Form 8879-Eo - Irs E-File Signature Authorization For An Exempt Organization Sample - 2015 Page 10

ADVERTISEMENT

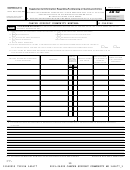

CANCER SUPPORT COMMUNITY MONTANA

81-0542266

9

Page

Form 990 (2015)

Part VIII

Statement of Revenue

Check if Schedule O contains a response or note to any line in this Part VIII •••••••••••••••••••••••••

(A)

(B)

(C)

(D)

Revenue excluded

Related or

Unrelated

Total revenue

from tax under

exempt function

business

sections

revenue

revenue

512 - 514

1 a

Federated campaigns

~~~~~~

1

a

5,000.

b

Membership dues

~~~~~~~~

1

b

c

Fundraising events

~~~~~~~~

1

c

d

Related organizations

~~~~~~

1

d

e

Government grants (contributions)

1

e

f

All other contributions, gifts, grants, and

309,891.

similar amounts not included above

~~

1

f

16,785.

g

Noncash contributions included in lines 1a-1f: $

314,891.

Add lines 1a-1f ••••••••••••••••• |

h

Total.

Business Code

2

a

b

c

d

e

f

All other program service revenue ~~~~~

g

Total.

Add lines 2a-2f ••••••••••••••••• |

3

Investment income (including dividends, interest, and

353.

353.

other similar amounts)

~~~~~~~~~~~~~~~~~ |

4

Income from investment of tax-exempt bond proceeds

|

5

Royalties ••••••••••••••••••••••• |

(i) Real

(ii) Personal

11,340.

6 a

Gross rents

~~~~~~~

523.

b

Less: rental expenses

~~~

10,817.

c

Rental income or (loss)

~~

10,817.

10,817.

d

Net rental income or (loss)

•••••••••••••• |

7

a

Gross amount from sales of

(i) Securities

(ii) Other

assets other than inventory

b

Less: cost or other basis

and sales expenses

~~~

c

Gain or (loss)

~~~~~~~

d

Net gain or (loss) ••••••••••••••••••• |

8

a

Gross income from fundraising events (not

including $

of

contributions reported on line 1c). See

139,552.

Part IV, line 18 ~~~~~~~~~~~~~

a

30,002.

b

Less: direct expenses~~~~~~~~~~

b

109,550.

109,550.

c

Net income or (loss) from fundraising events ••••• |

9 a

Gross income from gaming activities. See

Part IV, line 19 ~~~~~~~~~~~~~

a

b

Less: direct expenses

~~~~~~~~~

b

c

Net income or (loss) from gaming activities

•••••• |

10 a

Gross sales of inventory, less returns

4,931.

and allowances ~~~~~~~~~~~~~

a

5,552.

b

Less: cost of goods sold

~~~~~~~~

b

-621.

-621.

c

Net income or (loss) from sales of inventory

•••••• |

Miscellaneous Revenue

Business Code

11 a

b

c

d

All other revenue ~~~~~~~~~~~~~

e Total.

Add lines 11a-11d ~~~~~~~~~~~~~~~ |

434,990.

0.

-621. 120,720.

Total revenue.

See instructions.

|

12

•••••••••••••

990

Form

(2015)

532009 12-16-15

9

13340919 792194 141677

2015.04020 CANCER SUPPORT COMMUNITY MO 141677_1

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18 19

19 20

20 21

21 22

22 23

23 24

24 25

25 26

26 27

27 28

28 29

29 30

30 31

31 32

32 33

33 34

34 35

35 36

36 37

37 38

38 39

39 40

40 41

41