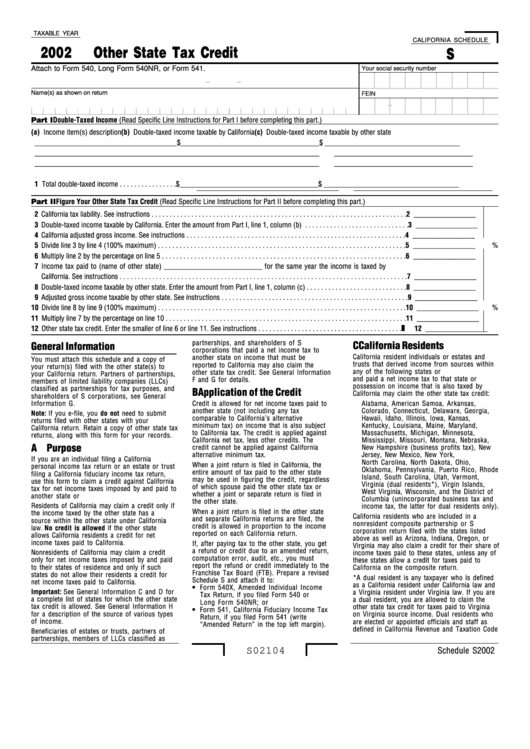

Schedule S - Other State Tax Credit - 2002

ADVERTISEMENT

TAXABLE YEAR

CALIFORNIA SCHEDULE

2002

Other State Tax Credit

S

Attach to Form 540, Long Form 540NR, or Form 541.

Your social security number

-

-

Name(s) as shown on return

FEIN

-

Part I Double-Taxed Income (Read Specific Line Instructions for Part I before completing this part.)

(a) Income item(s) description

(b) Double-taxed income taxable by California

(c) Double-taxed income taxable by other state

_______________________________________

$ ______________________________________

$ _____________________________________

_______________________________________

_______________________________________

______________________________________

_______________________________________

_______________________________________

______________________________________

1 Total double-taxed income . . . . . . . . . . . . . . . .

$ ______________________________________

$ _____________________________________

_______________________________________

______________________________________

Part II Figure Your Other State Tax Credit (Read Specific Line Instructions for Part II before completing this part.)

2 California tax liability. See instructions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

2 _________________

3 Double-taxed income taxable by California. Enter the amount from Part I, line 1, column (b) . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

3 _________________

4 California adjusted gross income. See instructions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

4 ________________

5 Divide line 3 by line 4 (100% maximum) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

5 ________________

%

6 Multiply line 2 by the percentage on line 5 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

6 ________________

7 Income tax paid to (name of other state) ___________________________ for the same year the income is taxed by

California. See instructions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

7 _________________

8 Double-taxed income taxable by other state. Enter the amount from Part I, line 1, column (c) . . . . . . . . . . . . . . . . . . . . . . . . . . . .

8 _________________

9 Adjusted gross income taxable by other state. See instructions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

9 _________________

10 Divide line 8 by line 9 (100% maximum) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

10 _________________

%

11 Multiply line 7 by the percentage on line 10 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

11 _________________

12 Other state tax credit. Enter the smaller of line 6 or line 11. See instructions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

12 _________________

partnerships, and shareholders of S

C California Residents

General Information

corporations that paid a net income tax to

California resident individuals or estates and

another state on income that must be

You must attach this schedule and a copy of

trusts that derived income from sources within

reported to California may also claim the

your return(s) filed with the other state(s) to

any of the following states or U.S. possessions

other state tax credit. See General Information

your California return. Partners of partnerships,

and paid a net income tax to that state or U.S.

F and G for details.

members of limited liability companies (LLCs)

possession on income that is also taxed by

classified as partnerships for tax purposes, and

B Application of the Credit

California may claim the other state tax credit:

shareholders of S corporations, see General

Information G.

Credit is allowed for net income taxes paid to

Alabama, American Samoa, Arkansas,

another state (not including any tax

Colorado, Connecticut, Delaware, Georgia,

Note: If you e-file, you do not need to submit

comparable to California’s alternative

Hawaii, Idaho, Illinois, Iowa, Kansas,

returns filed with other states with your

minimum tax) on income that is also subject

Kentucky, Louisiana, Maine, Maryland,

California return. Retain a copy of other state tax

to California tax. The credit is applied against

Massachusetts, Michigan, Minnesota,

returns, along with this form for your records.

California net tax, less other credits. The

Mississippi, Missouri, Montana, Nebraska,

A Purpose

credit cannot be applied against California

New Hampshire (business profits tax), New

alternative minimum tax.

Jersey, New Mexico, New York,

If you are an individual filing a California

North Carolina, North Dakota, Ohio,

When a joint return is filed in California, the

personal income tax return or an estate or trust

Oklahoma, Pennsylvania, Puerto Rico, Rhode

entire amount of tax paid to the other state

filing a California fiduciary income tax return,

Island, South Carolina, Utah, Vermont,

may be used in figuring the credit, regardless

use this form to claim a credit against California

Virginia (dual residents*), Virgin Islands,

of which spouse paid the other state tax or

tax for net income taxes imposed by and paid to

West Virginia, Wisconsin, and the District of

whether a joint or separate return is filed in

another state or U.S. possession.

Columbia (unincorporated business tax and

the other state.

Residents of California may claim a credit only if

income tax, the latter for dual residents only).

When a joint return is filed in the other state

the income taxed by the other state has a

California residents who are included in a

and separate California returns are filed, the

source within the other state under California

nonresident composite partnership or S

credit is allowed in proportion to the income

law. No credit is allowed if the other state

corporation return filed with the states listed

reported on each California return.

allows California residents a credit for net

above as well as Arizona, Indiana, Oregon, or

income taxes paid to California.

If, after paying tax to the other state, you get

Virginia may also claim a credit for their share of

a refund or credit due to an amended return,

Nonresidents of California may claim a credit

income taxes paid to these states, unless any of

computation error, audit, etc., you must

only for net income taxes imposed by and paid

these states allow a credit for taxes paid to

report the refund or credit immediately to the

to their states of residence and only if such

California on the composite return.

Franchise Tax Board (FTB). Prepare a revised

states do not allow their residents a credit for

*A dual resident is any taxpayer who is defined

Schedule S and attach it to:

net income taxes paid to California.

as a California resident under California law and

• Form 540X, Amended Individual Income

Important: See General Information C and D for

a Virginia resident under Virginia law. If you are

Tax Return, if you filed Form 540 or

a complete list of states for which the other state

a dual resident, you are allowed to claim the

Long Form 540NR; or

tax credit is allowed. See General Information H

other state tax credit for taxes paid to Virginia

• Form 541, California Fiduciary Income Tax

for a description of the source of various types

on Virginia source income. Dual residents who

Return, if you filed Form 541 (write

of income.

are elected or appointed officials and staff as

“Amended Return” in the top left margin).

defined in California Revenue and Taxation Code

Beneficiaries of estates or trusts, partners of

partnerships, members of LLCs classified as

S02104

Schedule S 2002

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1