Instructions For Completing The Amended Quarterly Report Of Wages Paid (Ldol-Es51/w) - Louisiana Department Of Labor

ADVERTISEMENT

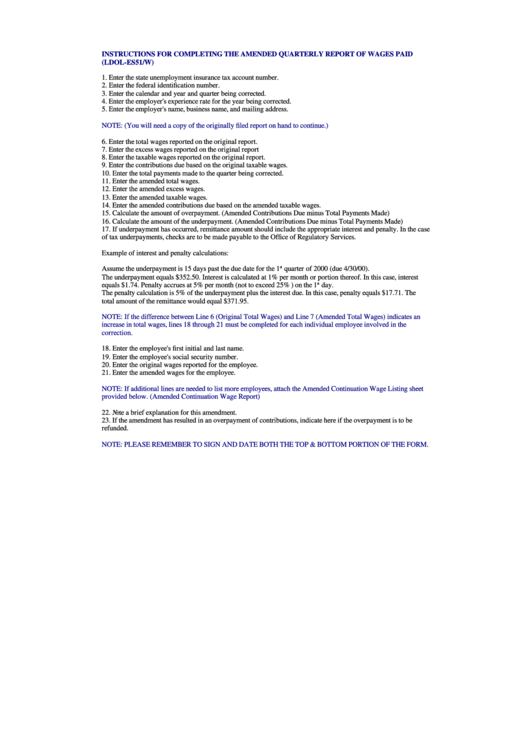

INSTRUCTIONS FOR COMPLETING THE AMENDED QUARTERLY REPORT OF WAGES PAID

(LDOL-ES51/W)

1. Enter the state unemployment insurance tax account number.

2. Enter the federal identification number.

3. Enter the calendar and year and quarter being corrected.

4. Enter the employer's experience rate for the year being corrected.

5. Enter the employer's name, business name, and mailing address.

NOTE: (You will need a copy of the originally filed report on hand to continue.)

6. Enter the total wages reported on the original report.

7. Enter the excess wages reported on the original report

8. Enter the taxable wages reported on the original report.

9. Enter the contributions due based on the original taxable wages.

10. Enter the total payments made to the quarter being corrected.

11. Enter the amended total wages.

12. Enter the amended excess wages.

13. Enter the amended taxable wages.

14. Enter the amended contributions due based on the amended taxable wages.

15. Calculate the amount of overpayment. (Amended Contributions Due minus Total Payments Made)

16. Calculate the amount of the underpayment. (Amended Contributions Due minus Total Payments Made)

17. If underpayment has occurred, remittance amount should include the appropriate interest and penalty. In the case

of tax underpayments, checks are to be made payable to the Office of Regulatory Services.

Example of interest and penalty calculations:

Assume the underpayment is 15 days past the due date for the 1

st

quarter of 2000 (due 4/30/00).

The underpayment equals $352.50. Interest is calculated at 1% per month or portion thereof. In this case, interest

st

equals $1.74. Penalty accrues at 5% per month (not to exceed 25% ) on the 1

day.

The penalty calculation is 5% of the underpayment plus the interest due. In this case, penalty equals $17.71. The

total amount of the remittance would equal $371.95.

NOTE: If the difference between Line 6 (Original Total Wages) and Line 7 (Amended Total Wages) indicates an

increase in total wages, lines 18 through 21 must be completed for each individual employee involved in the

correction.

18. Enter the employee's first initial and last name.

19. Enter the employee's social security number.

20. Enter the original wages reported for the employee.

21. Enter the amended wages for the employee.

NOTE: If additional lines are needed to list more employees, attach the Amended Continuation Wage Listing sheet

provided below. (Amended Continuation Wage Report)

22. Note a brief explanation for this amendment.

23. If the amendment has resulted in an overpayment of contributions, indicate here if the overpayment is to be

refunded.

NOTE: PLEASE REMEMBER TO SIGN AND DATE BOTH THE TOP & BOTTOM PORTION OF THE FORM.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1