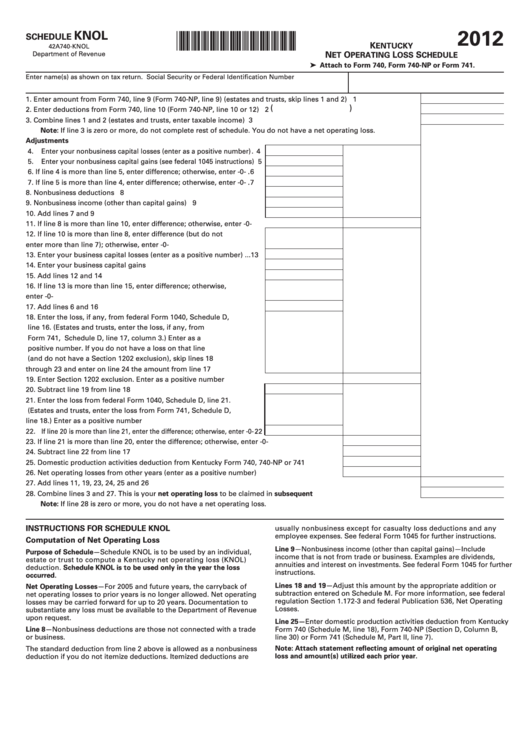

2012

KNOL

*1200030017*

SCHEDULE

K

ENTUCKY

42A740-KNOL

Department of Revenue

N

O

L

S

ET

PERATING

OSS

CHEDULE

➤ Attach to Form 740, Form 740-NP or Form 741.

Enter name(s) as shown on tax return.

Social Security or Federal Identification Number

1. Enter amount from Form 740, line 9 (Form 740-NP, line 9) (estates and trusts, skip lines 1 and 2) ............................. 1

(

)

2. Enter deductions from Form 740, line 10 (Form 740-NP, line 10 or 12) .......................................................................... 2

3. Combine lines 1 and 2 (estates and trusts, enter taxable income).................................................................................. 3

Note: If line 3 is zero or more, do not complete rest of schedule. You do not have a net operating loss.

Adjustments

4. Enter your nonbusiness capital losses (enter as a positive number) . 4

5. Enter your nonbusiness capital gains (see federal 1045 instructions) 5

6. If line 4 is more than line 5, enter difference; otherwise, enter -0- . 6

7. If line 5 is more than line 4, enter difference; otherwise, enter -0- . 7

8. Nonbusiness deductions ................................................................... 8

9. Nonbusiness income (other than capital gains) .............................. 9

10. Add lines 7 and 9 ................................................................................ 10

11. If line 8 is more than line 10, enter difference; otherwise, enter -0- ........................................11

12. If line 10 is more than line 8, enter difference (but do not

enter more than line 7); otherwise, enter -0- .................................... 12

13. Enter your business capital losses (enter as a positive number) ... 13

14. Enter your business capital gains ..................................................... 14

15. Add lines 12 and 14 ............................................................................ 15

16. If line 13 is more than line 15, enter difference; otherwise,

enter -0- ............................................................................................... 16

17. Add lines 6 and 16 .............................................................................. 17

18. Enter the loss, if any, from federal Form 1040, Schedule D,

line 16. (Estates and trusts, enter the loss, if any, from

Form 741, Schedule D, line 17, column 3.) Enter as a

positive number. If you do not have a loss on that line

(and do not have a Section 1202 exclusion), skip lines 18

through 23 and enter on line 24 the amount from line 17 .............. 18

19. Enter Section 1202 exclusion. Enter as a positive number ......................................................19

20. Subtract line 19 from line 18 ............................................................. 20

21. Enter the loss from federal Form 1040, Schedule D, line 21.

(Estates and trusts, enter the loss from Form 741, Schedule D,

line 18.) Enter as a positive number ................................................. 21

22. If line 20 is more than line 21, enter the difference; otherwise, enter -0- .22

23. If line 21 is more than line 20, enter the difference; otherwise, enter -0- ...............................23

24. Subtract line 22 from line 17 ......................................................................................................24

25. Domestic production activities deduction from Kentucky Form 740, 740-NP or 741 ............25

26. Net operating losses from other years (enter as a positive number) .....................................26

27. Add lines 11, 19, 23, 24, 25 and 26 ..................................................................................................................................... 27

28. Combine lines 3 and 27. This is your net operating loss to be claimed in subsequent years...................................... 28

Note: If line 28 is zero or more, you do not have a net operating loss.

INSTRUCTIONS FOR SCHEDULE KNOL

usually nonbusiness except for casualty loss deductions and any

employee expenses. See federal Form 1045 for further instructions.

Computation of Net Operating Loss

Line 9—Nonbusiness income (other than capital gains)—Include

Purpose of Schedule—Schedule KNOL is to be used by an individual,

income that is not from trade or business. Examples are dividends,

estate or trust to compute a Kentucky net operating loss (KNOL)

annuities and interest on investments. See federal Form 1045 for further

deduction. Schedule KNOL is to be used only in the year the loss

instructions.

occurred.

Lines 18 and 19—Adjust this amount by the appropriate addition or

Net Operating Losses—For 2005 and future years, the carryback of

subtraction entered on Schedule M. For more information, see federal

net operating losses to prior years is no longer allowed. Net operating

regulation Section 1.172-3 and federal Publication 536, Net Operating

losses may be carried forward for up to 20 years. Documentation to

Losses.

substantiate any loss must be available to the Department of Revenue

upon request.

Line 25—Enter domestic production activities deduction from Kentucky

Line 8—Nonbusiness deductions are those not connected with a trade

Form 740 (Schedule M, line 18), Form 740-NP (Section D, Column B,

or business.

line 30) or Form 741 (Schedule M, Part II, line 7).

The standard deduction from line 2 above is allowed as a nonbusiness

Note: Attach statement reflecting amount of original net operating

deduction if you do not itemize deductions. Itemized deductions are

loss and amount(s) utilized each prior year.

1

1