Instructions For Uct-6a - Employer'S Quarterly Report Continuation Sheet

ADVERTISEMENT

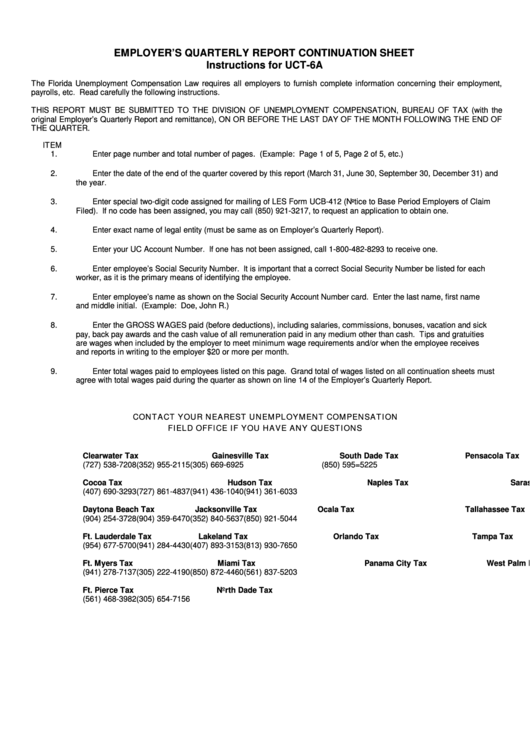

EMPLOYER’ S QUARTERLY REPORT CONTINUATION SHEET

Instructions for UCT-6A

The Florida Unemployment Compensation Law requires all employers to furnish complete information concerning their employment,

payrolls, etc. Read carefully the following instructions.

THIS REPORT MUST BE SUBMITTED TO THE DIVISION OF UNEMPLOYMENT COMPENSATION, BUREAU OF TAX (with the

original Employer’ s Quarterly Report and remittance), ON OR BEFORE THE LAST DAY OF THE MONTH FOLLOWING THE END OF

THE QUARTER.

ITEM

1.

Enter page number and total number of pages. (Example: Page 1 of 5, Page 2 of 5, etc.)

2.

Enter the date of the end of the quarter covered by this report (March 31, June 30, September 30, December 31) and

the year.

3.

Enter special two-digit code assigned for mailing of LES Form UCB-412 (Notice to Base Period Employers of Claim

Filed). If no code has been assigned, you may call (850) 921-3217, to request an application to obtain one.

4.

Enter exact name of legal entity (must be same as on Employer’ s Quarterly Report).

5.

Enter your UC Account Number. If one has not been assigned, call 1-800-482-8293 to receive one.

6.

Enter employee’ s Social Security Number. It is important that a correct Social Security Number be listed for each

worker, as it is the primary means of identifying the employee.

7.

Enter employee’ s name as shown on the Social Security Account Number card. Enter the last name, first name

and middle initial. (Example: Doe, John R.)

8.

Enter the GROSS WAGES paid (before deductions), including salaries, commissions, bonuses, vacation and sick

pay, back pay awards and the cash value of all remuneration paid in any medium other than cash. Tips and gratuities

are wages when included by the employer to meet minimum wage requirements and/or when the employee receives

and reports in writing to the employer $20 or more per month.

9.

Enter total wages paid to employees listed on this page. Grand total of wages listed on all continuation sheets must

agree with total wages paid during the quarter as shown on line 14 of the Employer’ s Quarterly Report.

CONTACT YOUR NEAREST UNEMPLOYMENT COMPENSATION

FIELD OFFICE IF YOU HAVE ANY QUESTIONS

Clearwater Tax

Gainesville Tax

South Dade Tax

Pensacola Tax

(727) 538-7208

(352) 955-2115

(305) 669-6925

(850) 595=5225

Cocoa Tax

Hudson Tax

Naples Tax

Sarasota Tax

(407) 690-3293

(727) 861-4837

(941) 436-1040

(941) 361-6033

Daytona Beach Tax

Jacksonville Tax

Ocala Tax

Tallahassee Tax

(904) 254-3728

(904) 359-6470

(352) 840-5637

(850) 921-5044

Ft. Lauderdale Tax

Lakeland Tax

Orlando Tax

Tampa Tax

(954) 677-5700

(941) 284-4430

(407) 893-3153

(813) 930-7650

Ft. Myers Tax

Miami Tax

Panama City Tax

West Palm Beach Tax

(941) 278-7137

(305) 222-4190

(850) 872-4460

(561) 837-5203

Ft. Pierce Tax

North Dade Tax

(561) 468-3982

(305) 654-7156

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1