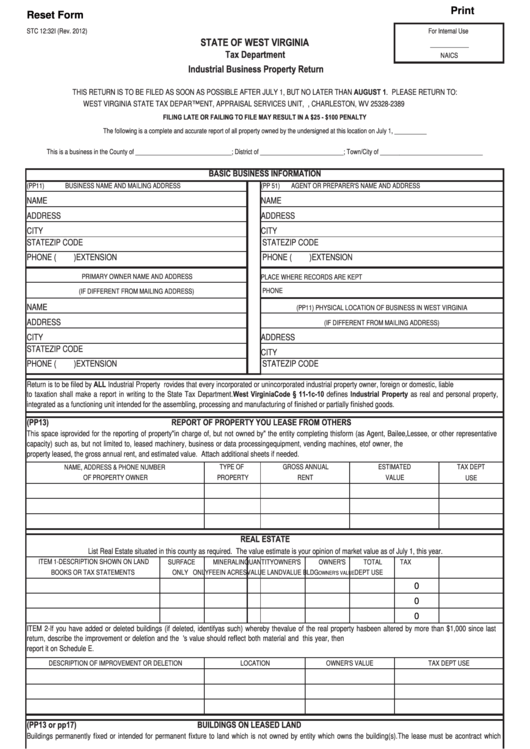

Print

Reset Form

STC 12:32I (Rev. 2012)

For Internal Use

STATE OF WEST VIRGINIA

____________

Tax Department

NAICS

Industrial Business Property Return

THIS RETURN IS TO BE FILED AS SOON AS POSSIBLE AFTER JULY 1, BUT NO LATER THAN AUGUST 1. PLEASE RETURN TO:

WEST VIRGINIA STATE TAX DEPARTMENT, APPRAISAL SERVICES UNIT, P.O. BOX 2389, CHARLESTON, WV 25328-2389

FILING LATE OR FAILING TO FILE MAY RESULT IN A $25 - $100 PENALTY

The following is a complete and accurate report of all property owned by the undersigned at this location on July 1, __________

This is a business in the County of ______________________________; District of __________________________; Town/City of ________________________________

BASIC BUSINESS INFORMATION

(PP11)

BUSINESS NAME AND MAILING ADDRESS

(PP 51)

AGENT OR PREPARER'S NAME AND ADDRESS

NAME

NAME

ADDRESS

ADDRESS

CITY

CITY

STATE

ZIP CODE

STATE

ZIP CODE

PHONE (

)

EXTENSION

PHONE (

)

EXTENSION

PRIMARY OWNER NAME AND ADDRESS

PLACE WHERE RECORDS ARE KEPT

PHONE

(IF DIFFERENT FROM MAILING ADDRESS)

NAME

(PP11) PHYSICAL LOCATION OF BUSINESS IN WEST VIRGINIA

ADDRESS

(IF DIFFERENT FROM MAILING ADDRESS)

CITY

ADDRESS

STATE

ZIP CODE

CITY

PHONE (

)

EXTENSION

STATE

ZIP CODE

Return is to be filed by ALL Industrial Property owners. The law provides that every incorporated or unincorporated industrial property owner, foreign or domestic, liable

to taxation shall make a report in writing to the State Tax Department. West Virginia Code § 11-1c-10 defines Industrial Property as real and personal property,

integrated as a functioning unit intended for the assembling, processing and manufacturing of finished or partially finished goods.

(PP13)

REPORT OF PROPERTY YOU LEASE FROM OTHERS

This space is provided for the reporting of property "in charge of, but not owned by" the entity completing this form (as Agent, Bailee, Lessee, or other representative

capacity) such as, but not limited to, leased machinery, business or data processing equipment, vending machines, etc. Indicate the name and address of owner, the

property leased, the gross annual rent, and estimated value. Attach additional sheets if needed.

NAME, ADDRESS & PHONE NUMBER

TYPE OF

GROSS ANNUAL

ESTIMATED

TAX DEPT

OF PROPERTY OWNER

PROPERTY

RENT

VALUE

USE

REAL ESTATE

List Real Estate situated in this county as required. The value estimate is your opinion of market value as of July 1, this year.

ITEM 1-DESCRIPTION SHOWN ON LAND

SURFACE

MINERAL

IN

QUANTITY

OWNER'S

OWNER'S

TOTAL

TAX

BOOKS OR TAX STATEMENTS

ONLY

ONLY

FEE

IN ACRES

VALUE LAND

VALUE BLDG

DEPT USE

OWNER'S VALUE

0

0

0

ITEM 2-If you have added or deleted buildings (if deleted, identify as such) whereby the value of the real property has been altered by more than $1,000 since last

return, describe the improvement or deletion and the location. Owner's value should reflect both material and labor. If work is in progress on July 1 of this year, then

report it on Schedule E.

DESCRIPTION OF IMPROVEMENT OR DELETION

LOCATION

OWNER'S VALUE

TAX DEPT USE

(PP13 or pp17)

BUILDINGS ON LEASED LAND

Buildings permanently fixed or intended for permanent fixture to land which is not owned by entity which owns the building(s). The lease must be a contract which

transfers ALL or PART of the right to use of the land, exclusion and disposition from owner to tenant in exchange for a promise to pay rent.

NAME AND ADDRESS OF LAND OWNER

OWNER'S VALUE BUILDING

TAX DEPT USE

NOTE: Other leasehold improvements, to be reported on SCHEDULE A, are improvements and/or additions exclusive of buildings, to leased property which have been made by the

lessee.

1

1 2

2 3

3 4

4