Form Dte 100ex - Statement Of Reason For Exemption From Real Property Conveyance Fee

ADVERTISEMENT

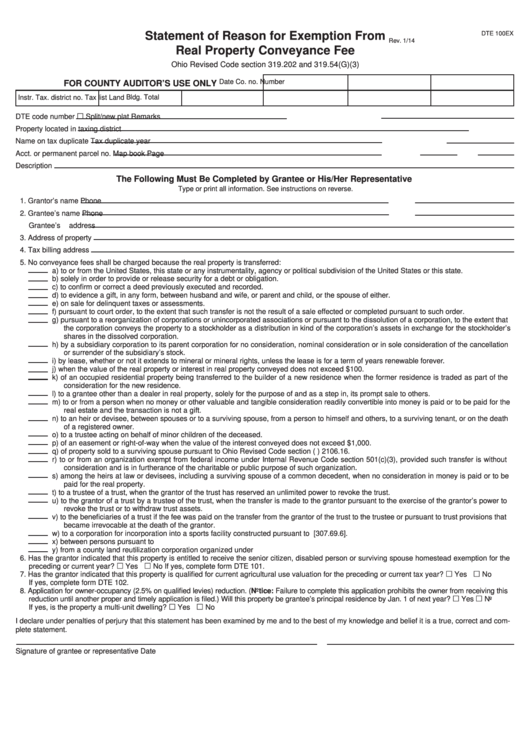

Statement of Reason for Exemption From

DTE 100EX

Rev. 1/14

Real Property Conveyance Fee

Ohio Revised Code section 319.202 and 319.54(G)(3)

Date

Co. no.

Number

FOR COUNTY AUDITOR’S USE ONLY

Instr.

Tax. district no.

Tax list

Land

Bldg.

Total

…

DTE code number

Split/new plat

Remarks

Property located in

taxing district

Name on tax duplicate

Tax duplicate year

Acct. or permanent parcel no.

Map book

Page

Description

The Following Must Be Completed by Grantee or His/Her Representative

Type or print all information. See instructions on reverse.

1. Grantor’s name

Phone

2. Grantee’s name

Phone

Grantee’s address

3. Address of property

4. Tax billing address

5. No conveyance fees shall be charged because the real property is transferred:

a) to or from the United States, this state or any instrumentality, agency or political subdivision of the United States or this state.

b) solely in order to provide or release security for a debt or obligation.

c) to confirm or correct a deed previously executed and recorded.

d) to evidence a gift, in any form, between husband and wife, or parent and child, or the spouse of either.

e) on sale for delinquent taxes or assessments.

f) pursuant to court order, to the extent that such transfer is not the result of a sale effected or completed pursuant to such order.

g) pursuant to a reorganization of corporations or unincorporated associations or pursuant to the dissolution of a corporation, to the extent that

the corporation conveys the property to a stockholder as a distribution in kind of the corporation’s assets in exchange for the stockholder’s

shares in the dissolved corporation.

h) by a subsidiary corporation to its parent corporation for no consideration, nominal consideration or in sole consideration of the cancellation

or surrender of the subsidiary’s stock.

i) by lease, whether or not it extends to mineral or mineral rights, unless the lease is for a term of years renewable forever.

j) when the value of the real property or interest in real property conveyed does not exceed $100.

k) of an occupied residential property being transferred to the builder of a new residence when the former residence is traded as part of the

consideration for the new residence.

l) to a grantee other than a dealer in real property, solely for the purpose of and as a step in, its prompt sale to others.

m) to or from a person when no money or other valuable and tangible consideration readily convertible into money is paid or to be paid for the

real estate and the transaction is not a gift.

n) to an heir or devisee, between spouses or to a surviving spouse, from a person to himself and others, to a surviving tenant, or on the death

of a registered owner.

o) to a trustee acting on behalf of minor children of the deceased.

p) of an easement or right-of-way when the value of the interest conveyed does not exceed $1,000.

q) of property sold to a surviving spouse pursuant to Ohio Revised Code section (R.C.) 2106.16.

r) to or from an organization exempt from federal income under Internal Revenue Code section 501(c)(3), provided such transfer is without

consideration and is in furtherance of the charitable or public purpose of such organization.

s) among the heirs at law or devisees, including a surviving spouse of a common decedent, when no consideration in money is paid or to be

paid for the real property.

t) to a trustee of a trust, when the grantor of the trust has reserved an unlimited power to revoke the trust.

u) to the grantor of a trust by a trustee of the trust, when the transfer is made to the grantor pursuant to the exercise of the grantor’s power to

revoke the trust or to withdraw trust assets.

v) to the beneficiaries of a trust if the fee was paid on the transfer from the grantor of the trust to the trustee or pursuant to trust provisions that

became irrevocable at the death of the grantor.

w) to a corporation for incorporation into a sports facility constructed pursuant to R.C. section 307.696[307.69.6].

x) between persons pursuant to R.C. section 5302.18.

y) from a county land reutilization corporation organized under R.C. section 1724 to a third party.

6. Has the grantor indicated that this property is entitled to receive the senior citizen, disabled person or surviving spouse homestead exemption for the

…

…

Yes

No

If yes, complete form DTE 101.

preceding or current year?

…

…

7. Has the grantor indicated that this property is qualified for current agricultural use valuation for the preceding or current tax year?

Yes

No

If yes, complete form DTE 102.

8. Application for owner-occupancy (2.5% on qualified levies) reduction. (Notice: Failure to complete this application prohibits the owner from receiving this

…

…

reduction until another proper and timely application is filed.) Will this property be grantee’s principal residence by Jan. 1 of next year?

Yes

No

…

…

If yes, is the property a multi-unit dwelling?

Yes

No

I declare under penalties of perjury that this statement has been examined by me and to the best of my knowledge and belief it is a true, correct and com-

plete statement.

Signature of grantee or representative

Date

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2