Instructions For Form 1099-R - Distributions From Pensions, Annuities, Retirement Or Profit-Sharing Plans, Iras, Insurance Contracts, Etc

ADVERTISEMENT

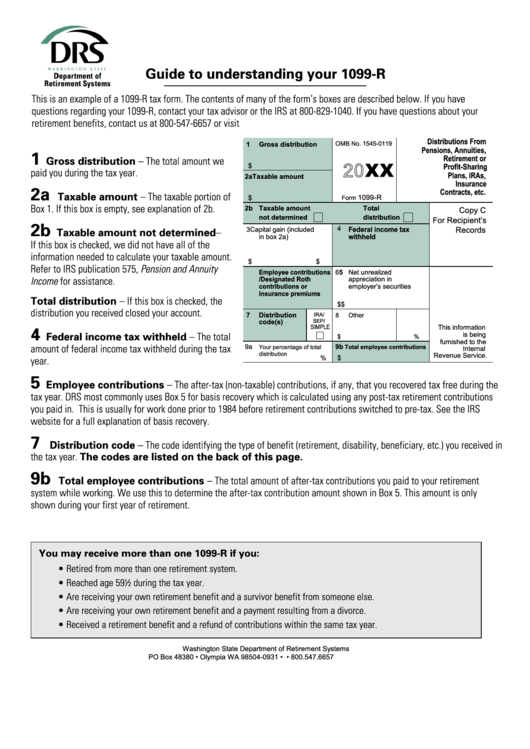

Guide to understanding your 1099-R

This is an example of a 1099-R tax form. The contents of many of the form’s boxes are described below. If you have

questions regarding your 1099-R, contact your tax advisor or the IRS at 800-829-1040. If you have questions about your

retirement benefits, contact us at 800-547-6657 or visit

Distributions From

1

Gross distribution

OMB No. 1545-0119

Pensions, Annuities,

1

Retirement or

Gross distribution – The total amount we

XX

$

Profit-Sharing

paid you during the tax year.

Plans, IRAs,

2a Taxable amount

Insurance

2a

Contracts, etc.

Taxable amount – The taxable portion of

1099-R

$

Form

Box 1. If this box is empty, see explanation of 2b.

2b

Taxable amount

Total

Copy C

not determined

distribution

For Recipient’s

2b

4

Federal income tax

Records

3

Capital gain (included

Taxable amount not determined –

withheld

in box 2a)

If this box is checked, we did not have all of the

information needed to calculate your taxable amount.

$

$

Refer to IRS publication 575, Pension and Annuity

5

Employee contributions

6

Net unrealized

Income for assistance.

/Designated Roth

appreciation in

contributions or

employer’s securities

insurance premiums

Total distribution – If this box is checked, the

$

$

distribution you received closed your account.

7

Distribution

8

Other

IRA/

code(s)

SEP/

SIMPLE

4

This information

Federal income tax withheld – The total

is being

$

%

furnished to the

9b

amount of federal income tax withheld during the tax

9a

Your percentage of total

Total employee contributions

Internal

distribution

Revenue Service.

%

$

year.

5

Employee contributions – The after-tax (non-taxable) contributions, if any, that you recovered tax free during the

tax year. DRS most commonly uses Box 5 for basis recovery which is calculated using any post-tax retirement contributions

you paid in. This is usually for work done prior to 1984 before retirement contributions switched to pre-tax. See the IRS

website for a full explanation of basis recovery.

7

Distribution code – The code identifying the type of benefit (retirement, disability, beneficiary, etc.) you received in

the tax year. The codes are listed on the back of this page.

9b

Total employee contributions – The total amount of after-tax contributions you paid to your retirement

system while working. We use this to determine the after-tax contribution amount shown in Box 5. This amount is only

shown during your first year of retirement.

You may receive more than one 1099-R if you:

• Retired from more than one retirement system.

• Reached age 59½ during the tax year.

• Are receiving your own retirement benefit and a survivor benefit from someone else.

• Are receiving your own retirement benefit and a payment resulting from a divorce.

• Received a retirement benefit and a refund of contributions within the same tax year.

Washington State Department of Retirement Systems

PO Box 48380 • Olympia WA 98504-0931 • • 800.547.6657

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2