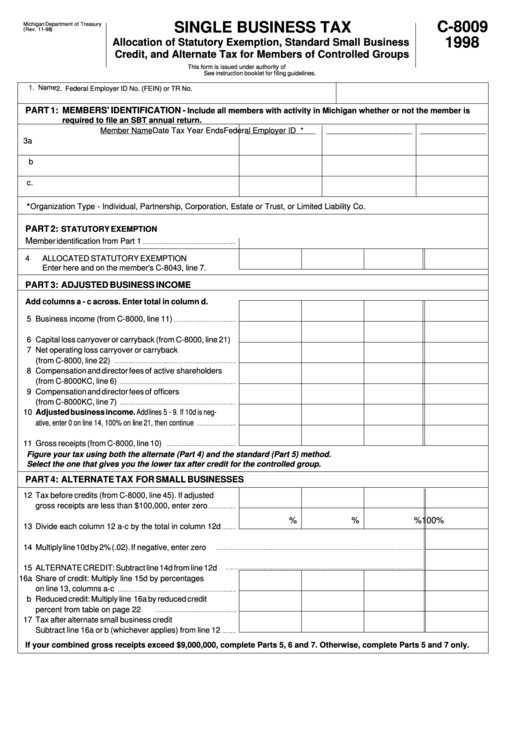

C-8009

SINGLE BUSINESS TAX

Michigan Department of Treasury

(Rev. 11-98)

1998

Allocation of Statutory Exemption, Standard Small Business

Credit, and Alternate Tax for Members of Controlled Groups

This form is issued under authority of P.A. 228 of 1975.

See instruction booklet for filing guidelines.

1. Name

2. Federal Employer ID No. (FEIN) or TR No.

PART 1:

MEMBERS' IDENTIFICATION -

Include all members with activity in Michigan whether or not the member is

required to file an SBT annual return.

Member Name

Date Tax Year Ends

Federal Employer ID No. Organization Type*

3a

b

c.

*Organization Type - Individual, Partnership, Corporation, Estate or Trust, or Limited Liability Co.

PART 2:

STATUTORY EXEMPTION

Me

a.

b.

c.

d. Total

mber identification from Part 1

4

ALLOCATED STATUTORY EXEMPTION

Enter here and on the member's C-8043, line 7.

PART 3: ADJUSTED BUSINESS INCOME

Add columns a - c across. Enter total in column d.

5

Business income (from C-8000, line 11)

6

Capital loss carryover or carryback (from C-8000, line 21)

7

Net operating loss carryover or carryback

(from C-8000, line 22)

8

Compensation and director fees of active shareholders

(from C-8000KC, line 6)

9

Compensation and director fees of officers

(from C-8000KC, line 7)

10

Adjusted business income. Add lines 5 - 9. If 10d is neg-

ative, enter 0 on line 14, 100% on line 21, then continue

11

Gross receipts (from C-8000, line 10)

Figure your tax using both the alternate (Part 4) and the standard (Part 5) method.

Select the one that gives you the lower tax after credit for the controlled group.

PART 4: ALTERNATE TAX FOR SMALL BUSINESSES

12

Tax before credits (from C-8000, line 45). If adjusted

gross receipts are less than $100,000, enter zero

%

%

%

100%

13

Divide each column 12 a-c by the total in column 12d

14

Multiply line 10d by 2% (.02). If negative, enter zero

15

ALTERNATE CREDIT: Subtract line 14d from line 12d

16a

Share of credit: Multiply line 15d by percentages

on line 13, columns a-c

b

Reduced credit: Multiply line 16a by reduced credit

percent from table on page 22

17

Tax after alternate small business credit

Subtract line 16a or b (whichever applies) from line 12

If your combined gross receipts exceed $9,000,000, complete Parts 5, 6 and 7. Otherwise, complete Parts 5 and 7 only.

www. treas. state. mi. us

1

1 2

2