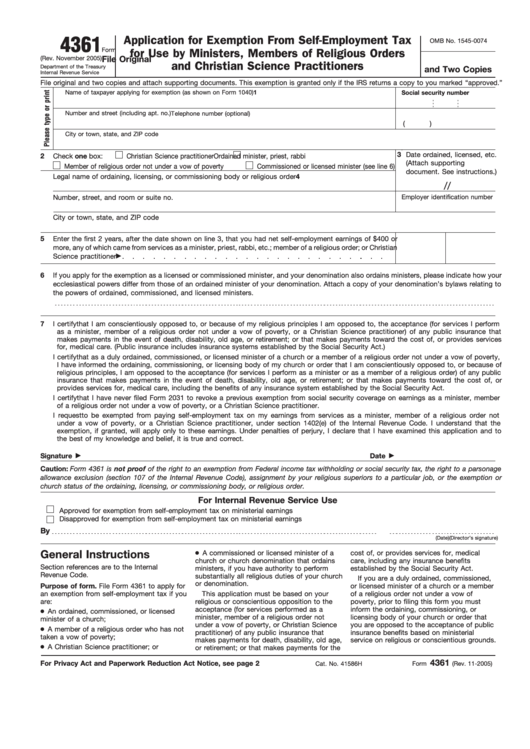

Application for Exemption From Self-Employment Tax

4361

OMB No. 1545-0074

Form

for Use by Ministers, Members of Religious Orders

(Rev. November 2005)

File Original

and Christian Science Practitioners

Department of the Treasury

and Two Copies

Internal Revenue Service

File original and two copies and attach supporting documents. This exemption is granted only if the IRS returns a copy to you marked “approved.”

1

Name of taxpayer applying for exemption (as shown on Form 1040)

Social security number

Number and street (including apt. no.)

Telephone number (optional)

(

)

City or town, state, and ZIP code

3

Date ordained, licensed, etc.

2

Check one box:

Christian Science practitioner

Ordained minister, priest, rabbi

(Attach supporting

Member of religious order not under a vow of poverty

Commissioned or licensed minister (see line 6)

document. See instructions.)

4

Legal name of ordaining, licensing, or commissioning body or religious order

/

/

Employer identification number

Number, street, and room or suite no.

City or town, state, and ZIP code

5

Enter the first 2 years, after the date shown on line 3, that you had net self-employment earnings of $400 or

more, any of which came from services as a minister, priest, rabbi, etc.; member of a religious order; or Christian

Science practitioner

6

If you apply for the exemption as a licensed or commissioned minister, and your denomination also ordains ministers, please indicate how your

ecclesiastical powers differ from those of an ordained minister of your denomination. Attach a copy of your denomination’s bylaws relating to

the powers of ordained, commissioned, and licensed ministers.

7

I certify that I am conscientiously opposed to, or because of my religious principles I am opposed to, the acceptance (for services I perform

as a minister, member of a religious order not under a vow of poverty, or a Christian Science practitioner) of any public insurance that

makes payments in the event of death, disability, old age, or retirement; or that makes payments toward the cost of, or provides services

for, medical care. (Public insurance includes insurance systems established by the Social Security Act.)

I certify that as a duly ordained, commissioned, or licensed minister of a church or a member of a religious order not under a vow of poverty,

I have informed the ordaining, commissioning, or licensing body of my church or order that I am conscientiously opposed to, or because of

religious principles, I am opposed to the acceptance (for services I perform as a minister or as a member of a religious order) of any public

insurance that makes payments in the event of death, disability, old age, or retirement; or that makes payments toward the cost of, or

provides services for, medical care, including the benefits of any insurance system established by the Social Security Act.

I certify that I have never filed Form 2031 to revoke a previous exemption from social security coverage on earnings as a minister, member

of a religious order not under a vow of poverty, or a Christian Science practitioner.

I request to be exempted from paying self-employment tax on my earnings from services as a minister, member of a religious order not

under a vow of poverty, or a Christian Science practitioner, under section 1402(e) of the Internal Revenue Code. I understand that the

exemption, if granted, will apply only to these earnings. Under penalties of perjury, I declare that I have examined this application and to

the best of my knowledge and belief, it is true and correct.

Signature

Date

Caution: Form 4361 is not proof of the right to an exemption from Federal income tax withholding or social security tax, the right to a parsonage

allowance exclusion (section 107 of the Internal Revenue Code), assignment by your religious superiors to a particular job, or the exemption or

church status of the ordaining, licensing, or commissioning body, or religious order.

For Internal Revenue Service Use

Approved for exemption from self-employment tax on ministerial earnings

Disapproved for exemption from self-employment tax on ministerial earnings

By

(Director’s signature)

(Date)

● A commissioned or licensed minister of a

General Instructions

cost of, or provides services for, medical

church or church denomination that ordains

care, including any insurance benefits

Section references are to the Internal

ministers, if you have authority to perform

established by the Social Security Act.

Revenue Code.

substantially all religious duties of your church

If you are a duly ordained, commissioned,

or denomination.

Purpose of form. File Form 4361 to apply for

or licensed minister of a church or a member

an exemption from self-employment tax if you

This application must be based on your

of a religious order not under a vow of

are:

religious or conscientious opposition to the

poverty, prior to filing this form you must

acceptance (for services performed as a

inform the ordaining, commissioning, or

● An ordained, commissioned, or licensed

minister, member of a religious order not

licensing body of your church or order that

minister of a church;

under a vow of poverty, or Christian Science

you are opposed to the acceptance of public

● A member of a religious order who has not

practitioner) of any public insurance that

insurance benefits based on ministerial

taken a vow of poverty;

makes payments for death, disability, old age,

service on religious or conscientious grounds.

● A Christian Science practitioner; or

or retirement; or that makes payments for the

4361

For Privacy Act and Paperwork Reduction Act Notice, see page 2

Cat. No. 41586H

Form

(Rev. 11-2005)

1

1 2

2