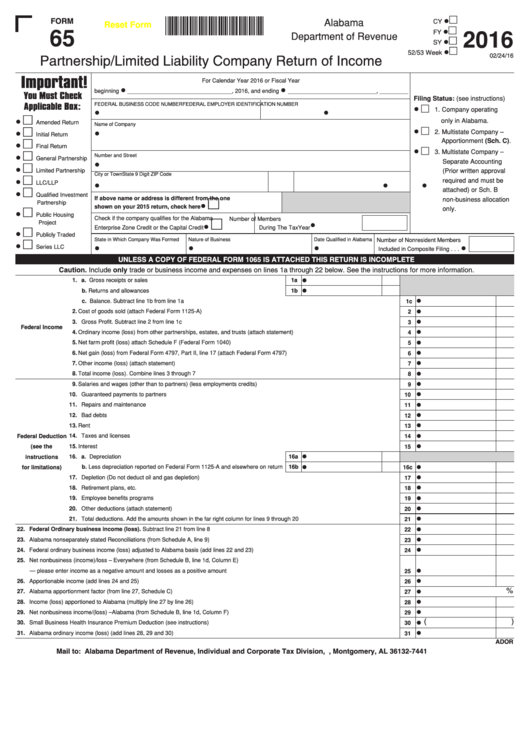

16000165

CY •

Alabama

FORM

Reset Form

65

FY •

2016

Department of Revenue

SY •

52/53 Week •

02/24/16

Partnership/Limited Liability Company Return of Income

Important!

For Calendar Year 2016 or Fiscal Year

•

•

beginning

_________________________________, 2016, and ending

____________________________, _________

You Must Check

Filing Status: (see instructions)

FEDERAL BUSINESS CODE NUMBER

FEDERAL EMPLOYER IDENTIFICATION NUMBER

Applicable Box:

•

1. Company operating

•

•

•

only in Alabama.

Amended Return

Name of Company

•

2. Multistate Company –

•

•

Initial Return

Apportionment (Sch. C).

•

Final Return

•

3. Multistate Company –

Number and Street

•

General Partnership

Separate Accounting

•

•

Limited Partnership

(Prior written approval

City or Town

State

9 Digit ZIP Code

required and must be

•

LLC/LLP

•

•

•

attached) or Sch. B

•

Qualified Investment

If above name or address is different from the one

non-business allocation

Partnership

•

shown on your 2015 return, check here . . . . . . . . . . . . . . . . .

only.

•

Public Housing

Check if the company qualifies for the Alabama

Number of Members

Project

•

•

Enterprise Zone Credit or the Capital Credit. . . . . . . . . .

During The Tax Year. . . . . . . . . . . . . .

•

Publicly Traded

State in Which Company Was Formed

Nature of Business

Date Qualified in Alabama

Number of Nonresident Members

•

Series LLC

•

•

•

•

Included in Composite Filing . . .

UNLESS A COPY OF FEDERAL FORM 1065 IS ATTACHED THIS RETURN IS INCOMPLETE

Caution. Include only trade or business income and expenses on lines 1a through 22 below. See the instructions for more information.

•

1. a. Gross receipts or sales . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

1a

•

b. Returns and allowances . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

1b

•

c. Balance. Subtract line 1b from line 1a . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

1c

•

2. Cost of goods sold (attach Federal Form 1125-A) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

2

•

3. Gross Profit. Subtract line 2 from line 1c . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

3

Federal Income

•

4. Ordinary income (loss) from other partnerships, estates, and trusts (attach statement). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

4

•

5. Net farm profit (loss) attach Schedule F (Federal Form 1040) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

5

•

6. Net gain (loss) from Federal Form 4797, Part II, line 17 (attach Federal Form 4797). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

6

•

7. Other income (loss) (attach statement) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

7

•

8. Total income (loss). Combine lines 3 through 7. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

8

•

9. Salaries and wages (other than to partners) (less employments credits) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

9

•

10. Guaranteed payments to partners . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

10

•

11. Repairs and maintenance . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

11

•

12. Bad debts . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

12

•

13. Rent . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

13

•

14. Taxes and licenses . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Federal Deduction

14

•

15. Interest. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

(see the

15

•

instructions

16. a. Depreciation. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

16a

•

•

b. Less depreciation reported on Federal Form 1125-A and elsewhere on return

16b

for limitations)

16c

•

17. Depletion (Do not deduct oil and gas depletion) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

17

•

18. Retirement plans, etc. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

18

•

19. Employee benefits programs. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

19

•

20. Other deductions (attach statement) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

20

•

21. Total deductions. Add the amounts shown in the far right column for lines 9 through 20 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

21

•

22. Federal Ordinary business income (loss). Subtract line 21 from line 8. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

22

•

23. Alabama nonseparately stated Reconciliations (from Schedule A, line 9) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

23

•

24. Federal ordinary business income (loss) adjusted to Alabama basis (add lines 22 and 23) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

24

25. Net nonbusiness (income)/loss – Everywhere (from Schedule B, line 1d, Column E)

•

— please enter income as a negative amount and losses as a positive amount . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

25

•

26. Apportionable income (add lines 24 and 25). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

26

•

%

27. Alabama apportionment factor (from line 27, Schedule C) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

27

•

28. Income (loss) apportioned to Alabama (multiply line 27 by line 26) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

28

•

29. Net nonbusiness income/(loss) – Alabama (from Schedule B, line 1d, Column F) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

29

•

(

)

30. Small Business Health Insurance Premium Deduction (see instructions) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

30

•

31. Alabama ordinary income (loss) (add lines 28, 29 and 30) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

31

ADOR

Mail to: Alabama Department of Revenue, Individual and Corporate Tax Division, P.O. Box 327441, Montgomery, AL 36132-7441

1

1 2

2 3

3 4

4