Form 89-140 - Annual Information Return - 2004

ADVERTISEMENT

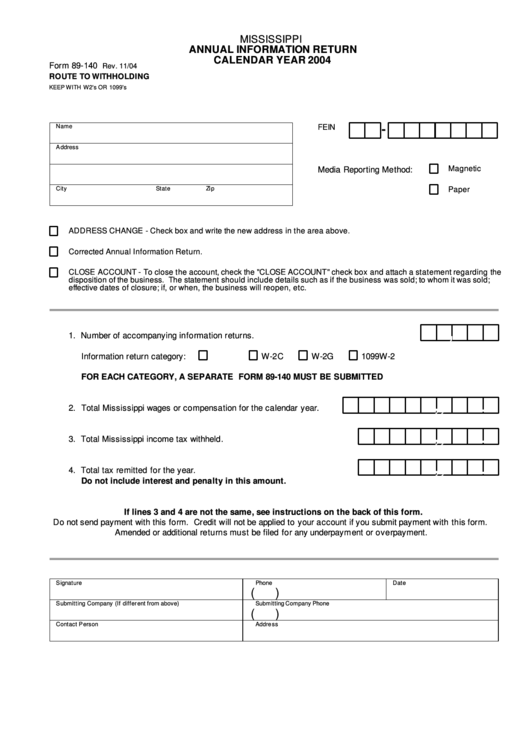

MISSISSIPPI

ANNUAL INFORMATION RETURN

CALENDAR YEAR 2004

Form 89-140

Rev. 11/04

ROUTE TO WITHHOLDING

KEE P WITH W2's OR 1099's

Name

FEIN

-

A ddress

Magnetic

Media Reporting Method:

City

State

Zi p

Paper

ADDRESS CHANGE - Check box and write the new address in the area above.

Corrected Annual Information Return.

CLOSE ACCOUNT - To close the account, check the "CLOSE ACCOUNT" check box and attach a statement regarding the

disposition of the business. The statement should include details such as if the business was sold; to whom it was sold;

effective dates of closure; if, or when, the business will reopen, etc.

,

1. Number of accompanying information returns.

Information return category:

W-2

W-2C

W-2G

1099

FOR EACH CATEGORY, A SEPARATE FORM 89-140 MUST BE SUBMITTED

,

,

.

00

2.

Total Mississippi wages or compensation for the calendar year.

,

,

.

00

3. Total Mississippi income tax withheld.

,

,

.

00

4. Total tax remitted for the year.

Do not include interest and penalty in this amount.

If lines 3 and 4 are not the same, see instructions on the back of this form.

Do not send payment with this form. Credit will not be applied to your account if you submit payment with this form.

Amended or additional returns must be filed for any underpayment or overpayment.

S ignature

Phone

Date

(

)

S ubmitting Company (If differ ent from a bove)

Submittin g Compan y Phon e

(

)

Contact P erson

Addre ss

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1