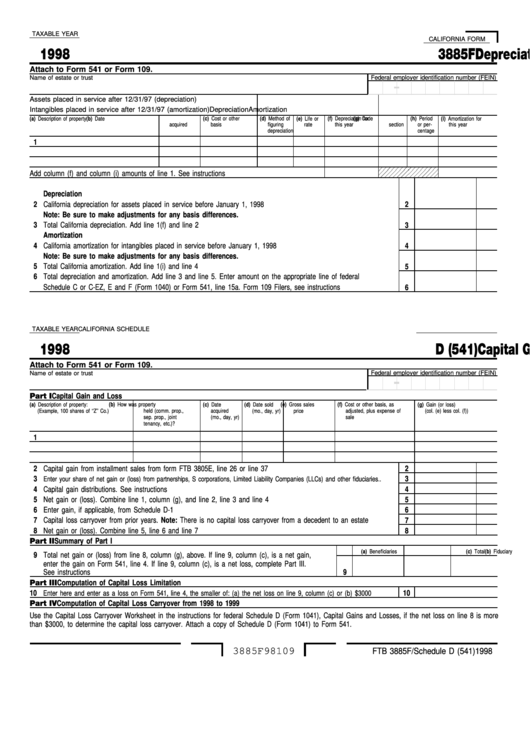

TAXABLE YEAR

CALIFORNIA FORM

1998

Depreciation and Amortization

3885F

Attach to Form 541 or Form 109.

Federal employer identification number (FEIN)

Name of estate or trust

Assets placed in service after 12/31/97 (depreciation)

Intangibles placed in service after 12/31/97 (amortization)

Depreciation

Amortization

(a) Description of property

(b) Date

(c) Cost or other

(d) Method of

(e) Life or

(f) Depreciation for

(g) Code

(h) Period

(i) Amortization for

acquired

basis

figuring

rate

this year

section

or per-

this year

depreciation

centage

1

Add column (f) and column (i) amounts of line 1. See instructions . . . . . . . . . . . . . . . . . . .

Depreciation

2 California depreciation for assets placed in service before January 1, 1998. . . . . . . . . . . . . . . . . . . . . . . . . .

2

Note: Be sure to make adjustments for any basis differences.

3 Total California depreciation. Add line 1(f) and line 2 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

3

Amortization

4 California amortization for intangibles placed in service before January 1, 1998 . . . . . . . . . . . . . . . . . . . . . . .

4

Note: Be sure to make adjustments for any basis differences.

5 Total California amortization. Add line 1(i) and line 4 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

5

6 Total depreciation and amortization. Add line 3 and line 5. Enter amount on the appropriate line of federal

Schedule C or C-EZ, E and F (Form 1040) or Form 541, line 15a. Form 109 Filers, see instructions . . . . . . . . . . .

6

TAXABLE YEAR

CALIFORNIA SCHEDULE

1998

Capital Gain and Loss

D (541)

Attach to Form 541 or Form 109.

Name of estate or trust

Federal employer identification number (FEIN)

Part I

Capital Gain and Loss

(a) Description of property:

(b) How was property

(c) Date

(d) Date sold

(e) Gross sales

(f) Cost or other basis, as

(g) Gain (or loss)

(Example, 100 shares of ‘‘Z’’ Co.)

held (comm. prop.,

acquired

(mo., day, yr)

price

adjusted, plus expense of

(col. (e) less col. (f))

sep. prop., joint

(mo., day, yr)

sale

tenancy, etc.)?

1

2 Capital gain from installment sales from form FTB 3805E, line 26 or line 37 . . . . . . . . . . . . . . . . . . . . . . . .

2

3

3

Enter your share of net gain or (loss) from partnerships, S corporations, Limited Liability Companies (LLCs) and other fiduciaries . .

4 Capital gain distributions. See instructions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

4

5 Net gain or (loss). Combine line 1, column (g), and line 2, line 3 and line 4 . . . . . . . . . . . . . . . . . . . . . . . .

5

6 Enter gain, if applicable, from Schedule D-1 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

6

7 Capital loss carryover from prior years. Note: There is no capital loss carryover from a decedent to an estate . . . . .

7

8 Net gain or (loss). Combine line 5, line 6 and line 7 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

8

Part II

Summary of Part I

(a) Beneficiaries

(b) Fiduciary

(c) Total

9 Total net gain or (loss) from line 8, column (g), above. If line 9, column (c), is a net gain,

enter the gain on Form 541, line 4. If line 9, column (c), is a net loss, complete Part III.

See instructions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

9

Part III

Computation of Capital Loss Limitation

10

10

Enter here and enter as a loss on Form 541, line 4, the smaller of: (a) the net loss on line 9, column (c) or (b) $3000 . . . .

Computation of Capital Loss Carryover from 1998 to 1999

Part IV

Use the Capital Loss Carryover Worksheet in the instructions for federal Schedule D (Form 1041), Capital Gains and Losses, if the net loss on line 8 is more

than $3000, to determine the capital loss carryover. Attach a copy of Schedule D (Form 1041) to Form 541.

3885F98109

FTB 3885F/Schedule D (541) 1998

1

1