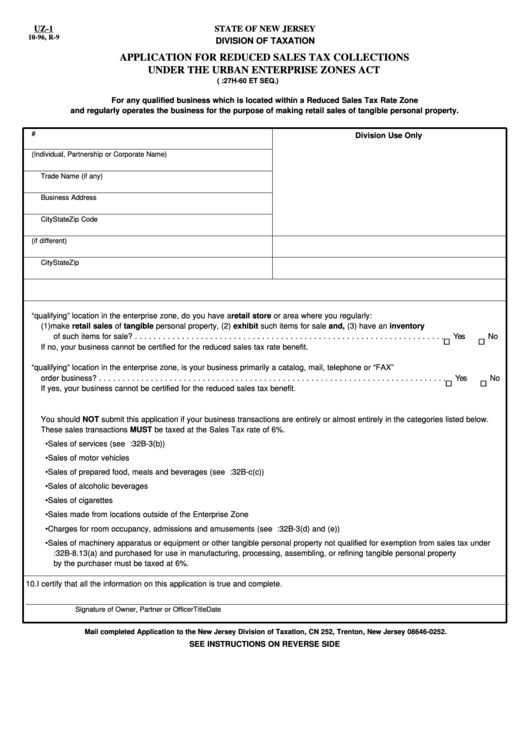

UZ-1

STATE OF NEW JERSEY

10-96, R-9

DIVISION OF TAXATION

APPLICATION FOR REDUCED SALES TAX COLLECTIONS

UNDER THE URBAN ENTERPRISE ZONES ACT

(N.J.S.A. 52:27H-60 ET SEQ.)

For any qualified business which is located within a Reduced Sales Tax Rate Zone

and regularly operates the business for the purpose of making retail sales of tangible personal property.

1. Federal Employer I.D.#

Division Use Only

2. Name of Owner (Individual, Partnership or Corporate Name)

Trade Name (if any)

Business Address

City

State

Zip Code

3. Mailing Address (if different)

4. Telephone Number

City

State

Zip Code

5. Person to Contact

6. Principal Product or Service

7. At your “qualifying” location in the enterprise zone, do you have a retail store or area where you regularly:

(1) make retail sales of tangible personal property, (2) exhibit such items for sale and, (3) have an inventory

of such items for sale? . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Yes

No

If no, your business cannot be certified for the reduced sales tax rate benefit.

8. At your “qualifying” location in the enterprise zone, is your business primarily a catalog, mail, telephone or “FAX”

order business? . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Yes

No

If yes, your business cannot be certified for the reduced sales tax benefit.

9. Carefully review the list below of sales that are not eligible for the reduced sales tax benefit.

You should NOT submit this application if your business transactions are entirely or almost entirely in the categories listed below.

These sales transactions MUST be taxed at the Sales Tax rate of 6%.

• Sales of services (see N.J.S.A. 54:32B-3(b))

• Sales of motor vehicles

• Sales of prepared food, meals and beverages (see N.J.S.A. 54:32B-c(c))

• Sales of alcoholic beverages

• Sales of cigarettes

• Sales made from locations outside of the Enterprise Zone

• Charges for room occupancy, admissions and amusements (see N.J.S.A. 54:32B-3(d) and (e))

• Sales of machinery apparatus or equipment or other tangible personal property not qualified for exemption from sales tax under

N.J.S.A. 54:32B-8.13(a) and purchased for use in manufacturing, processing, assembling, or refining tangible personal property

by the purchaser must be taxed at 6%.

10. I certify that all the information on this application is true and complete.

____________________________________________________________________________________________________________________________

Signature of Owner, Partner or Officer

Title

Date

Mail completed Application to the New Jersey Division of Taxation, CN 252, Trenton, New Jersey 08646-0252.

SEE INSTRUCTIONS ON REVERSE SIDE

1

1