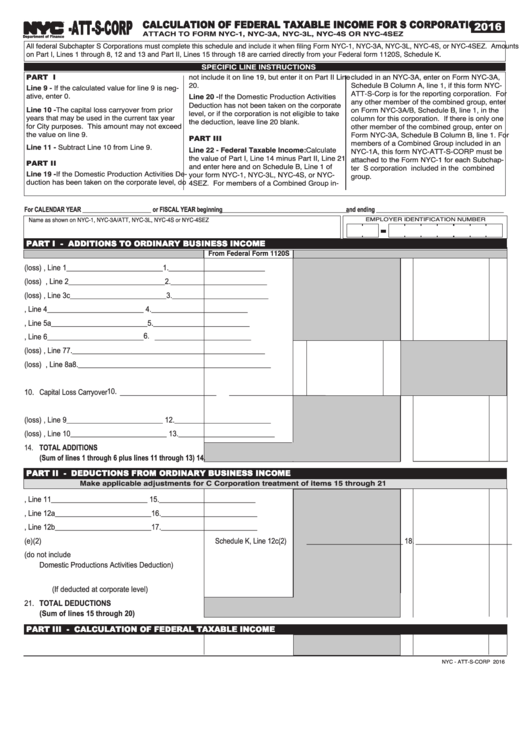

Form Nyc-Att-S-Corp - Calculation Of Federal Taxable Income For S Corporations - New York Department Of Finance - 2016

ADVERTISEMENT

-ATT-S-CORP

CALCULATION OF FEDERAL TAXABLE INCOME FOR S CORPORATIONS

2016

TM

ATTACH TO FORM NYC-1, NYC-3A, NYC-3L, NYC-4S OR NYC-4SEZ

Department of Finance

All federal Subchapter S Corporations must complete this schedule and include it when filing Form NYC-1, NYC-3A, NYC-3L, NYC-4S, or NYC-4SEZ. Amounts

on Part I, Lines 1 through 8, 12 and 13 and Part II, Lines 15 through 18 are carried directly from your Federal form 1120S, Schedule K.

SPECIFIC LINE INSTRUCTIONS

not include it on line 19, but enter it on Part II Line

cluded in an NYC-3A, enter on Form NYC-3A,

PART I

20.

Schedule B Column A, line 1, if this form NYC-

Line 9 - If the calculated value for line 9 is neg-

ATT-S-Corp is for the reporting corporation. For

ative, enter 0.

Line 20 - If the Domestic Production Activities

any other member of the combined group, enter

Deduction has not been taken on the corporate

Line 10 - The capital loss carryover from prior

on Form NYC-3A/B, Schedule B, line 1, in the

level, or if the corporation is not eligible to take

years that may be used in the current tax year

column for this corporation. If there is only one

the deduction, leave line 20 blank.

for City purposes. This amount may not exceed

other member of the combined group, enter on

the value on line 9.

Form NYC-3A, Schedule B Column B, line 1. For

PART III

members of a Combined Group included in an

Line 11 - Subtract Line 10 from Line 9.

Line 22 - Federal Taxable Income: Calculate

NYC-1A, this form NYC-ATT-S-CORP must be

the value of Part I, Line 14 minus Part II, Line 21

attached to the Form NYC-1 for each Subchap-

PART II

and enter here and on Schedule B, Line 1 of

ter S corporation included in the combined

Line 19 - If the Domestic Production Activities De-

your form NYC-1, NYC-3L, NYC-4S, or NYC-

group.

duction has been taken on the corporate level, do

4SEZ. For members of a Combined Group in-

For CALENDAR YEAR ______________________ or FISCAL YEAR beginning _____________________________________ and ending _____________________________________

Name as shown on NYC-1, NYC-3A/ATT, NYC-3L, NYC-4S or NYC-4SEZ

EMPLOYER IDENTIFICATION NUMBER

PART I - ADDITIONS TO ORDINARY BUSINESS INCOME

From Federal Form 1120S

1.

Ordinary business income (loss)................................

Schedule K, Line 1

________________________ 1. ________________________

2.

Net rental real estate income (loss) ...........................

Schedule K, Line 2

________________________ 2. ________________________

3.

Other net rental income (loss)....................................

Schedule K, Line 3c

________________________ 3. ________________________

4.

Interest income...........................................................

Schedule K, Line 4

________________________ 4. ________________________

5.

Ordinary dividends .....................................................

Schedule K, Line 5a

________________________ 5. ________________________

________________________ 6. ________________________

6.

Royalties ....................................................................

Schedule K, Line 6

7.

Net short-term capital gain (loss) ...............................

Schedule K, Line 7

7. ________________________

________________________

8.

Net long-term capital gain (loss) ................................

Schedule K, Line 8a

8. ________________________

________________________

9.

Sum of lines 7 and 8 ..................................................

See Instructions

9. ________________________

________________________

10. ________________________

10. Capital Loss Carryover .................................................

See Instructions

________________________

11. Net Capital Gain.........................................................

See Instructions

________________________ 11. ________________________

12. Net Section 1231 gain (loss) ......................................

Schedule K, Line 9

________________________ 12. ________________________

13. Other income (loss)....................................................

Schedule K, Line 10

________________________ 13. ________________________

14. TOTAL ADDITIONS

....

_____________________

__________________

(Sum of lines 1 through 6 plus lines 11 through 13)

14.

PART II - DEDUCTIONS FROM ORDINARY BUSINESS INCOME

Make applicable adjustments for C Corporation treatment of items 15 through 21

15. Section 179 deduction................................................

Schedule K, Line 11

________________________ 15. ________________________

16. Contributions ..............................................................

Schedule K, Line 12a

________________________ 16. ________________________

17. Investment interest expense ......................................

Schedule K, Line 12b

________________________ 17. ________________________

18. Section 59(e)(2) expenditures....................................

Schedule K, Line 12c(2)

________________________ 18. ________________________

19. Other deductions (do not include

Domestic Productions Activities Deduction)...............

See Instructions

________________________ 19. ________________________

20. Domestic Production Activities Deduction..................

(If deducted at corporate level) ............................

See Instructions

________________________ 20. ________________________

21. TOTAL DEDUCTIONS

(Sum of lines 15 through 20)...................................

________________________ 21. ________________________

PART III - CALCULATION OF FEDERAL TAXABLE INCOME

22. Federal Taxable Income ...........................................

See Instructions

________________________ 22. ________________________

NYC - ATT-S-CORP 2016

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1