Michigan Department of Treasury

4 (Rev. 2-07)

Instructions for Application for Extension of Time to File Michigan Tax Returns

General Information

An extension of time to file is not an extension of time

- If you e-filed an MI-1040 return, retain a copy of the

to pay.

Read instructions before completing this

extension form for your records. Add a short comment

Application.

explaining why you are unable to file your return by the

due date.

This information is issued under Public Acts 301 of 1939,

281 of 1967 and 228 of 1975. Filing of this form is

Single Business Tax filers must use this form to request

mandatory for Single Business Tax (SBT) filers to obtain

an extension and must file it even if the IRS has approved

an extension. Income Tax filers may file this form or a

a federal extension. If this form is received by the due

copy of their federal extension.

date of the annual return and a federal extension was

granted, Treasury will grant the taxpayer the same length

Income Tax (individual and fiduciary). An extension of

of time as the federal extension plus 60 days. If this form

time to file the federal return automatically extends the

is received and a federal extension was not granted,

due date of the Michigan return to the new federal due

Treasury will grant a 180-day extension.

date. If you have not been granted a federal extension, the

Michigan Department of Treasury will grant a 180-day

An extension of time to file is not an extension of time to

extension.

pay. Payment must be included with this form or

appropriate estimated tax payments must have been made

Do not file this form if a refund is expected or if you are

during the year. Extension requests received without

not submitting payment with this form.

payment on the account will not be honored and penalty

and interest will accrue on the unpaid tax from the

- If at the time the extension is filed, it is determined

original due date of the return. Penalty and interest for

additional Michigan tax is due, send the amount due and a

late filing is only charged if tax will be due on the SBT

completed Michigan extension application or a copy of

annual return. If no tax will be due on the SBT annual

your federal extension form. Extension requests received

return, there is no need to request an extension to avoid

without payment on the account will not be honored and

penalty and interest.

penalty and interest will accrue on the unpaid tax from the

original due date of the return.

Read the line-by-line instructions on page 2 before

completing the Application below.

- Attach a copy of all federal and Michigan extensions to

the MI-1040 or MI-1041 when it is filed. DO NOT attach a

copy of the federal extension with this form.

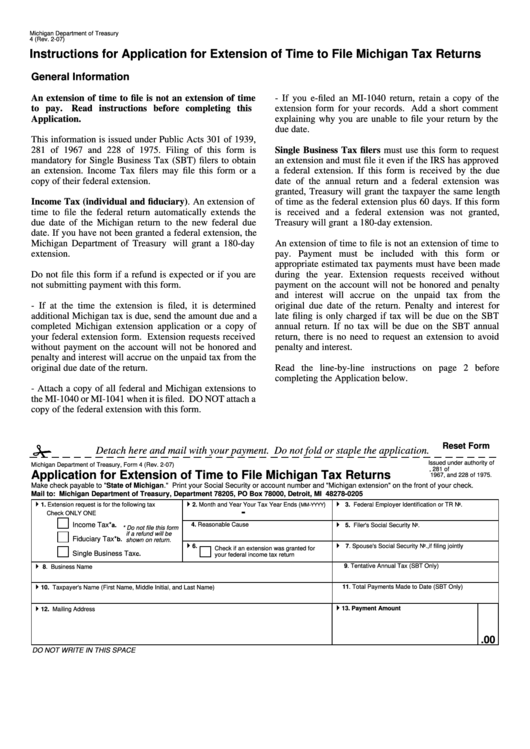

Reset Form

Detach here and mail with your payment. Do not fold or staple the application.

Issued under authority of

Michigan Department of Treasury, Form 4 (Rev. 2-07)

P.A. 301 of 1939, 281 of

Application for Extension of Time to File Michigan Tax Returns

1967, and 228 of 1975.

Make check payable to "State of Michigan." Print your Social Security or account number and "Michigan extension" on the front of your check.

Mail to: Michigan Department of Treasury, Department 78205, PO Box 78000, Detroit, MI 48278-0205

1. Extension request is for the following tax

2. Month and Year Your Tax Year Ends (

)

3. Federal Employer Identification or TR No.

MM-YYYY

-

Check ONLY ONE

4. Reasonable Cause

Income Tax*

a.

5. Filer's Social Security No.

* Do not file this form

if a refund will be

Fiduciary Tax*

b.

shown on return.

6.

7. Spouse's Social Security No., if filing jointly

Check if an extension was granted for

Single Business Tax

c.

your federal income tax return

9. Tentative Annual Tax (SBT Only)

8. Business Name

11. Total Payments Made to Date (SBT Only)

10. Taxpayer's Name (First Name, Middle Initial, and Last Name)

13. Payment Amount

12. Mailing Address

.00

DO NOT WRITE IN THIS SPACE

1

1