Form 8879-Eo - Irs E-File Signature Authorization For An Exempt Organization Sample - 2015 Page 18

ADVERTISEMENT

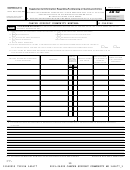

CANCER SUPPORT COMMUNITY MONTANA

81-0542266

Schedule A (Form 990 or 990-EZ) 2015

Page

5

Part IV

Supporting Organizations

(continued)

Yes

No

11

Has the organization accepted a gift or contribution from any of the following persons?

a

A person who directly or indirectly controls, either alone or together with persons described in (b) and (c)

below, the governing body of a supported organization?

11a

b

A family member of a person described in (a) above?

11b

If "Yes" to a, b, or c, provide detail in

c

A 35% controlled entity of a person described in (a) or (b) above?

Part VI.

11c

Section B. Type I Supporting Organizations

Yes

No

1

Did the directors, trustees, or membership of one or more supported organizations have the power to

regularly appoint or elect at least a majority of the organization's directors or trustees at all times during the

If "No," describe in

how the supported organization(s) effectively operated, supervised, or

tax year?

Part VI

controlled the organization's activities. If the organization had more than one supported organization,

describe how the powers to appoint and/or remove directors or trustees were allocated among the supported

organizations and what conditions or restrictions, if any, applied to such powers during the tax year.

1

2

Did the organization operate for the benefit of any supported organization other than the supported

If "Yes," explain in

organization(s) that operated, supervised, or controlled the supporting organization?

how providing such benefit carried out the purposes of the supported organization(s) that operated,

Part VI

supervised, or controlled the supporting organization.

2

Section C. Type II Supporting Organizations

Yes

No

1

Were a majority of the organization's directors or trustees during the tax year also a majority of the directors

If "No," describe in

how control

Part VI

or trustees of each of the organization's supported organization(s)?

or management of the supporting organization was vested in the same persons that controlled or managed

the supported organization(s).

1

Section D. All Type III Supporting Organizations

Yes

No

1

Did the organization provide to each of its supported organizations, by the last day of the fifth month of the

organization's tax year, (i) a written notice describing the type and amount of support provided during the prior tax

year, (ii) a copy of the Form 990 that was most recently filed as of the date of notification, and (iii) copies of the

organization's governing documents in effect on the date of notification, to the extent not previously provided?

1

2

Were any of the organization's officers, directors, or trustees either (i) appointed or elected by the supported

If "No," explain in

how

Part VI

organization(s) or (ii) serving on the governing body of a supported organization?

the organization maintained a close and continuous working relationship with the supported organization(s).

2

3

By reason of the relationship described in (2), did the organization's supported organizations have a

significant voice in the organization's investment policies and in directing the use of the organization's

If "Yes," describe in

the role the organization's

Part VI

income or assets at all times during the tax year?

supported organizations played in this regard.

3

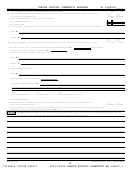

Section E. Type III Functionally-Integrated Supporting Organizations

Check the box next to the method that the organization used to satisfy the Integral Part Test during the year

(see instructions):

1

Complete

below.

line 2

a

The organization satisfied the Activities Test.

Complete

below.

line 3

b

The organization is the parent of each of its supported organizations.

Describe in Part VI how you supported a government entity (see instructions).

c

The organization supported a governmental entity.

Answer (a) and (b) below.

2

Activities Test.

Yes

No

a

Did substantially all of the organization's activities during the tax year directly further the exempt purposes of

If "Yes," then in

Part VI identify

the supported organization(s) to which the organization was responsive?

how these activities directly furthered their exempt purposes,

those supported organizations and explain

how the organization was responsive to those supported organizations, and how the organization determined

that these activities constituted substantially all of its activities.

2a

b

Did the activities described in (a) constitute activities that, but for the organization's involvement, one or more

If "Yes," explain in

the

Part VI

of the organization's supported organization(s) would have been engaged in?

reasons for the organization's position that its supported organization(s) would have engaged in these

activities but for the organization's involvement.

2b

Answer (a) and (b) below.

3

Parent of Supported Organizations.

a

Did the organization have the power to regularly appoint or elect a majority of the officers, directors, or

Part VI.

trustees of each of the supported organizations? Provide details in

3a

b

Did the organization exercise a substantial degree of direction over the policies, programs, and activities of each

the role played by the organization in this regard.

Part VI

of its supported organizations? If "Yes," describe in

3b

Schedule A (Form 990 or 990-EZ) 2015

532025 09-23-15

17

13340919 792194 141677

2015.04020 CANCER SUPPORT COMMUNITY MO 141677_1

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18 19

19 20

20 21

21 22

22 23

23 24

24 25

25 26

26 27

27 28

28 29

29 30

30 31

31 32

32 33

33 34

34 35

35 36

36 37

37 38

38 39

39 40

40 41

41