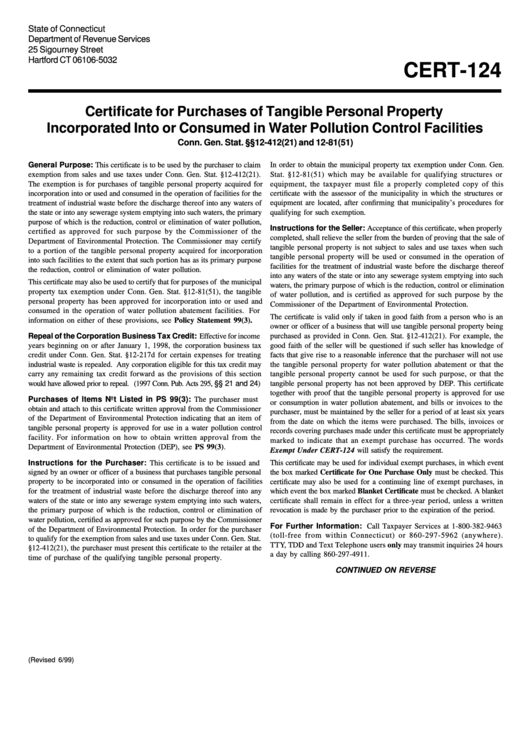

State of Connecticut

Department of Revenue Services

25 Sigourney Street

Hartford CT 06106-5032

CERT-124

Certificate for Purchases of Tangible Personal Property

Incorporated Into or Consumed in Water Pollution Control Facilities

Conn. Gen. Stat. §§12-412(21) and 12-81(51)

General Purpose: This certificate is to be used by the purchaser to claim

In order to obtain the municipal property tax exemption under Conn. Gen.

exemption from sales and use taxes under Conn. Gen. Stat. §12-412(21).

Stat. §12-81(51) which may be available for qualifying structures or

The exemption is for purchases of tangible personal property acquired for

equipment, the taxpayer must file a properly completed copy of this

incorporation into or used and consumed in the operation of facilities for the

certificate with the assessor of the municipality in which the structures or

treatment of industrial waste before the discharge thereof into any waters of

equipment are located, after confirming that municipality’s procedures for

the state or into any sewerage system emptying into such waters, the primary

qualifying for such exemption.

purpose of which is the reduction, control or elimination of water pollution,

Instructions for the Seller: Acceptance of this certificate, when properly

certified as approved for such purpose by the Commissioner of the

completed, shall relieve the seller from the burden of proving that the sale of

Department of Environmental Protection. The Commissioner may certify

tangible personal property is not subject to sales and use taxes when such

to a portion of the tangible personal property acquired for incorporation

tangible personal property will be used or consumed in the operation of

into such facilities to the extent that such portion has as its primary purpose

facilities for the treatment of industrial waste before the discharge thereof

the reduction, control or elimination of water pollution.

into any waters of the state or into any sewerage system emptying into such

This certificate may also be used to certify that for purposes of the municipal

waters, the primary purpose of which is the reduction, control or elimination

property tax exemption under Conn. Gen. Stat. §12-81(51), the tangible

of water pollution, and is certified as approved for such purpose by the

personal property has been approved for incorporation into or used and

Commissioner of the Department of Environmental Protection.

consumed in the operation of water pollution abatement facilities. For

The certificate is valid only if taken in good faith from a person who is an

information on either of these provisions, see Policy Statement 99(3).

owner or officer of a business that will use tangible personal property being

Repeal of the Corporation Business Tax Credit: Effective for income

purchased as provided in Conn. Gen. Stat. §12-412(21). For example, the

years beginning on or after January 1, 1998, the corporation business tax

good faith of the seller will be questioned if such seller has knowledge of

credit under Conn. Gen. Stat. §12-217d for certain expenses for treating

facts that give rise to a reasonable inference that the purchaser will not use

industrial waste is repealed. Any corporation eligible for this tax credit may

the tangible personal property for water pollution abatement or that the

tangible personal property cannot be used for such purpose, or that the

carry any remaining tax credit forward as the provisions of this section

would have allowed prior to repeal. (1997 Conn. Pub. Acts 295, §§ 21 and 24)

tangible personal property has not been approved by DEP. This certificate

together with proof that the tangible personal property is approved for use

Purchases of Items Not Listed in PS 99(3): The purchaser must

or consumption in water pollution abatement, and bills or invoices to the

obtain and attach to this certificate written approval from the Commissioner

purchaser, must be maintained by the seller for a period of at least six years

of the Department of Environmental Protection indicating that an item of

from the date on which the items were purchased. The bills, invoices or

tangible personal property is approved for use in a water pollution control

records covering purchases made under this certificate must be appropriately

facility. For information on how to obtain written approval from the

marked to indicate that an exempt purchase has occurred. The words

Department of Environmental Protection (DEP), see PS 99(3).

Exempt Under CERT-124 will satisfy the requirement.

Instructions for the Purchaser: This certificate is to be issued and

This certificate may be used for individual exempt purchases, in which event

signed by an owner or officer of a business that purchases tangible personal

the box marked Certificate for One Purchase Only must be checked. This

property to be incorporated into or consumed in the operation of facilities

certificate may also be used for a continuing line of exempt purchases, in

for the treatment of industrial waste before the discharge thereof into any

which event the box marked Blanket Certificate must be checked. A blanket

waters of the state or into any sewerage system emptying into such waters,

certificate shall remain in effect for a three-year period, unless a written

the primary purpose of which is the reduction, control or elimination of

revocation is made by the purchaser prior to the expiration of the period.

water pollution, certified as approved for such purpose by the Commissioner

For Further Information: Call Taxpayer Services at 1-800-382-9463

of the Department of Environmental Protection. In order for the purchaser

(toll-free from within Connecticut) or 860-297-5962 (anywhere).

to qualify for the exemption from sales and use taxes under Conn. Gen. Stat.

TTY, TDD and Text Telephone users only may transmit inquiries 24 hours

§12-412(21), the purchaser must present this certificate to the retailer at the

a day by calling 860-297-4911.

time of purchase of the qualifying tangible personal property.

CONTINUED ON REVERSE

(Revised 6/99)

1

1 2

2