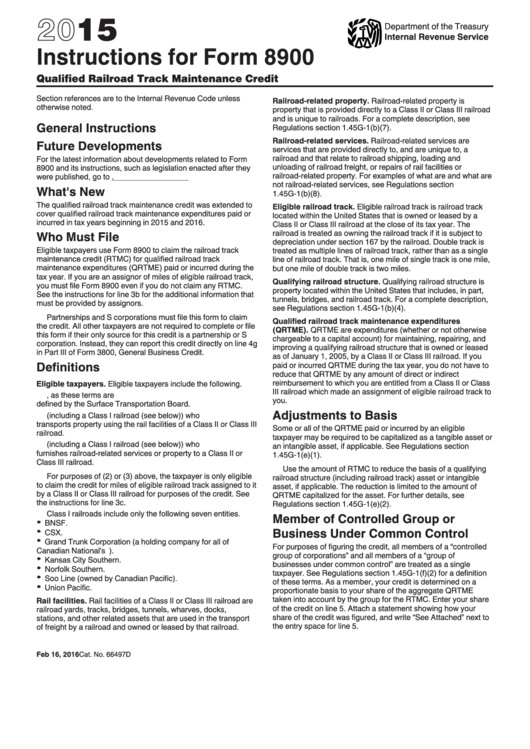

Instructions For Form 8900 - Qualified Railroad Track Maintenance Credit - 2015

ADVERTISEMENT

2015

Department of the Treasury

Internal Revenue Service

Instructions for Form 8900

Qualified Railroad Track Maintenance Credit

Section references are to the Internal Revenue Code unless

Railroad-related property. Railroad-related property is

otherwise noted.

property that is provided directly to a Class II or Class III railroad

and is unique to railroads. For a complete description, see

General Instructions

Regulations section 1.45G-1(b)(7).

Railroad-related services. Railroad-related services are

Future Developments

services that are provided directly to, and are unique to, a

railroad and that relate to railroad shipping, loading and

For the latest information about developments related to Form

unloading of railroad freight, or repairs of rail facilities or

8900 and its instructions, such as legislation enacted after they

railroad-related property. For examples of what are and what are

were published, go to

not railroad-related services, see Regulations section

What's New

1.45G-1(b)(8).

The qualified railroad track maintenance credit was extended to

Eligible railroad track. Eligible railroad track is railroad track

cover qualified railroad track maintenance expenditures paid or

located within the United States that is owned or leased by a

incurred in tax years beginning in 2015 and 2016.

Class II or Class III railroad at the close of its tax year. The

Who Must File

railroad is treated as owning the railroad track if it is subject to

depreciation under section 167 by the railroad. Double track is

Eligible taxpayers use Form 8900 to claim the railroad track

treated as multiple lines of railroad track, rather than as a single

maintenance credit (RTMC) for qualified railroad track

line of railroad track. That is, one mile of single track is one mile,

maintenance expenditures (QRTME) paid or incurred during the

but one mile of double track is two miles.

tax year. If you are an assignor of miles of eligible railroad track,

Qualifying railroad structure. Qualifying railroad structure is

you must file Form 8900 even if you do not claim any RTMC.

property located within the United States that includes, in part,

See the instructions for line 3b for the additional information that

tunnels, bridges, and railroad track. For a complete description,

must be provided by assignors.

see Regulations section 1.45G-1(b)(4).

Partnerships and S corporations must file this form to claim

Qualified railroad track maintenance expenditures

the credit. All other taxpayers are not required to complete or file

(QRTME). QRTME are expenditures (whether or not otherwise

this form if their only source for this credit is a partnership or S

chargeable to a capital account) for maintaining, repairing, and

corporation. Instead, they can report this credit directly on line 4g

improving a qualifying railroad structure that is owned or leased

in Part III of Form 3800, General Business Credit.

as of January 1, 2005, by a Class II or Class III railroad. If you

Definitions

paid or incurred QRTME during the tax year, you do not have to

reduce that QRTME by any amount of direct or indirect

reimbursement to which you are entitled from a Class II or Class

Eligible taxpayers. Eligible taxpayers include the following.

III railroad which made an assignment of eligible railroad track to

1. Any Class II or Class III railroad, as these terms are

you.

defined by the Surface Transportation Board.

Adjustments to Basis

2. Any person (including a Class I railroad (see below)) who

transports property using the rail facilities of a Class II or Class III

Some or all of the QRTME paid or incurred by an eligible

railroad.

taxpayer may be required to be capitalized as a tangible asset or

3. Any person (including a Class I railroad (see below)) who

an intangible asset, if applicable. See Regulations section

furnishes railroad-related services or property to a Class II or

1.45G-1(e)(1).

Class III railroad.

Use the amount of RTMC to reduce the basis of a qualifying

For purposes of (2) or (3) above, the taxpayer is only eligible

railroad structure (including railroad track) asset or intangible

to claim the credit for miles of eligible railroad track assigned to it

asset, if applicable. The reduction is limited to the amount of

by a Class II or Class III railroad for purposes of the credit. See

QRTME capitalized for the asset. For further details, see

the instructions for line 3c.

Regulations section 1.45G-1(e)(2).

Class I railroads include only the following seven entities.

Member of Controlled Group or

BNSF.

Business Under Common Control

CSX.

Grand Trunk Corporation (a holding company for all of

For purposes of figuring the credit, all members of a “controlled

Canadian National's U.S. railroad operations).

group of corporations” and all members of a “group of

Kansas City Southern.

businesses under common control” are treated as a single

Norfolk Southern.

taxpayer. See Regulations section 1.45G-1(f)(2) for a definition

Soo Line (owned by Canadian Pacific).

of these terms. As a member, your credit is determined on a

Union Pacific.

proportionate basis to your share of the aggregate QRTME

taken into account by the group for the RTMC. Enter your share

Rail facilities. Rail facilities of a Class II or Class III railroad are

of the credit on line 5. Attach a statement showing how your

railroad yards, tracks, bridges, tunnels, wharves, docks,

share of the credit was figured, and write “See Attached” next to

stations, and other related assets that are used in the transport

the entry space for line 5.

of freight by a railroad and owned or leased by that railroad.

Feb 16, 2016

Cat. No. 66497D

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2