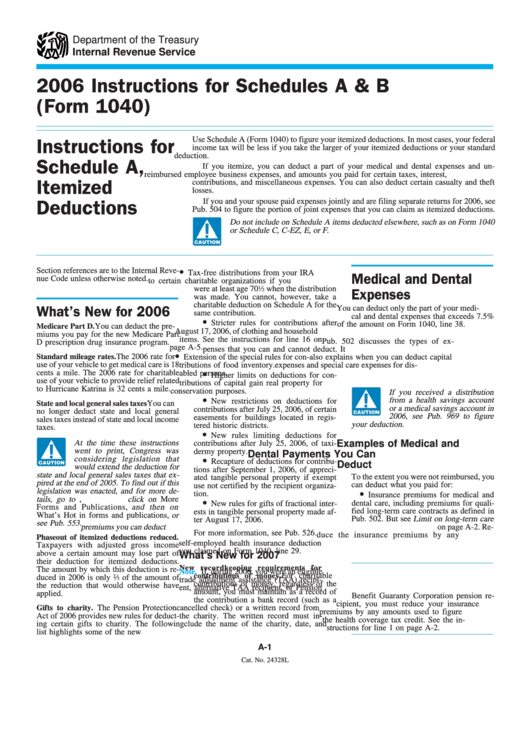

Instructions For Schedules A & B (Form 1040) - 2006

ADVERTISEMENT

Department of the Treasury

Internal Revenue Service

2006 Instructions for Schedules A & B

(Form 1040)

Use Schedule A (Form 1040) to figure your itemized deductions. In most cases, your federal

Instructions for

income tax will be less if you take the larger of your itemized deductions or your standard

deduction.

Schedule A,

If you itemize, you can deduct a part of your medical and dental expenses and un-

reimbursed employee business expenses, and amounts you paid for certain taxes, interest,

contributions, and miscellaneous expenses. You can also deduct certain casualty and theft

Itemized

losses.

If you and your spouse paid expenses jointly and are filing separate returns for 2006, see

Deductions

Pub. 504 to figure the portion of joint expenses that you can claim as itemized deductions.

Do not include on Schedule A items deducted elsewhere, such as on Form 1040

or Schedule C, C-EZ, E, or F.

•

Section references are to the Internal Reve-

Tax-free distributions from your IRA

Medical and Dental

nue Code unless otherwise noted.

to certain charitable organizations if you

were at least age 70

1

⁄

when the distribution

2

Expenses

was made. You cannot, however, take a

charitable deduction on Schedule A for the

You can deduct only the part of your medi-

What’s New for 2006

same contribution.

cal and dental expenses that exceeds 7.5%

•

Stricter rules for contributions after

of the amount on Form 1040, line 38.

Medicare Part D.

You can deduct the pre-

August 17, 2006, of clothing and household

miums you pay for the new Medicare Part

items. See the instructions for line 16 on

Pub. 502 discusses the types of ex-

D prescription drug insurance program.

page A-5.

penses that you can and cannot deduct. It

•

The 2006 rate for

Standard mileage rates.

Extension of the special rules for con-

also explains when you can deduct capital

use of your vehicle to get medical care is 18

tributions of food inventory.

expenses and special care expenses for dis-

•

cents a mile. The 2006 rate for charitable

abled persons.

Higher limits on deductions for con-

use of your vehicle to provide relief related

tributions of capital gain real property for

to Hurricane Katrina is 32 cents a mile.

conservation purposes.

If you received a distribution

•

from a health savings account

New restrictions on deductions for

You can

State and local general sales taxes

or a medical savings account in

contributions after July 25, 2006, of certain

no longer deduct state and local general

2006, see Pub. 969 to figure

easements for buildings located in regis-

sales taxes instead of state and local income

your deduction.

tered historic districts.

taxes.

•

New rules limiting deductions for

At the time these instructions

Examples of Medical and

contributions after July 25, 2006, of taxi-

went to print, Congress was

dermy property.

Dental Payments You Can

•

considering legislation that

Recapture of deductions for contribu-

Deduct

would extend the deduction for

tions after September 1, 2006, of appreci-

state and local general sales taxes that ex-

To the extent you were not reimbursed, you

ated tangible personal property if exempt

pired at the end of 2005. To find out if this

can deduct what you paid for:

use not certified by the recipient organiza-

legislation was enacted, and for more de-

•

tion.

Insurance premiums for medical and

tails, go to , click on More

•

dental care, including premiums for quali-

New rules for gifts of fractional inter-

Forms and Publications, and then on

fied long-term care contracts as defined in

ests in tangible personal property made af-

What’s Hot in forms and publications, or

Pub. 502. But see Limit on long-term care

ter August 17, 2006.

see Pub. 553.

premiums you can deduct on page A-2. Re-

For more information, see Pub. 526.

duce the insurance premiums by any

Phaseout of itemized deductions reduced.

self-employed health insurance deduction

Taxpayers with adjusted gross income

you claimed on Form 1040, line 29.

above a certain amount may lose part of

What’s New for 2007

their deduction for itemized deductions.

New recordkeeping requirements for

The amount by which this deduction is re-

Note.

If, during 2006, you were an eligible

For charitable

contributions of money.

duced in 2006 is only

2

⁄

of the amount of

3

trade adjustment assistance (TAA) recipi-

contributions of money, regardless of the

the reduction that would otherwise have

ent, alternative TAA recipient, or Pension

amount, you must maintain as a record of

applied.

Benefit Guaranty Corporation pension re-

the contribution a bank record (such as a

cipient, you must reduce your insurance

Gifts to charity.

The Pension Protection

cancelled check) or a written record from

premiums by any amounts used to figure

Act of 2006 provides new rules for deduct-

the charity. The written record must in-

the health coverage tax credit. See the in-

ing certain gifts to charity. The following

clude the name of the charity, date, and

structions for line 1 on page A-2.

list highlights some of the new rules.

amount of the contribution.

A-1

Cat. No. 24328L

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7