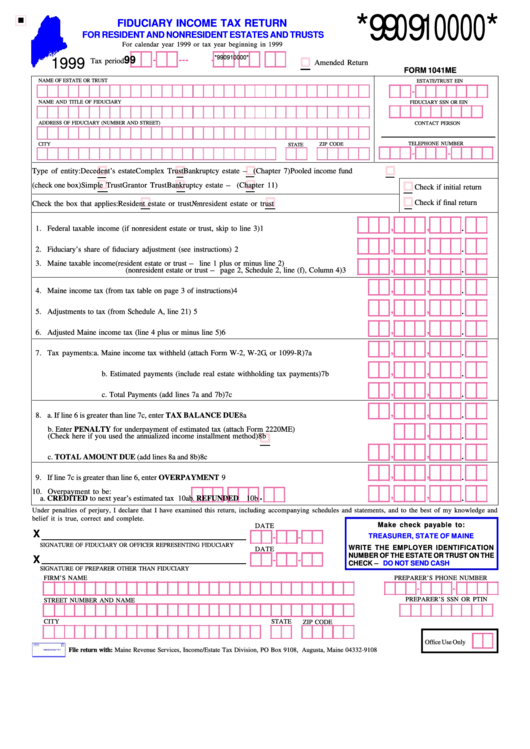

Form 1041me - Fiduciary Income Tax Return For Resident And Nonresident Estates And Trusts - 1999

ADVERTISEMENT

*990910000*

FIDUCIARY INCOME TAX RETURN

FOR RESIDENT AND NONRESIDENT ESTATES AND TRUSTS

For calendar year 1999 or tax year beginning in 1999

*990910000*

-

-

99

-

-

-

1999

Tax period

Amended Return

FORM 1041ME

NAME OF ESTATE OR TRUST

ESTATE/TRUST EIN

-

NAME AND TITLE OF FIDUCIARY

FIDUCIARY SSN OR EIN

ADDRESS OF FIDUCIARY (NUMBER AND STREET)

CONTACT PERSON

CITY

ZIP CODE

TELEPHONE NUMBER

STATE

-

-

Type of entity:

Decedent’ s estate

Complex Trust

Bankruptcy estate — (Chapter 7)

Pooled income fund

(check one box)

Simple Trust

Grantor Trust

Bankruptcy estate — (Chapter 11)

Check if initial return

Check if final return

Check the box that applies:

Resident estate or trust

Nonresident estate or trust

,

,

.

1. Federal taxable income (if nonresident estate or trust, skip to line 3) ................................................ 1

,

,

.

2. Fiduciary’ s share of fiduciary adjustment (see instructions) .............................................................. 2

3. Maine taxable income

(resident estate or trust — line 1 plus or minus line 2)

,

,

.

(nonresident estate or trust — page 2, Schedule 2, line (f), Column 4) .... 3

,

,

4. Maine income tax (from tax table on page 3 of instructions) ................................................................... 4

.

,

,

.

5. Adjustments to tax (from Schedule A, line 21) ......................................................................................... 5

,

,

.

6. Adjusted Maine income tax (line 4 plus or minus line 5) ......................................................................... 6

,

,

.

7. Tax payments:

a. Maine income tax withheld (attach Form W-2, W-2G, or 1099-R) ....................... 7a

,

,

.

b. Estimated payments (include real estate withholding tax payments) .................. 7b

,

,

c. Total Payments (add lines 7a and 7b) ..................................................................... 7c

.

,

,

.

8. a. If line 6 is greater than line 7c, enter TAX BALANCE DUE .............................................................. 8a

b. Enter PENALTY for underpayment of estimated tax (attach Form 2220ME)

,

.

(Check here if you used the annualized income installment method)

..................................................... 8b

,

,

.

c. TOTAL AMOUNT DUE (add lines 8a and 8b) .................................................................................. 8c

,

,

.

9. If line 7c is greater than line 6, enter OVERPAYMENT .......................................................................... 9

10. Overpayment to be:

,

,

,

.

a. CREDITED to next year’ s estimated tax 10a

b. REFUNDED 10b

.

Under penalties of perjury, I declare that I have examined this return, including accompanying schedules and statements, and to the best of my knowledge and

belief it is true, correct and complete.

Make check payable to:

DATE

X

TREASURER, STATE OF MAINE

-

-

SIGNATURE OF FIDUCIARY OR OFFICER REPRESENTING FIDUCIARY

WRITE THE EMPLOYER IDENTIFICATION

DATE

NUMBER OF THE ESTATE OR TRUST ON THE

X

-

-

CHECK —

DO NOT SEND CASH

SIGNATURE OF PREPARER OTHER THAN FIDUCIARY

FIRM’ S NAME

PREPARER’ S PHONE NUMBER

-

-

PREPARER’ S SSN OR PTIN

STREET NUMBER AND NAME

STATE

CITY

ZIP CODE

Office Use Only

File return with: Maine Revenue Services, Income/Estate Tax Division, PO Box 9108, Augusta, Maine 04332-9108

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2