Form 8879-Eo - Irs E-File Signature Authorization For An Exempt Organization Sample - 2015 Page 11

ADVERTISEMENT

CANCER SUPPORT COMMUNITY MONTANA

81-0542266

10

Form 990 (2015)

Page

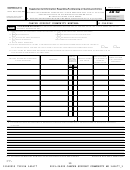

Part IX Statement of Functional Expenses

Section 501(c)(3) and 501(c)(4) organizations must complete all columns. All other organizations must complete column (A).

Check if Schedule O contains a response or note to any line in this Part IX ••••••••••••••••••••••••••

(A)

(B)

(C)

(D)

Do not include amounts reported on lines 6b,

Total expenses

Program service

Management and

Fundraising

7b, 8b, 9b, and 10b of Part VIII.

expenses

general expenses

expenses

Grants and other assistance to domestic organizations

1

and domestic governments. See Part IV, line 21

~

2

Grants and other assistance to domestic

individuals. See Part IV, line 22 ~~~~~~~

3

Grants and other assistance to foreign

organizations, foreign governments, and foreign

individuals. See Part IV, lines 15 and 16 ~~~

Benefits paid to or for members ~~~~~~~

4

Compensation of current officers, directors,

5

58,411.

49,649.

5,841.

2,921.

trustees, and key employees ~~~~~~~~

Compensation not included above, to disqualified

6

persons (as defined under section 4958(f)(1)) and

persons described in section 4958(c)(3)(B)

~~~

132,336.

112,485.

13,234.

6,617.

7

Other salaries and wages ~~~~~~~~~~

Pension plan accruals and contributions (include

8

section 401(k) and 403(b) employer contributions)

11,934.

10,144.

1,193.

597.

9

Other employee benefits ~~~~~~~~~~

16,554.

14,071.

1,655.

828.

10

Payroll taxes ~~~~~~~~~~~~~~~~

11

Fees for services (non-employees):

a

Management

~~~~~~~~~~~~~~~~

b

Legal

~~~~~~~~~~~~~~~~~~~~

4,251.

3,613.

425.

213.

c

Accounting

~~~~~~~~~~~~~~~~~

d

Lobbying

~~~~~~~~~~~~~~~~~~

Professional fundraising services. See Part IV, line 17

e

f

Investment management fees

~~~~~~~~

(If line 11g amount exceeds 10% of line 25,

g

Other.

column (A) amount, list line 11g expenses on Sch O.)

9,408.

7,997.

941.

470.

12

Advertising and promotion

~~~~~~~~~

9,846.

8,369.

985.

492.

13

Office expenses

~~~~~~~~~~~~~~~

14

Information technology

~~~~~~~~~~~

15

Royalties

~~~~~~~~~~~~~~~~~~

12,952.

11,009.

1,295.

648.

16

Occupancy ~~~~~~~~~~~~~~~~~

17

Travel

~~~~~~~~~~~~~~~~~~~

18

Payments of travel or entertainment expenses

for any federal, state, or local public officials

10,527.

8,948.

1,053.

526.

19

Conferences, conventions, and meetings ~~

20

Interest

~~~~~~~~~~~~~~~~~~

21

Payments to affiliates

~~~~~~~~~~~~

39,088.

39,088.

22

Depreciation, depletion, and amortization

~~

7,429.

6,315.

743.

371.

23

Insurance

~~~~~~~~~~~~~~~~~

Other expenses. Itemize expenses not covered

24

above. (List miscellaneous expenses in line 24e. If line

24e amount exceeds 10% of line 25, column (A)

amount, list line 24e expenses on Schedule O.)

~~

UBTI INCOME TAX

1,439.

1,439.

a

PROGRAM SUPPLIES

51,157.

51,157.

b

RETREAT EXPENSES

32,035.

32,035.

c

BANK CHARGES/CREDIT CAR

1,620.

1,377.

162.

81.

d

1,148.

1,148.

e

All other expenses

400,135.

357,696.

27,527.

14,912.

Total functional expenses.

Add lines 1 through 24e

25

Joint costs.

Complete this line only if the organization

26

reported in column (B) joint costs from a combined

educational campaign and fundraising solicitation.

|

Check here

if following SOP 98-2 (ASC 958-720)

990

Form

(2015)

532010 12-16-15

10

13340919 792194 141677

2015.04020 CANCER SUPPORT COMMUNITY MO 141677_1

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18 19

19 20

20 21

21 22

22 23

23 24

24 25

25 26

26 27

27 28

28 29

29 30

30 31

31 32

32 33

33 34

34 35

35 36

36 37

37 38

38 39

39 40

40 41

41