Education Improvement Scholarships Tax Credits Program Preauthorization Form - Virginia Department Of Education

ADVERTISEMENT

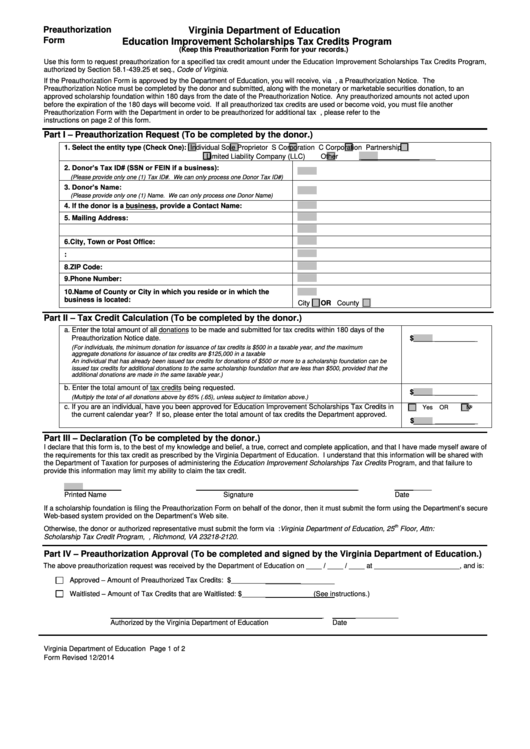

Preauthorization

Virginia Department of Education

Form

Education Improvement Scholarships Tax Credits Program

(Keep this Preauthorization Form for your records.)

Use this form to request preauthorization for a specified tax credit amount under the Education Improvement Scholarships Tax Credits Program,

authorized by Section 58.1-439.25 et seq., Code of Virginia.

If the Preauthorization Form is approved by the Department of Education, you will receive, via U.S. Mail, a Preauthorization Notice. The

Preauthorization Notice must be completed by the donor and submitted, along with the monetary or marketable securities donation, to an

approved scholarship foundation within 180 days from the date of the Preauthorization Notice. Any preauthorized amounts not acted upon

before the expiration of the 180 days will become void. If all preauthorized tax credits are used or become void, you must file another

Preauthorization Form with the Department in order to be preauthorized for additional tax credits. For additional information, please refer to the

instructions on page 2 of this form.

Part I – Preauthorization Request (To be completed by the donor.)

1. Select the entity type (Check One):

Individual

Sole Proprietor

S Corporation

C Corporation

Partnership

Limited Liability Company (LLC)

Other

_______________

2. Donor’s Tax ID# (SSN or FEIN if a business):

(Please provide only one (1) Tax ID#. We can only process one Donor Tax ID#)

3. Donor’s Name:

(Please provide only one (1) Name. We can only process one Donor Name)

4. If the donor is a business, provide a Contact Name:

5. Mailing Address:

6. City, Town or Post Office:

7. State:

8. ZIP Code:

9. Phone Number:

10. Name of County or City in which you reside or in which the

business is located:

City

OR County

Part II – Tax Credit Calculation (To be completed by the donor.)

a. Enter the total amount of all donations to be made and submitted for tax credits within 180 days of the

Preauthorization Notice date.

$

___________

(For individuals, the minimum donation for issuance of tax credits is $500 in a taxable year, and the maximum

aggregate donations for issuance of tax credits are $125,000 in a taxable year. There are no limitations for businesses.

An individual that has already been issued tax credits for donations of $500 or more to a scholarship foundation can be

issued tax credits for additional donations to the same scholarship foundation that are less than $500, provided that the

additional donations are made in the same taxable year.)

b. Enter the total amount of tax credits being requested.

$

___________

(Multiply the total of all donations above by 65% (.65), unless subject to limitation above.)

c. If you are an individual, have you been approved for Education Improvement Scholarships Tax Credits in

Yes

No

OR

the current calendar year? If so, please enter the total amount of tax credits the Department approved.

$

___________

Part III – Declaration (To be completed by the donor.)

I declare that this form is, to the best of my knowledge and belief, a true, correct and complete application, and that I have made myself aware of

the requirements for this tax credit as prescribed by the Virginia Department of Education. I understand that this information will be shared with

the Department of Taxation for purposes of administering the Education Improvement Scholarships Tax Credits Program, and that failure to

provide this information may limit my ability to claim the tax credit.

__________

__________________________________________

_______

Printed Name

Signature

Date

If a scholarship foundation is filing the Preauthorization Form on behalf of the donor, then it must submit the form using the Department’s secure

Web-based system provided on the Department’s Web site.

th

Otherwise, the donor or authorized representative must submit the form via U.S. Mail to: Virginia Department of Education, 25

Floor, Attn:

Scholarship Tax Credit Program, P.O. Box 2120, Richmond, VA 23218-2120.

Part IV – Preauthorization Approval (To be completed and signed by the Virginia Department of Education.)

The above preauthorization request was received by the Department of Education on ____ / ____ / ____ at ______________________, and is:

Approved – Amount of Preauthorized Tax Credits:

$__________________

Waitlisted – Amount of Tax Credits that are Waitlisted:

$__________________ (See instructions.)

_______________________________________________________

_________________

Authorized by the Virginia Department of Education

Date

Virginia Department of Education

Page 1 of 2

Form Revised 12/2014

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2