Form Rev 41 0056 - Small Business B&o Tax Credit Worksheet - Washington Department Of Revenue

ADVERTISEMENT

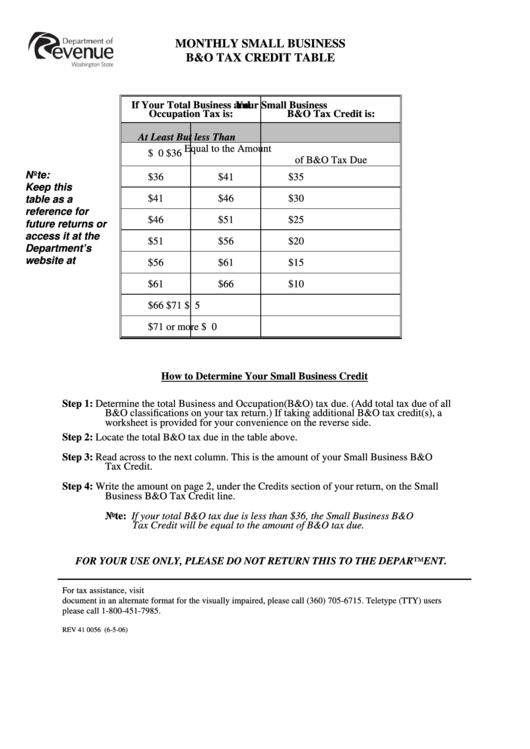

MONTHLY SMALL BUSINESS

B&O TAX CREDIT TABLE

If Your Total Business and

Your Small Business

Occupation Tax is:

B&O Tax Credit is:

At Least

But less Than

Equal to the Amount

$ 0

$36

of B&O Tax Due

Note:

$36

$41

$35

Keep this

$41

$46

$30

table as a

reference for

$46

$51

$25

future returns or

access it at the

$51

$56

$20

Department’s

website at

$56

$61

$15

$61

$66

$10

$66

$71

$ 5

$71

or more

$ 0

How to Determine Your Small Business Credit

Step 1:

Determine the total Business and Occupation (B&O) tax due. (Add total tax due of all

B&O classifications on your tax return.) If taking additional B&O tax credit(s), a

worksheet is provided for your convenience on the reverse side.

Step 2:

Locate the total B&O tax due in the table above.

Step 3:

Read across to the next column. This is the amount of your Small Business B&O

Tax Credit.

Step 4:

Write the amount on page 2, under the Credits section of your return, on the Small

Business B&O Tax Credit line.

Note: If your total B&O tax due is less than $36, the Small Business B&O

Tax Credit will be equal to the amount of B&O tax due.

FOR YOUR USE ONLY, PLEASE DO NOT RETURN THIS TO THE DEPARTMENT.

For tax assistance, visit or call 1-800-647-7706. To inquire about the availability of this

document in an alternate format for the visually impaired, please call (360) 705-6715. Teletype (TTY) users

please call 1-800-451-7985.

REV 41 0056 (6-5-06)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18