Michigan Income Tax Withholding Tables Weekly Payroll Period

ADVERTISEMENT

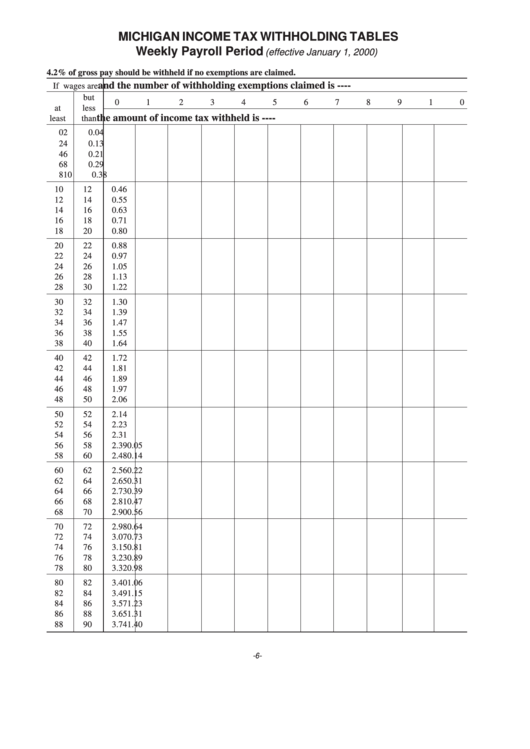

MICHIGAN INCOME TAX WITHHOLDING TABLES

Weekly Payroll Period

(effective January 1, 2000)

4.2% of gross pay should be withheld if no exemptions are claimed.

and the number of withholding exemptions claimed is ----

If wages are

but

0

1

2

3

4

5

6

7

8

9

10

at

less

the amount of income tax withheld is ----

least

than

0

2

0.04

2

4

0.13

4

6

0.21

6

8

0.29

8

10

0.38

10

12

0.46

12

14

0.55

14

16

0.63

16

18

0.71

18

20

0.80

20

22

0.88

22

24

0.97

24

26

1.05

26

28

1.13

28

30

1.22

30

32

1.30

32

34

1.39

34

36

1.47

36

38

1.55

38

40

1.64

40

42

1.72

42

44

1.81

44

46

1.89

46

48

1.97

48

50

2.06

50

52

2.14

52

54

2.23

54

56

2.31

56

58

2.39

0.05

58

60

2.48

0.14

60

62

2.56

0.22

62

64

2.65

0.31

64

66

2.73

0.39

66

68

2.81

0.47

68

70

2.90

0.56

70

72

2.98

0.64

72

74

3.07

0.73

74

76

3.15

0.81

76

78

3.23

0.89

78

80

3.32

0.98

80

82

3.40

1.06

82

84

3.49

1.15

84

86

3.57

1.23

86

88

3.65

1.31

88

90

3.74

1.40

-6-

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18