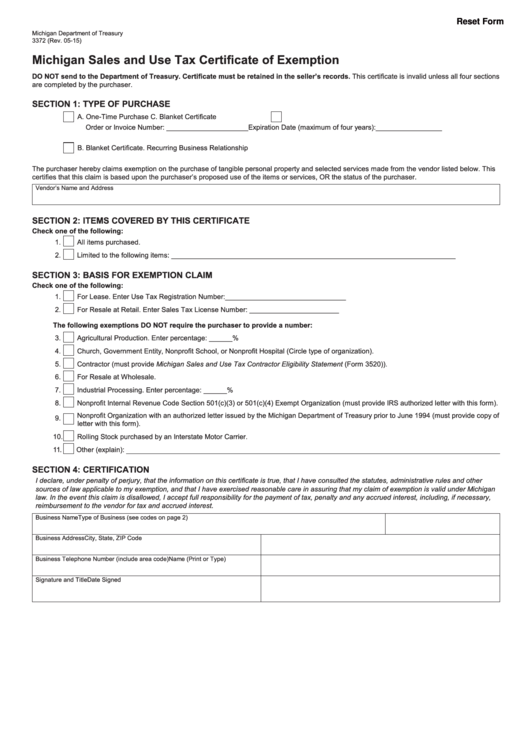

Reset Form

Michigan Department of Treasury

3372 (Rev. 05-15)

Michigan Sales and Use Tax Certificate of Exemption

DO NOT send to the Department of Treasury. Certificate must be retained in the seller’s records. This certificate is invalid unless all four sections

are completed by the purchaser.

SECTION 1: TYPE OF PURCHASE

A. One-Time Purchase

C. Blanket Certificate

Order or Invoice Number: _____________________

Expiration Date (maximum of four years):_________________

B. Blanket Certificate. Recurring Business Relationship

The purchaser hereby claims exemption on the purchase of tangible personal property and selected services made from the vendor listed below. This

certifies that this claim is based upon the purchaser’s proposed use of the items or services, OR the status of the purchaser.

Vendor’s Name and Address

SECTION 2: ITEMS COVERED BY THIS CERTIFICATE

Check one of the following:

1.

All items purchased.

2.

Limited to the following items: _________________________________________________________________________

SECTION 3: BASIS FOR EXEMPTION CLAIM

Check one of the following:

1.

For Lease. Enter Use Tax Registration Number:_______________________________

2.

For Resale at Retail. Enter Sales Tax License Number: _______________________

The following exemptions DO NOT require the purchaser to provide a number:

3.

Agricultural Production. Enter percentage: ______%

4.

Church, Government Entity, Nonprofit School, or Nonprofit Hospital (Circle type of organization).

5.

Contractor (must provide Michigan Sales and Use Tax Contractor Eligibility Statement (Form 3520)).

6.

For Resale at Wholesale.

7.

Industrial Processing. Enter percentage: ______%

8.

Nonprofit Internal Revenue Code Section 501(c)(3) or 501(c)(4) Exempt Organization (must provide IRS authorized letter with this form).

Nonprofit Organization with an authorized letter issued by the Michigan Department of Treasury prior to June 1994 (must provide copy of

9.

letter with this form).

10.

Rolling Stock purchased by an Interstate Motor Carrier.

11.

Other (explain):

SECTION 4: CERTIFICATION

I declare, under penalty of perjury, that the information on this certificate is true, that I have consulted the statutes, administrative rules and other

sources of law applicable to my exemption, and that I have exercised reasonable care in assuring that my claim of exemption is valid under Michigan

law. In the event this claim is disallowed, I accept full responsibility for the payment of tax, penalty and any accrued interest, including, if necessary,

reimbursement to the vendor for tax and accrued interest.

Business Name

Type of Business (see codes on page 2)

Business Address

City, State, ZIP Code

Business Telephone Number (include area code)

Name (Print or Type)

Signature and Title

Date Signed

1

1 2

2