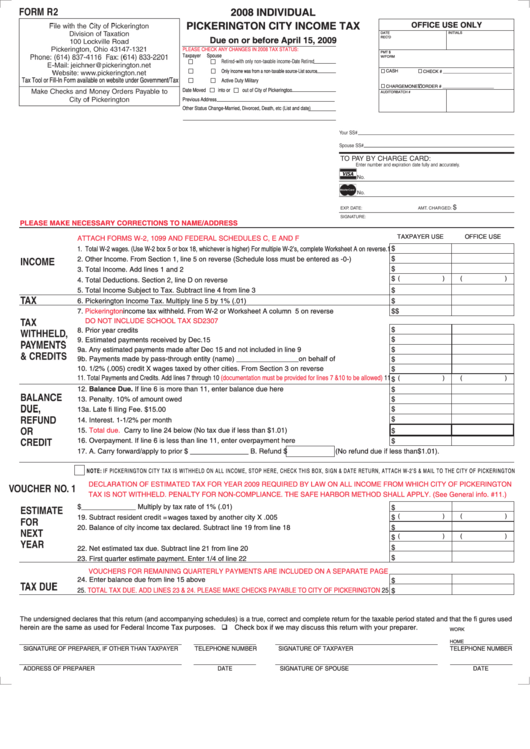

2008 INDIVIDUAL

PICKERINGTON CITY INCOME TAX

OFFICE USE ONLY

DATE

INITIALS

Due on or before April 15, 2009

REC’D

PLEASE CHECK ANY CHANGES IN 2008 TAX STATUS:

PMT $

Taxpayer

Spouse

W/FORM

Retired-with only non-taxable income-Date Retired

Only income was from a non-taxable source-List source

CASH

CHECK # ____________________________

Tax Tool or Fill-In Form available on website under Government/Tax

Active Duty Military

CHARGE

MONEY ORDER # _____________________

Date Moved

into or

out of City of Pickerington

AUDITOR

BATCH #

Previous Address

Other Status Change-Married, Divorced, Death, etc (List and date)

PLEASE MAKE NECESSARY CORRECTIONS TO NAME/ADDRESS

TAXPAYER USE

OFFICE USE

ATTACH FORMS W-2, 1099 AND FEDERAL SCHEDULES C, E AND F

1. Total W-2 wages. (Use W-2 box 5 or box 18, whichever is higher) For multiple W-2’s, complete Worksheet A on reverse.1

$

$

2. Other Income. From Section 1, line 5 on reverse (Schedule loss must be entered as -0-) ..................2

$

3. Total Income. Add lines 1 and 2 .......................................................................................................3

$

(

)

(

)

4. Total Deductions. Section 2, line D on reverse .................................................................................4

5. Total Income Subject to Tax. Subtract line 4 from line 3 ...................................................................5

$

6. Pickerington Income Tax. Multiply line 5 by 1% (.01) ........................................................................6

$

7.

Pickerington

income tax withheld. From W-2 or Worksheet A column 5 on reverse ..........................7

$ $

DO NOT INCLUDE SCHOOL TAX SD2307

$

8. Prior year credits ...............................................................................................................................8

$

9. Estimated payments received by Dec.15 ..........................................................................................9

9a. Any estimated payments made after Dec 15 and not included in line 9 ..........................................9a

$

9b. Payments made by pass-through entity (name) ________________on behalf of taxpayer..........9b

$

10. 1/2% (.005) credit X wages taxed by other cities. From Section 3 on reverse ..............................10

$

11. Total Payments and Credits. Add lines 7 through 10

(documentation must be provided for lines 7 &10 to be allowed)

11

(

)

(

)

$

12. Balance Due. If line 6 is more than 11, enter balance due here ..................................................12

$

13. Penalty. 10% of amount owed ......................................................................................................13

$

$

13a. Late fi lling Fee. $15.00 ..............................................................................................................13a

$

14. Interest. 1-1/2% per month ............................................................................................................14

15.

Total due.

Carry to line 24 below (No tax due if less than $1.01) ................................................15

$

16. Overpayment. If line 6 is less than line 11, enter overpayment here ...........................................16

$

17. A. Carry forward/apply to prior $ _______________ B. Refund $

(No refund due if less than$1.01).

NOTE: IF PICKERINGTON CITY TAX IS WITHHELD ON ALL INCOME, STOP HERE, CHECK THIS BOX, SIGN & DATE RETURN, ATTACH W-2’S & MAIL TO THE CITY OF PICKERINGTON

DECLARATION OF ESTIMATED TAX FOR YEAR 2009 REQUIRED BY LAW ON ALL INCOME FROM WHICH CITY OF PICKERINGTON

TAX IS NOT WITHHELD. PENALTY FOR NON-COMPLIANCE. THE SAFE HARBOR METHOD SHALL APPLY. (See General info. #11.)

18.Estimated income subject to tax $______________ Multiply by tax rate of 1% (.01) ....................18

$

(

)

(

)

19. Subtract resident credit = wages taxed by another city X .005 .....................................................19

$

20. Balance of city income tax declared. Subtract line 19 from line 18 .............................................. 20

$

(

)

(

)

$

21.Less credits. Enter line 17A from above ........................................................................................ 21

$

22. Net estimated tax due. Subtract line 21 from line 20 .................................................................... 22

$

23. First quarter estimate payment. Enter 1/4 of line 22 .................................................................. 23

VOUCHERS FOR REMAINING QUARTERLY PAYMENTS ARE INCLUDED ON A SEPARATE PAGE

24. Enter balance due from line 15 above .......................................................................................... 24

$

25.

TOTAL TAX DUE. ADD LINES 23 & 24. PLEASE MAKE CHECKS PAYABLE TO CITY OF PICKERINGTON

25

$

The undersigned declares that this return (and accompanying schedules) is a true, correct and complete return for the taxable period stated and that the fi gures used

herein are the same as used for Federal Income Tax purposes.

Check box if we may discuss this return with your preparer.

WORK

HOME

SIGNATURE OF PREPARER, IF OTHER THAN TAXPAYER

TELEPHONE NUMBER

SIGNATURE OF TAXPAYER

TELEPHONE NUMBER

ADDRESS OF PREPARER

DATE

SIGNATURE OF SPOUSE

DATE

1

1 2

2