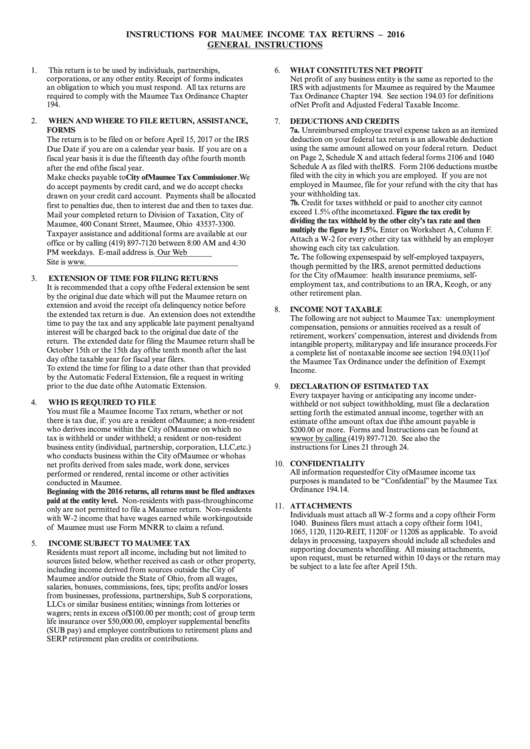

Instructions For Maumee Income Tax Returns - 2016

ADVERTISEMENT

INSTRUCTIONS FOR MAUMEE INCOME TAX RETURNS – 2016

GENERAL INSTRUCTIONS

WHAT CONSTITUTES NET PROFIT

1.

This return is to be used by individuals, partnerships,

6.

corporations, or any other entity. Receipt of forms indicates

Net profit of any business entity is the same as reported to the

an obligation to which you must respond. All tax returns are

IRS with adjustments for Maumee as required by the Maumee

required to comply with the Maumee Tax Ordinance Chapter

Tax Ordinance Chapter 194. See section 194.03 for definitions

194.

of Net Profit and Adjusted Federal Taxable Income.

WHEN AND WHERE TO FILE RETURN, ASSISTANCE,

2.

7.

DEDUCTIONS AND CREDITS

FORMS

7a. Unreimbursed employee travel expense taken as an itemized

deduction on your federal tax return is an allowable deduction

The return is to be filed on or before April 15, 2017 or the IRS

using the same amount allowed on your federal return. Deduct

Due Date if you are on a calendar year basis. If you are on a

on Page 2, Schedule X and attach federal forms 2106 and 1040

fiscal year basis it is due the fifteenth day of the fourth month

Schedule A as filed with the IRS. Form 2106 deductions must be

after the end of the fiscal year.

filed with the city in which you are employed. If you are not

Make checks payable to City of Maumee Tax Commissioner. We

employed in Maumee, file for your refund with the city that has

do accept payments by credit card, and we do accept checks

your withholding tax.

drawn on your credit card account. Payments shall be allocated

7b. Credit for taxes withheld or paid to another city cannot

first to penalties due, then to interest due and then to taxes due.

exceed 1.5% of the income taxed. Figure the tax credit by

Mail your completed return to Division of Taxation, City of

dividing the tax withheld by the other city’s tax rate and then

Maumee, 400 Conant Street, Maumee, Ohio 43537-3300.

multiply the figure by 1.5%. Enter on Worksheet A, Column F.

Taxpayer assistance and additional forms are available at our

Attach a W-2 for every other city tax withheld by an employer

office or by calling (419) 897-7120 between 8:00 AM and 4:30

showing each city tax calculation.

PM weekdays. E-mail address is . Our Web

7c. The following expenses paid by self-employed taxpayers,

Site is

though permitted by the IRS, are not permitted deductions

for the City of Maumee: health insurance premiums, self-

EXTENSION OF TIME FOR FILING RETURNS

3.

employment tax, and contributions to an IRA, Keogh, or any

It is recommended that a copy of the Federal extension be sent

other retirement plan.

by the original due date which will put the Maumee return on

extension and avoid the receipt of a delinquency notice before

8.

INCOME NOT TAXABLE

the extended tax return is due. An extension does not extend the

The following are not subject to Maumee Tax: unemployment

time to pay the tax and any applicable late payment penalty and

compensation, pensions or annuities received as a result of

interest will be charged back to the original due date of the

retirement, workers’ compensation, interest and dividends from

return. The extended date for filing the Maumee return shall be

intangible property, military pay and life insurance proceeds. For

October 15th or the 15th day of the tenth month after the last

a complete list of nontaxable income see section 194.03(11) of

day of the taxable year for fiscal year filers.

the Maumee Tax Ordinance under the definition of Exempt

To extend the time for filing to a date other than that provided

Income.

by the Automatic Federal Extension, file a request in writing

prior to the due date of the Automatic Extension.

DECLARATION OF ESTIMATED TAX

9.

Every taxpayer having or anticipating any income under-

4.

WHO IS REQUIRED TO FILE

withheld or not subject to withholding, must file a declaration

You must file a Maumee Income Tax return, whether or not

setting forth the estimated annual income, together with an

there is tax due, if: you are a resident of Maumee; a non-resident

estimate of the amount of tax due if the amount payable is

who derives income within the City of Maumee on which no

$200.00 or more. Forms and Instructions can be found at

tax is withheld or under withheld; a resident or non-resident

or by calling (419) 897-7120. See also the

business entity (individual, partnership, corporation, LLC, etc.)

instructions for Lines 21 through 24.

who conducts business within the City of Maumee or who has

10. CONFIDENTIALITY

net profits derived from sales made, work done, services

All information requested for City of Maumee income tax

performed or rendered, rental income or other activities

purposes is mandated to be “Confidential” by the Maumee Tax

conducted in Maumee.

Ordinance 194.14.

Beginning with the 2016 returns, all returns must be filed and taxes

paid at the entity level. Non-residents with pass-through income

11. ATTACHMENTS

only are not permitted to file a Maumee return. Non-residents

Individuals must attach all W-2 forms and a copy of their Form

with W-2 income that have wages earned while working outside

1040. Business filers must attach a copy of their form 1041,

of Maumee must use Form MNRR to claim a refund.

1065, 1120, 1120-REIT, 1120F or 1120S as applicable. To avoid

delays in processing, taxpayers should include all schedules and

5.

INCOME SUBJECT TO MAUMEE TAX

supporting documents when filing. All missing attachments,

Residents must report all income, including but not limited to

upon request, must be returned within 10 days or the return may

sources listed below, whether received as cash or other property,

be subject to a late fee after April 15th.

including income derived from sources outside the City of

Maumee and/or outside the State of Ohio, from all wages,

salaries, bonuses, commissions, fees, tips; profits and/or losses

from businesses, professions, partnerships, Sub S corporations,

LLCs or similar business entities; winnings from lotteries or

wagers; rents in excess of $100.00 per month; cost of group term

life insurance over $50,000.00, employer supplemental benefits

(SUB pay) and employee contributions to retirement plans and

SERP retirement plan credits or contributions.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2