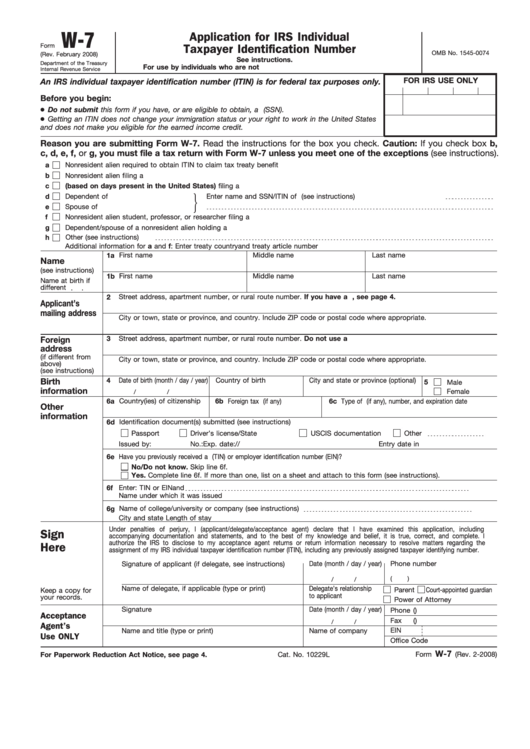

W-7

Application for IRS Individual

Form

Taxpayer Identification Number

OMB No. 1545-0074

(Rev. February 2008)

See instructions.

Department of the Treasury

For use by individuals who are not U.S. citizens or permanent residents.

Internal Revenue Service

FOR IRS USE ONLY

An IRS individual taxpayer identification number (ITIN) is for federal tax purposes only.

Before you begin:

Do not submit this form if you have, or are eligible to obtain, a U.S. social security number (SSN).

Getting an ITIN does not change your immigration status or your right to work in the United States

and does not make you eligible for the earned income credit.

Reason you are submitting Form W-7. Read the instructions for the box you check. Caution: If you check box b,

c, d, e, f, or g, you must file a tax return with Form W-7 unless you meet one of the exceptions (see instructions).

a

Nonresident alien required to obtain ITIN to claim tax treaty benefit

b

Nonresident alien filing a U.S. tax return

c

U.S. resident alien (based on days present in the United States) filing a U.S. tax return

d

Dependent of U.S. citizen/resident alien

Enter name and SSN/ITIN of U.S. citizen/resident alien (see instructions)

e

Spouse of U.S. citizen/resident alien

f

Nonresident alien student, professor, or researcher filing a U.S. tax return or claiming an exception

g

Dependent/spouse of a nonresident alien holding a U.S. visa

h

Other (see instructions)

Additional information for a and f: Enter treaty country

and treaty article number

1a First name

Middle name

Last name

Name

(see instructions)

1b First name

Middle name

Last name

Name at birth if

different

2

Street address, apartment number, or rural route number. If you have a P.O. box, see page 4.

Applicant’s

mailing address

City or town, state or province, and country. Include ZIP code or postal code where appropriate.

Street address, apartment number, or rural route number. Do not use a P.O. box number.

3

Foreign

address

(if different from

City or town, state or province, and country. Include ZIP code or postal code where appropriate.

above)

(see instructions)

4

Date of birth (month / day / year)

Country of birth

City and state or province (optional)

Birth

5

Male

information

Female

/

/

6a Country(ies) of citizenship

6b Foreign tax I.D. number (if any)

6c

Type of U.S. visa (if any), number, and expiration date

Other

information

6d Identification document(s) submitted (see instructions)

Passport

Driver’s license/State I.D.

USCIS documentation

Other

Issued by:

No.:

Exp. date:

/

/

Entry date in U.S.

/

/

6e Have you previously received a U.S. temporary taxpayer identification number (TIN) or employer identification number (EIN)?

No/Do not know. Skip line 6f.

Yes. Complete line 6f. If more than one, list on a sheet and attach to this form (see instructions).

6f

Enter: TIN or EIN

and

Name under which it was issued

6g Name of college/university or company (see instructions)

City and state

Length of stay

Under penalties of perjury, I (applicant/delegate/acceptance agent) declare that I have examined this application, including

Sign

accompanying documentation and statements, and to the best of my knowledge and belief, it is true, correct, and complete. I

authorize the IRS to disclose to my acceptance agent returns or return information necessary to resolve matters regarding the

Here

assignment of my IRS individual taxpayer identification number (ITIN), including any previously assigned taxpayer identifying number.

Signature of applicant (if delegate, see instructions)

Date (month / day / year)

Phone number

(

)

/

/

Name of delegate, if applicable (type or print)

Delegate’s relationship

Parent

Court-appointed guardian

Keep a copy for

to applicant

your records.

Power of Attorney

Signature

Date (month / day / year)

Phone (

)

Acceptance

Fax

(

)

/

/

Agent’s

EIN

Name and title (type or print)

Name of company

Use ONLY

Office Code

W-7

For Paperwork Reduction Act Notice, see page 4.

Cat. No. 10229L

Form

(Rev. 2-2008)

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8