Form Rev 85 0046 - Schedule T - Qualified Family-Owned Business Interest Deduction - Washington Department Of Revenue

ADVERTISEMENT

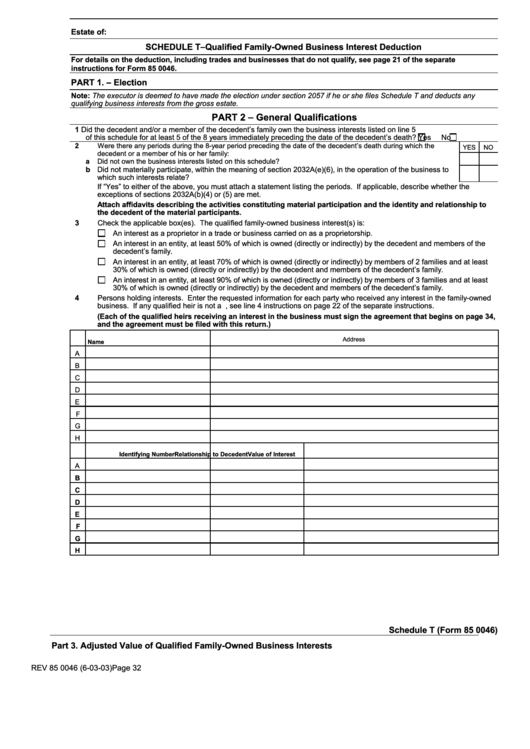

Estate of:

SCHEDULE T−Qualified Family-Owned Business Interest Deduction

For details on the deduction, including trades and businesses that do not qualify, see page 21 of the separate

instructions for Form 85 0046.

PART 1. − Election

Note: The executor is deemed to have made the election under section 2057 if he or she files Schedule T and deducts any

qualifying business interests from the gross estate.

PART 2 − General Qualifications

1 Did the decedent and/or a member of the decedent’s family own the business interests listed on line 5

of this schedule for at least 5 of the 8 years immediately preceding the date of the decedent’s death?

Yes

No

2

Were there any periods during the 8-year period preceding the date of the decedent’s death during which the

YES

NO

decedent or a member of his or her family:

a

Did not own the business interests listed on this schedule?

b Did not materially participate, within the meaning of section 2032A(e)(6), in the operation of the business to

which such interests relate?

If “Yes” to either of the above, you must attach a statement listing the periods. If applicable, describe whether the

exceptions of sections 2032A(b)(4) or (5) are met.

Attach affidavits describing the activities constituting material participation and the identity and relationship to

the decedent of the material participants.

3

Check the applicable box(es). The qualified family-owned business interest(s) is:

An interest as a proprietor in a trade or business carried on as a proprietorship.

An interest in an entity, at least 50% of which is owned (directly or indirectly) by the decedent and members of the

decedent’s family.

An interest in an entity, at least 70% of which is owned (directly or indirectly) by members of 2 families and at least

30% of which is owned (directly or indirectly) by the decedent and members of the decedent’s family.

An interest in an entity, at least 90% of which is owned (directly or indirectly) by members of 3 families and at least

30% of which is owned (directly or indirectly) by the decedent and members of the decedent’s family.

4

Persons holding interests. Enter the requested information for each party who received any interest in the family-owned

business. If any qualified heir is not a U.S. citizen, see line 4 instructions on page 22 of the separate instructions.

(Each of the qualified heirs receiving an interest in the business must sign the agreement that begins on page 34,

and the agreement must be filed with this return.)

Address

Name

A

B

C

D

E

F

G

H

Identifying Number

Relationship to Decedent

Value of Interest

A

B

C

D

E

F

G

H

Schedule T (Form 85 0046)

Part 3. Adjusted Value of Qualified Family-Owned Business Interests

REV 85 0046 (6-03-03)

Page 32

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4