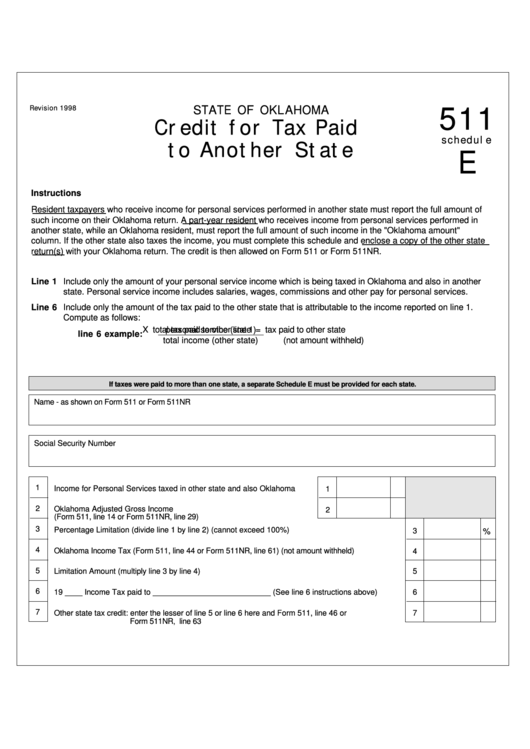

Revision 1998

STATE OF OKLAHOMA

511

Credit for Tax Paid

schedule

to Another State

E

Instructions

Resident taxpayers who receive income for personal services performed in another state must report the full amount of

such income on their Oklahoma return. A part-year resident who receives income from personal services performed in

another state, while an Oklahoma resident, must report the full amount of such income in the "Oklahoma amount"

column. If the other state also taxes the income, you must complete this schedule and enclose a copy of the other state

return(s) with your Oklahoma return. The credit is then allowed on Form 511 or Form 511NR.

Line 1

Include only the amount of your personal service income which is being taxed in Oklahoma and also in another

state. Personal service income includes salaries, wages, commissions and other pay for personal services.

Line 6

Include only the amount of the tax paid to the other state that is attributable to the income reported on line 1.

Compute as follows:

personal service (line 1)

X total tax paid to other state = tax paid to other state

line 6 example:

total income (other state)

(not amount withheld)

If taxes were paid to more than one state, a separate Schedule E must be provided for each state.

Name - as shown on Form 511 or Form 511NR

Social Security Number

1

Income for Personal Services taxed in other state and also Oklahoma

......

1

2

Oklahoma Adjusted Gross Income

............................................................................

2

(Form 511, line 14 or Form 511NR, line 29)

3

Percentage Limitation (divide line 1 by line 2) (cannot exceed 100%)

...........................................................

3

%

4

Oklahoma Income Tax (Form 511, line 44 or Form 511NR, line 61) (not amount withheld)

.......................

4

5

Limitation Amount (multiply line 3 by line 4)

..............................................................................................................

5

6

19 ____ Income Tax paid to ___________________________ (See line 6 instructions above)

..........

6

7

Other state tax credit: enter the lesser of line 5 or line 6 here and Form 511, line 46 or

7

Form 511NR, line 63

..........................................................................................................................................................

1

1