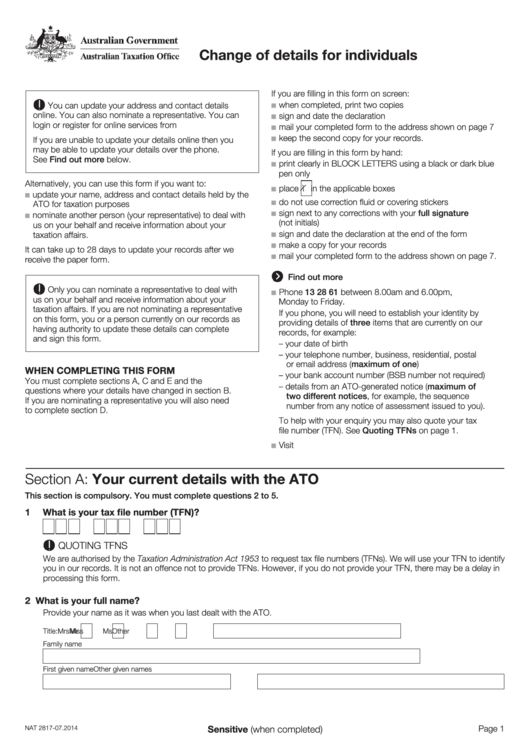

Change of details for individuals

If you are filling in this form on screen:

when completed, print two copies

You can update your address and contact details

■

online. You can also nominate a representative. You can

sign and date the declaration

■

login or register for online services from ato.gov.au

mail your completed form to the address shown on page 7

■

keep the second copy for your records.

If you are unable to update your details online then you

■

may be able to update your details over the phone.

If you are filling in this form by hand:

See Find out more below.

print clearly in BLOCK LETTERS using a black or dark blue

■

pen only

Alternatively, you can use this form if you want to:

place

X

in the applicable boxes

■

update your name, address and contact details held by the

■

do not use correction fluid or covering stickers

ATO for taxation purposes

■

sign next to any corrections with your full signature

nominate another person (your representative) to deal with

■

■

(not initials)

us on your behalf and receive information about your

sign and date the declaration at the end of the form

taxation affairs.

■

make a copy for your records

■

It can take up to 28 days to update your records after we

mail your completed form to the address shown on page 7.

■

receive the paper form.

Find out more

Only you can nominate a representative to deal with

Phone 13 28 61 between 8.00am and 6.00pm,

■

us on your behalf and receive information about your

Monday to Friday.

taxation affairs. If you are not nominating a representative

If you phone, you will need to establish your identity by

on this form, you or a person currently on our records as

providing details of three items that are currently on our

having authority to update these details can complete

records, for example:

and sign this form.

– your date of birth

– your telephone number, business, residential, postal

or email address (maximum of one)

WHEN COMPLETING THIS FORM

– your bank account number (BSB number not required)

You must complete sections A, C and E and the

– details from an ATO-generated notice (maximum of

questions where your details have changed in section B.

two different notices, for example, the sequence

If you are nominating a representative you will also need

number from any notice of assessment issued to you).

to complete section D.

To help with your enquiry you may also quote your tax

file number (TFN). See Quoting TFNs on page 1.

Visit ato.gov.au

■

Section A: Your current details with the ATO

This section is compulsory. You must complete questions 2 to 5.

1

What is your tax file number (TFN)?

QUOTING TFNS

We are authorised by the Taxation Administration Act 1953 to request tax file numbers (TFNs). We will use your TFN to identify

you in our records. It is not an offence not to provide TFNs. However, if you do not provide your TFN, there may be a delay in

processing this form.

2

What is your full name?

Provide your name as it was when you last dealt with the ATO.

Title:

Mr

Mrs

Miss

Ms

Other

Family name

First given name

Other given names

Sensitive (when completed)

Page 1

NAT 2817-07.2014

1

1 2

2 3

3 4

4 5

5 6

6 7

7