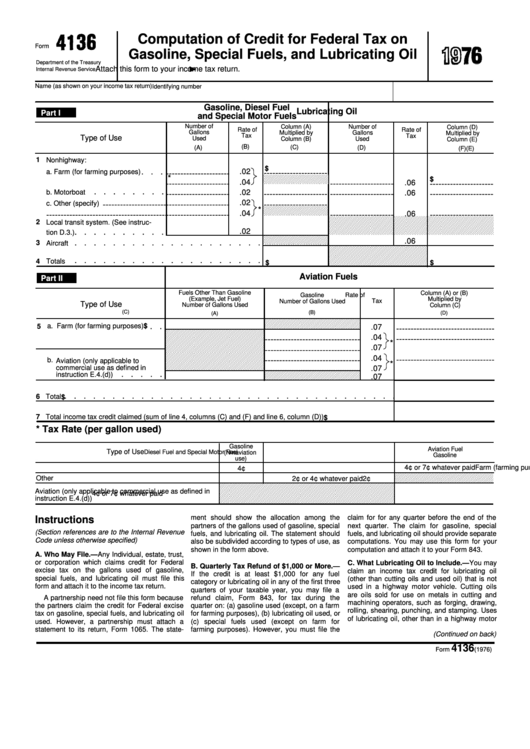

Form 4136 - Computation Of Credit For Federal Tax On Gasoline, Special Fuels, And Lubricating Oil - 1976

ADVERTISEMENT

Computation of Credit for Federal Tax on

Form

Gasoline, Special Fuels, and Lubricating Oil

Department of the Treasury

Attach this form to your income tax return.

Internal Revenue Service

Name (as shown on your income tax return)

Identifying number

Gasoline, Diesel Fuel

Lubricating Oil

Part I

and Special Motor Fuels

Number of

Column (A)

Number of

Column (D)

Rate of

Rate of

Gallons

Multiplied by

Gallons

Multiplied by

Tax

Tax

Type of Use

Used

Column (B)

Used

Column (E)

(B)

(A)

(C)

(D)

(E)

(F)

1

Nonhighway:

$

. . .

.02

a. Farm (for farming purposes)

----------------------

----------------------

*

$

.04

.06

----------------------

----------------------

----------------------

. . . . . . . .

.02

b. Motorboat

.06

----------------------

----------------------

----------------------

----------------------

.02

c. Other (specify)

----------------------

----------------------

----------------------

*

.04

.06

------------------------------------------

----------------------

----------------------

----------------------

2

Local transit system. (See instruc-

. . . . . . . . . .

.02

tion D.3.)

.06

. . . . . . . . . . . . . . . . . . . .

3

Aircraft

. . . . . . . . . . . . . . . . . . . .

4

Totals

$

$

Aviation Fuels

Part II

Fuels Other Than Gasoline

Column (A) or (B)

Gasoline

Rate of

(Example, Jet Fuel)

Multiplied by

Number of Gallons Used

Tax

Type of Use

Number of Gallons Used

Column (C)

(C)

(B)

(D)

(A)

. .

$

5

a. Farm (for farming purposes)

.07

----------------------------------

.04

---------------------------------

----------------------------------

*

.07

---------------------------------

.04

----------------------------------

b.

---------------------------------

Aviation (only applicable to

*

commercial use as defined in

.07

. . . . .

instruction E.4.(d))

.07

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

6 Total

$

7 Total income tax credit claimed (sum of line 4, columns (C) and (F) and line 6, column (D))

$

* Tax Rate (per gallon used)

Gasoline

Aviation Fuel

Type of Use

Diesel Fuel and Special Motor Fuel

(Nonaviation

Gasoline

use)

Farm (farming purposes)

4¢ or 7¢ whatever paid

4¢

2¢ or 4¢ whatever paid

Other

2¢

2¢ or 4¢ whatever paid

Aviation (only applicable to commercial use as defined in

4¢ or 7¢ whatever paid

instruction E.4.(d))

ment should show the allocation among the

claim for for any quarter before the end of the

Instructions

partners of the gallons used of gasoline, special

next quarter. The claim for gasoline, special

(Section references are to the Internal Revenue

fuels, and lubricating oil. The statement should

fuels, and lubricating oil should provide separate

Code unless otherwise specified)

also be subdivided according to types of use, as

computations. You may use this form for your

shown in the form above.

computation and attach it to your Form 843.

A. Who May File.—Any Individual, estate, trust,

or corporation which claims credit for Federal

C. What Lubricating Oil to Include.—You may

B. Quarterly Tax Refund of $1,000 or More.—

excise tax on the gallons used of gasoline,

claim an income tax credit for lubricating oil

If the credit is at least $1,000 for any fuel

special fuels, and lubricating oil must file this

(other than cutting oils and used oil) that is not

category or lubricating oil in any of the first three

form and attach it to the income tax return.

used in a highway motor vehicle. Cutting oils

quarters of your taxable year, you may file a

are oils sold for use on metals in cutting and

A partnership need not file this form because

refund claim, Form 843, for tax during the

machining operators, such as forging, drawing,

the partners claim the credit for Federal excise

quarter on: (a) gasoline used (except, on a farm

rolling, shearing, punching, and stamping. Uses

tax on gasoline, special fuels, and lubricating oil

for farming purposes), (b) lubricating oil used, or

of lubricating oil, other than in a highway motor

used. However, a partnership must attach a

(c) special fuels used (except on farm for

statement to its return, Form 1065. The state-

farming purposes). However, you must file the

(Continued on back)

4136

Form

(1976)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2