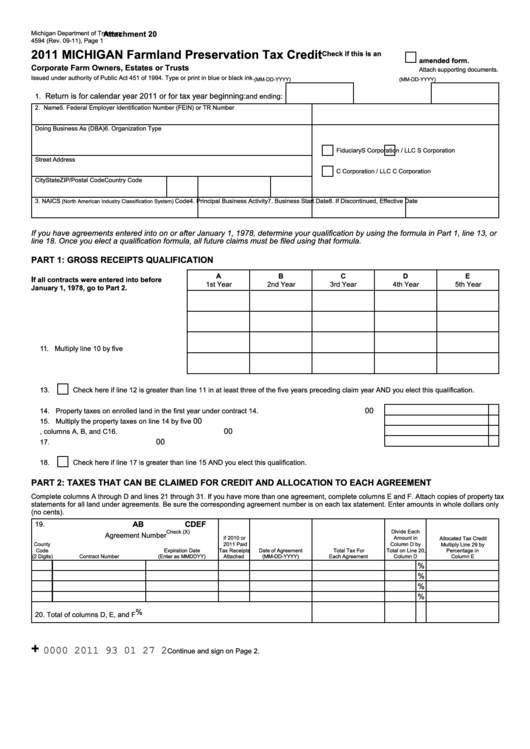

Form 4594 - Michigan Farmland Preservation Tax Credit - 2011

ADVERTISEMENT

Attachment 20

Michigan Department of Treasury

4594 (Rev. 09-11), Page 1

2011 MICHIGAN Farmland Preservation Tax Credit

Check if this is an

amended form.

Corporate Farm Owners, Estates or Trusts

Attach supporting documents.

Issued under authority of Public Act 451 of 1994. Type or print in blue or black ink.

(MM-DD-YYYY)

(MM-DD-YYYY)

Return is for calendar year 2011 or for tax year beginning:

1.

and ending:

2. Name

5. Federal Employer Identification Number (FEIN) or TR Number

Doing Business As (DBA)

6. Organization Type

Fiduciary

S Corporation / LLC S Corporation

Street Address

C Corporation / LLC C Corporation

City

State

ZIP/Postal Code

Country Code

3. NAICS

Code

4. Principal Business Activity

7. Business Start Date

8. If Discontinued, Effective Date

(North American Industry Classification System)

If you have agreements entered into on or after January 1, 1978, determine your qualification by using the formula in Part 1, line 13, or

line 18. Once you elect a qualification formula, all future claims must be filed using that formula.

PART 1: GROSS RECEIPTS QUALIFICATION

A

B

C

D

E

I

f all contracts were entered into before

1st Year

2nd Year

3rd Year

4th Year

5th Year

January 1, 1978, go to Part 2.

9. Years preceding the claim year .................

10. Property taxes on enrolled land .................

11. Multiply line 10 by five ...............................

12. Agricultural gross receipts .........................

13.

Check here if line 12 is greater than line 11 in at least three of the five years preceding claim year AND you elect this qualification.

00

14. Property taxes on enrolled land in the first year under contract ...........................................................

14.

00

15. Multiply the property taxes on line 14 by five ........................................................................................

15.

00

16. Agricultural receipts for averaging. Enter total of line 12, columns A, B, and C ...................................

16.

00

17. Average Gross Receipts. Divide line 16 by three .................................................................................

17.

18.

Check here if line 17 is greater than line 15 AND you elect this qualification.

PART 2: TAXES THAT CAN BE CLAIMED FOR CREDIT AND ALLOCATION TO EACH AGREEMENT

Complete columns A through D and lines 21 through 31. If you have more than one agreement, complete columns E and F. Attach copies of property tax

statements for all land under agreements. Be sure the corresponding agreement number is on each tax statement. Enter amounts in whole dollars only

(no cents).

A

B

C

D

E

F

19.

Check (X)

Divide Each

Agreement Number

if 2010 or

Amount in

Allocated Tax Credit

County

2011 Paid

Column D by

Multiply Line 29 by

Code

Expiration Date

Tax Receipts

Date of Agreement

Total Tax For

Total on Line 20,

Percentage in

(2 Digits)

Contract Number

(Enter as MMDDYY)

Attached

(MM-DD-YYYY)

Each Agreement

Column D

Column E

%

%

%

%

%

20. Total of columns D, E, and F .........................................................................................

+

0000 2011 93 01 27 2

Continue and sign on Page 2.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2