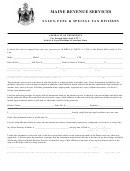

Form St-A-126 - Affidavit Of Exemption - Sales/excise Tax Division Page 2

ADVERTISEMENT

GENERAL RESTRICTIONS FOR USE OF THIS AFFIDAVIT OF EXEMPTION

This affidavit is to be retained in the records of the seller to document the qualification of exemption of any sale claimed

exempt under 36 M.R.S.A. § 2013(3). It must be accompanied by a copy of the purchaser's Certificate of Exemption

issued by Maine Revenue Services, valid at the time of sale. The seller must retain an Affidavit and a copy of the exemption

card held by each person to whom exempt sales are made. A separate Affidavit or copy of the exemption card is not required

for each individual sale. The invoice must be appropriately marked to indicate the exempt sale. This requirement is satisfied

by the purchaser’s exemption number and the words “Maine Sales Tax Exempt.”

This affidavit must be taken in good faith by the seller. The good faith of the seller will be questioned if the seller knows, or

has reason to know, that the person making the purchase is not the holder of the Certificate of Exemption, or that the machinery

or equipment purchased will not be used by the purchaser directly and primarily in the commercial activity as indicated on the

form, or that the fuel or electricity purchased will not be used by the purchaser for qualifying activities or support operations.

This affidavit is valid for purchases of depreciable machinery or equipment, including repair parts for qualifying machinery or

equipment, used directly and primarily in commercial agricultural production, commercial fishing, commercial aquacultural

production, or commercial wood harvesting; fuel purchased on or after January 1, 2017; and electricity purchased for use in the

commercial activity as indicated on the affidavit.

This affidavit is not to be used for the purchase of the following items:

(1) Machinery or equipment not 100% depreciable for Federal Income Tax purposes.

(2) Items not commonly used in commercial agricultural production, commercial fishing, commercial aquacultural

production, or commercial wood harvesting, such as lawn and garden tractors, fork lift trucks, lag tractors, backhoe

tractors, computers, etc.

(3) Motor vehicles including all terrain vehicles (ATVs) and snowmobiles.

(4) Attachments for motor vehicles such as fertilizer bodies and potato bulk bodies.

(5) Trailers.

(6) Materials to be incorporated into real property such as building materials, heating systems and ventilating systems.

(7) Silos.

(8) Consumable tools and supplies such as motor oil and other lubricants, coolants, solvents, cleaning supplies,

clothing, hydraulic fluid, welding supplies, and welding gases.

Misuse of Affidavit of Exemption

Purchasers who avoid payment of tax through deliberate misuse of this affidavit of exemption will be subject to prosecution.

Additional Information

Refer to Instructional Bulletin No. 59 (Farming, Fishing and Wood Harvesting) for further details regarding qualifications and

requirements. Instructional Bulletins may be viewed at Requests

for information on specific situations should be in writing, should contain full information as to the situation in question and

should be directed to:

MAINE REVENUE SERVICES

SALES, FUEL & SPECIAL TAX DIVISION

P.O. BOX 1060

AUGUSTA, MAINE 04332-1060

TEL. NO. (207) 624-9693

Or visit our website at:

ST-A-126

01/01/2017

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2