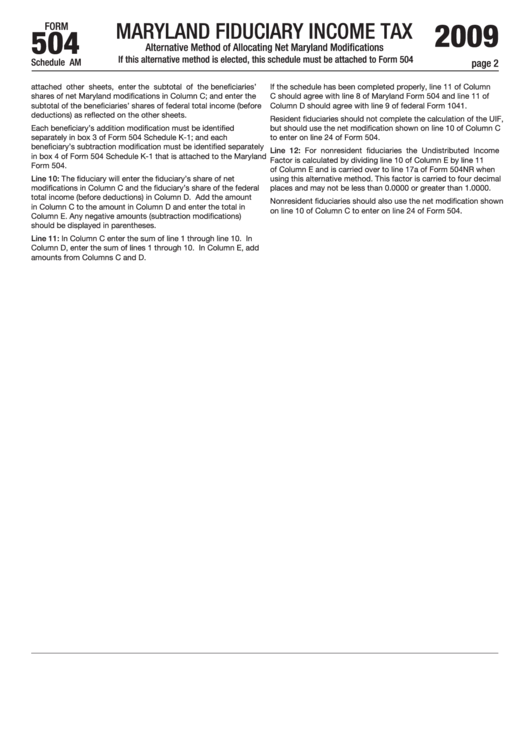

Form 504 - Schedule Am - Maryland Fiduciary Income Tax - 2009

ADVERTISEMENT

2009

MARYLAND FIDUCIARY INCOME TAX

FORM

504

Alternative Method of Allocating Net Maryland Modifications

If this alternative method is elected, this schedule must be attached to Form 504

Schedule AM

page 2

attached other sheets, enter the subtotal of the beneficiaries’

If the schedule has been completed properly, line 11 of Column

shares of net Maryland modifications in Column C; and enter the

C should agree with line 8 of Maryland Form 504 and line 11 of

subtotal of the beneficiaries’ shares of federal total income (before

Column D should agree with line 9 of federal Form 1041.

deductions) as reflected on the other sheets.

Resident fiduciaries should not complete the calculation of the UIF,

Each beneficiary’s addition modification must be identified

but should use the net modification shown on line 10 of Column C

separately in box 3 of Form 504 Schedule K-1; and each

to enter on line 24 of Form 504.

beneficiary’s subtraction modification must be identified separately

Line 12: For nonresident fiduciaries the Undistributed Income

in box 4 of Form 504 Schedule K-1 that is attached to the Maryland

Factor is calculated by dividing line 10 of Column E by line 11

Form 504.

of Column E and is carried over to line 17a of Form 504NR when

Line 10: The fiduciary will enter the fiduciary’s share of net

using this alternative method. This factor is carried to four decimal

modifications in Column C and the fiduciary’s share of the federal

places and may not be less than 0.0000 or greater than 1.0000.

total income (before deductions) in Column D. Add the amount

Nonresident fiduciaries should also use the net modification shown

in Column C to the amount in Column D and enter the total in

on line 10 of Column C to enter on line 24 of Form 504.

Column E. Any negative amounts (subtraction modifications)

should be displayed in parentheses.

Line 11: In Column C enter the sum of line 1 through line 10. In

Column D, enter the sum of lines 1 through 10. In Column E, add

amounts from Columns C and D.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1