agreement

Current Aircraft Registration

☐

☐

Hangar Lease/Rental Receipts

Other: _____________________________

I hereby certify, under penalty of perjury, that this aircraft is exempt from Indiana aircraft registration requirements and

excise tax because this aircraft is based out of state.

_____________________________

_______________________________

______________________

Printed Name of Owner

Signature of Owner

Date

Mailing/Contact Information:

Indiana Department of Revenue

Special Tax Division

P.O. Box 644

Indianapolis, IN 46206-0644

(317) 615-2544

aircrafttax@dor.in.gov

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1