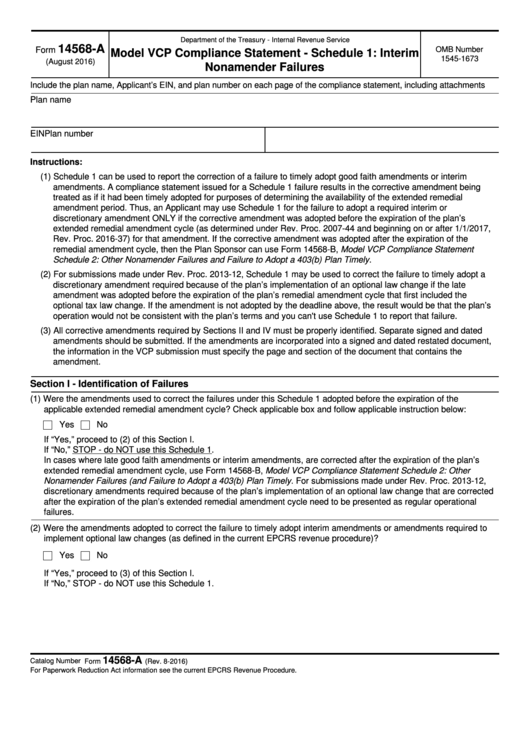

Department of the Treasury - Internal Revenue Service

14568-A

Form

OMB Number

Model VCP Compliance Statement - Schedule 1: Interim

1545-1673

(August 2016)

Nonamender Failures

Include the plan name, Applicant’s EIN, and plan number on each page of the compliance statement, including attachments

Plan name

EIN

Plan number

Instructions:

(1) Schedule 1 can be used to report the correction of a failure to timely adopt good faith amendments or interim

amendments. A compliance statement issued for a Schedule 1 failure results in the corrective amendment being

treated as if it had been timely adopted for purposes of determining the availability of the extended remedial

amendment period. Thus, an Applicant may use Schedule 1 for the failure to adopt a required interim or

discretionary amendment ONLY if the corrective amendment was adopted before the expiration of the plan’s

extended remedial amendment cycle (as determined under Rev. Proc. 2007-44 and beginning on or after 1/1/2017,

Rev. Proc. 2016-37) for that amendment. If the corrective amendment was adopted after the expiration of the

remedial amendment cycle, then the Plan Sponsor can use Form 14568-B, Model VCP Compliance Statement

Schedule 2: Other Nonamender Failures and Failure to Adopt a 403(b) Plan Timely.

(2) For submissions made under Rev. Proc. 2013-12, Schedule 1 may be used to correct the failure to timely adopt a

discretionary amendment required because of the plan’s implementation of an optional law change if the late

amendment was adopted before the expiration of the plan’s remedial amendment cycle that first included the

optional tax law change. If the amendment is not adopted by the deadline above, the result would be that the plan’s

operation would not be consistent with the plan’s terms and you can't use Schedule 1 to report that failure.

(3) All corrective amendments required by Sections II and IV must be properly identified. Separate signed and dated

amendments should be submitted. If the amendments are incorporated into a signed and dated restated document,

the information in the VCP submission must specify the page and section of the document that contains the

amendment.

Section I - Identification of Failures

(1) Were the amendments used to correct the failures under this Schedule 1 adopted before the expiration of the

applicable extended remedial amendment cycle? Check applicable box and follow applicable instruction below:

Yes

No

If “Yes,” proceed to (2) of this Section I.

If “No,” STOP - do NOT use this Schedule 1.

In cases where late good faith amendments or interim amendments, are corrected after the expiration of the plan’s

extended remedial amendment cycle, use Form 14568-B, Model VCP Compliance Statement Schedule 2: Other

Nonamender Failures (and Failure to Adopt a 403(b) Plan Timely. For submissions made under Rev. Proc. 2013-12,

discretionary amendments required because of the plan’s implementation of an optional law change that are corrected

after the expiration of the plan’s extended remedial amendment cycle need to be presented as regular operational

failures.

(2) Were the amendments adopted to correct the failure to timely adopt interim amendments or amendments required to

implement optional law changes (as defined in the current EPCRS revenue procedure)?

Yes

No

If “Yes,” proceed to (3) of this Section I.

If “No,” STOP - do NOT use this Schedule 1.

14568-A

Catalog Number 66144N

Form

(Rev. 8-2016)

For Paperwork Reduction Act information see the current EPCRS Revenue Procedure.

1

1 2

2