Form 8879-Eo - Irs E-File Signature Authorization For An Exempt Organization Sample - 2015 Page 26

ADVERTISEMENT

CANCER SUPPORT COMMUNITY MONTANA

81-0542266

4

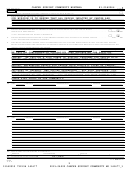

Schedule D (Form 990) 2015

Page

Part XI

Reconciliation of Revenue per Audited Financial Statements With Revenue per Return.

Complete if the organization answered "Yes" on Form 990, Part IV, line 12a.

1

Total revenue, gains, and other support per audited financial statements

~~~~~~~~~~~~~~~~~~~

1

2

Amounts included on line 1 but not on Form 990, Part VIII, line 12:

a

Net unrealized gains (losses) on investments

~~~~~~~~~~~~~~~~~~

2a

b

Donated services and use of facilities

~~~~~~~~~~~~~~~~~~~~~~

2b

c

Recoveries of prior year grants

~~~~~~~~~~~~~~~~~~~~~~~~~

2c

d

Other (Describe in Part XIII.)

~~~~~~~~~~~~~~~~~~~~~~~~~~

2d

e

Add lines

2a

through

2d

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

2e

3

Subtract line

2e

from line

1

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

3

4

Amounts included on Form 990, Part VIII, line 12, but not on line 1:

Investment expenses not included on Form 990, Part VIII, line 7b

~~~~~~~~

a

4a

Other (Describe in Part XIII.)

~~~~~~~~~~~~~~~~~~~~~~~~~~

b

4b

Add lines

and

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

c

4a

4b

4c

(This must equal Form 990, Part I, line 12.)

Total revenue. Add lines

and

•••••••••••••••••

5

3

4c.

5

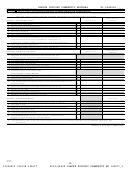

Part XII Reconciliation of Expenses per Audited Financial Statements With Expenses per Return.

Complete if the organization answered "Yes" on Form 990, Part IV, line 12a.

1

Total expenses and losses per audited financial statements

~~~~~~~~~~~~~~~~~~~~~~~~~~

1

2

Amounts included on line 1 but not on Form 990, Part IX, line 25:

a

Donated services and use of facilities

~~~~~~~~~~~~~~~~~~~~~~

2a

b

Prior year adjustments

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

2b

c

Other losses

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

2c

~~~~~~~~~~~~~~~~~~~~~~~~~~

d

Other (Describe in Part XIII.)

2d

e

Add lines

2a

through

2d

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

2e

3

Subtract line

2e

from line

1

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

3

4

Amounts included on Form 990, Part IX, line 25, but not on line 1:

a

Investment expenses not included on Form 990, Part VIII, line 7b

~~~~~~~~

4a

b

Other (Describe in Part XIII.)

~~~~~~~~~~~~~~~~~~~~~~~~~~

4b

c

Add lines

4a

and

4b

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

4c

(This must equal Form 990, Part I, line 18.)

••••••••••••••••

5

Total expenses. Add lines

3

and

4c.

5

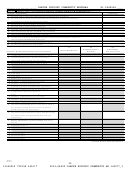

Part XIII Supplemental Information.

Provide the descriptions required for Part II, lines 3, 5, and 9; Part III, lines 1a and 4; Part IV, lines 1b and 2b; Part V, line 4; Part X, line 2; Part XI,

lines 2d and 4b; and Part XII, lines 2d and 4b. Also complete this part to provide any additional information.

PART V, LINE 4:

THE BOARD HAS DESIGNATED THESE FUNDS FOR LONG-TERM INVESTMENT WITH THE

INTENTION OF GROWING THE FUNDS TO BE USED TO SUBSIDIZE THE ORGANIZATION'S

ANNUAL OPERATING EXPENSES.

532054

Schedule D (Form 990) 2015

09-21-15

29

13340919 792194 141677

2015.04020 CANCER SUPPORT COMMUNITY MO 141677_1

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18 19

19 20

20 21

21 22

22 23

23 24

24 25

25 26

26 27

27 28

28 29

29 30

30 31

31 32

32 33

33 34

34 35

35 36

36 37

37 38

38 39

39 40

40 41

41