Form Ccft - Occupational License Fee Refund Request - 2006

ADVERTISEMENT

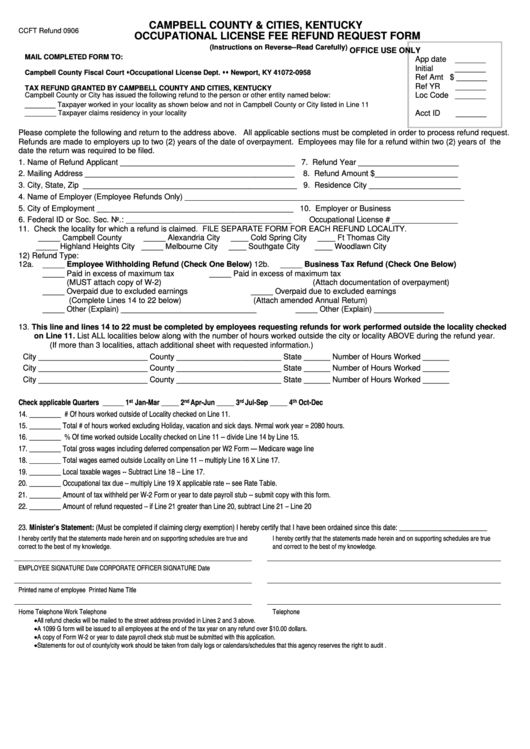

CAMPBELL COUNTY & CITIES, KENTUCKY

CCFT Refund 0906

OCCUPATIONAL LICENSE FEE REFUND REQUEST FORM

(Instructions on Reverse--Read Carefully)

OFFICE USE ONLY

MAIL COMPLETED FORM TO:

App date

_______

Initial

_______

Campbell County Fiscal Court Occupational License Dept. P.O. Box 72958 Newport, KY 41072-0958

Ref Amt $ _______

Ref YR

_______

TAX REFUND GRANTED BY CAMPBELL COUNTY AND CITIES, KENTUCKY

Loc Code _______

Campbell County or City has issued the following refund to the person or other entity named below:

_______

Taxpayer worked in your locality as shown below and not in Campbell County or City listed in Line 11

Acct ID

_______

________ Taxpayer claims residency in your locality

Please complete the following and return to the address above. All applicable sections must be completed in order to process refund request.

Refunds are made to employers up to two (2) years of the date of overpayment. Employees may file for a refund within two (2) years of the

date the return was required to be filed.

1.

Name of Refund Applicant ________________________________________ 7. Refund Year _______________________

2.

Mailing Address ________________________________________________

8. Refund Amount $___________________

3.

City, State, Zip _________________________________________________ 9. Residence City _____________________

4.

Name of Employer (Employee Refunds Only) ________________________________________________________________

5.

City of Employment _____________________________________________ 10. Employer or Business

6.

Federal ID or Soc. Sec. No.: ______________________________________

Occupational License # _______________

11. Check the locality for which a refund is claimed. FILE SEPARATE FORM FOR EACH REFUND LOCALITY.

_____ Campbell County

_____ Alexandria City

____ Cold Spring City

____ Ft Thomas City

_____ Highland Heights City _____ Melbourne City

____ Southgate City

____ Woodlawn City

12) Refund Type:

12a.

_____ Employee Withholding Refund (Check One Below)

12b.

_____ Business Tax Refund (Check One Below)

_____ Paid in excess of maximum tax

_____ Paid in excess of maximum tax

(MUST attach copy of W-2)

(Attach documentation of overpayment)

_____ Overpaid due to excluded earnings

_____ Overpaid due to excluded earnings

(Complete Lines 14 to 22 below)

(Attach amended Annual Return)

_____ Other (Explain) _______________________________

_____ Other (Explain) ________________

13. This line and lines 14 to 22 must be completed by employees requesting refunds for work performed outside the locality checked

on Line 11. List ALL localities below along with the number of hours worked outside the city or locality ABOVE during the refund year.

(If more than 3 localities, attach additional sheet with requested information.)

City _________________________ County ________________________ State ______ Number of Hours Worked ______

City _________________________ County ________________________ State ______ Number of Hours Worked ______

City _________________________ County ________________________ State ______ Number of Hours Worked ______

Check applicable Quarters ______ 1

st

Jan-Mar _____ 2

nd

Apr-Jun _____ 3

rd

Jul-Sep _____ 4

th

Oct-Dec

14. _________ # Of hours worked outside of Locality checked on Line 11.

15. _________ Total # of hours worked excluding Holiday, vacation and sick days. Normal work year = 2080 hours.

16. _________ % Of time worked outside Locality checked on Line 11 -- divide Line 14 by Line 15.

17. _________ Total gross wages including deferred compensation per W2 Form — Medicare wage line

18. _________ Total wages earned outside Locality on Line 11 -- multiply Line 16 X Line 17.

19. _________ Local taxable wages -- Subtract Line 18 – Line 17.

20. _________ Occupational tax due – multiply Line 19 X applicable rate -- see Rate Table.

21. _________ Amount of tax withheld per W-2 Form or year to date payroll stub -- submit copy with this form.

22. _________ Amount of refund requested – if Line 21 greater than Line 20, subtract Line 21 – Line 20

23. Minister’s Statement: (Must be completed if claiming clergy exemption) I hereby certify that I have been ordained since this date: _________________________

I hereby certify that the statements made herein and on supporting schedules are true and

I hereby certify that the statements made herein and on supporting schedules are true

correct to the best of my knowledge.

and correct to the best of my knowledge.

EMPLOYEE SIGNATURE

Date

CORPORATE OFFICER SIGNATURE

Date

Printed name of employee

Printed Name

Title

Home Telephone

Work Telephone

Telephone

•

All refund checks will be mailed to the street address provided in Lines 2 and 3 above.

•

A 1099 G form will be issued to all employees at the end of the tax year on any refund over $10.00 dollars.

•

A copy of Form W-2 or year to date payroll check stub must be submitted with this application.

•

Statements for out of county/city work should be taken from daily logs or calendars/schedules that this agency reserves the right to audit .

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2