Instructions For Form Boe-566-J - Oil, Gas And Geothermal Personal Property Statement

ADVERTISEMENT

BOE-566-J (BACK) REV. 6 (8-06)

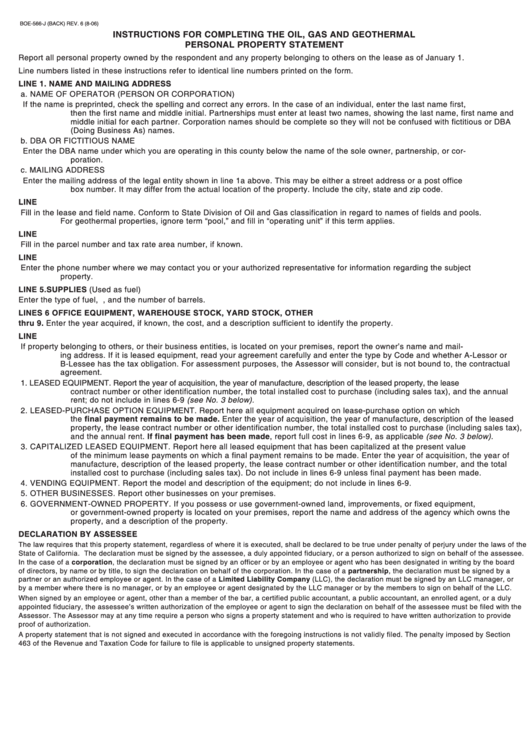

INSTRUCTIONS FOR COMPLETING THE OIL, GAS AND GEOTHERMAL

PERSONAL PROPERTY STATEMENT

Report all personal property owned by the respondent and any property belonging to others on the lease as of January 1.

Line numbers listed in these instructions refer to identical line numbers printed on the form.

LINE 1.

NAME AND MAILING ADDRESS

a. NAME OF OPERATOR (PERSON OR CORPORATION)

If the name is preprinted, check the spelling and correct any errors. In the case of an individual, enter the last name first,

then the first name and middle initial. Partnerships must enter at least two names, showing the last name, first name and

middle initial for each partner. Corporation names should be complete so they will not be confused with fictitious or DBA

(Doing Business As) names.

b. DBA OR FICTITIOUS NAME

Enter the DBA name under which you are operating in this county below the name of the sole owner, partnership, or cor-

poration.

c. MAILING ADDRESS

Enter the mailing address of the legal entity shown in line 1a above. This may be either a street address or a post office

box number. It may differ from the actual location of the property. Include the city, state and zip code.

LINE 2.

LOCATION OF THE PROPERTY

Fill in the lease and field name. Conform to State Division of Oil and Gas classification in regard to names of fields and pools.

For geothermal properties, ignore term “pool,” and fill in “operating unit” if this term applies.

LINE 3.

PARCEL NUMBER

Fill in the parcel number and tax rate area number, if known.

LINE 4.

PHONE NUMBER

Enter the phone number where we may contact you or your authorized representative for information regarding the subject

property.

LINE 5.

SUPPLIES (Used as fuel)

Enter the type of fuel, A.P.I. gravity, and the number of barrels.

LINES 6

OFFICE EQUIPMENT, WAREHOUSE STOCK, YARD STOCK, OTHER

thru 9.

Enter the year acquired, if known, the cost, and a description sufficient to identify the property.

LINE 10.

DECLARATION OF PROPERTY BELONGING TO OTHERS

If property belonging to others, or their business entities, is located on your premises, report the owner’s name and mail-

ing address. If it is leased equipment, read your agreement carefully and enter the type by Code and whether A-Lessor or

B-Lessee has the tax obligation. For assessment purposes, the Assessor will consider, but is not bound to, the contractual

agreement.

1. LEASED EQUIPMENT. Report the year of acquisition, the year of manufacture, description of the leased property, the lease

contract number or other identification number, the total installed cost to purchase (including sales tax), and the annual

rent; do not include in lines 6-9 (see No. 3 below).

2. LEASED-PURCHASE OPTION EQUIPMENT. Report here all equipment acquired on lease-purchase option on which

the final payment remains to be made. Enter the year of acquisition, the year of manufacture, description of the leased

property, the lease contract number or other identification number, the total installed cost to purchase (including sales tax),

and the annual rent. If final payment has been made, report full cost in lines 6-9, as applicable (see No. 3 below).

3. CAPITALIZED LEASED EQUIPMENT. Report here all leased equipment that has been capitalized at the present value

of the minimum lease payments on which a final payment remains to be made. Enter the year of acquisition, the year of

manufacture, description of the leased property, the lease contract number or other identification number, and the total

installed cost to purchase (including sales tax). Do not include in lines 6-9 unless final payment has been made.

4. VENDING EQUIPMENT. Report the model and description of the equipment; do not include in lines 6-9.

5. OTHER BUSINESSES. Report other businesses on your premises.

6. GOVERNMENT-OWNED PROPERTY. If you possess or use government-owned land, improvements, or fixed equipment,

or government-owned property is located on your premises, report the name and address of the agency which owns the

property, and a description of the property.

DECLARATION BY ASSESSEE

The law requires that this property statement, regardless of where it is executed, shall be declared to be true under penalty of perjury under the laws of the

State of California. The declaration must be signed by the assessee, a duly appointed fiduciary, or a person authorized to sign on behalf of the assessee.

In the case of a corporation, the declaration must be signed by an officer or by an employee or agent who has been designated in writing by the board

of directors, by name or by title, to sign the declaration on behalf of the corporation. In the case of a partnership, the declaration must be signed by a

partner or an authorized employee or agent. In the case of a Limited Liability Company (LLC), the declaration must be signed by an LLC manager, or

by a member where there is no manager, or by an employee or agent designated by the LLC manager or by the members to sign on behalf of the LLC.

When signed by an employee or agent, other than a member of the bar, a certified public accountant, a public accountant, an enrolled agent, or a duly

appointed fiduciary, the assessee’s written authorization of the employee or agent to sign the declaration on behalf of the assessee must be filed with the

Assessor. The Assessor may at any time require a person who signs a property statement and who is required to have written authorization to provide

proof of authorization.

A property statement that is not signed and executed in accordance with the foregoing instructions is not validly filed. The penalty imposed by Section

463 of the Revenue and Taxation Code for failure to file is applicable to unsigned property statements.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1