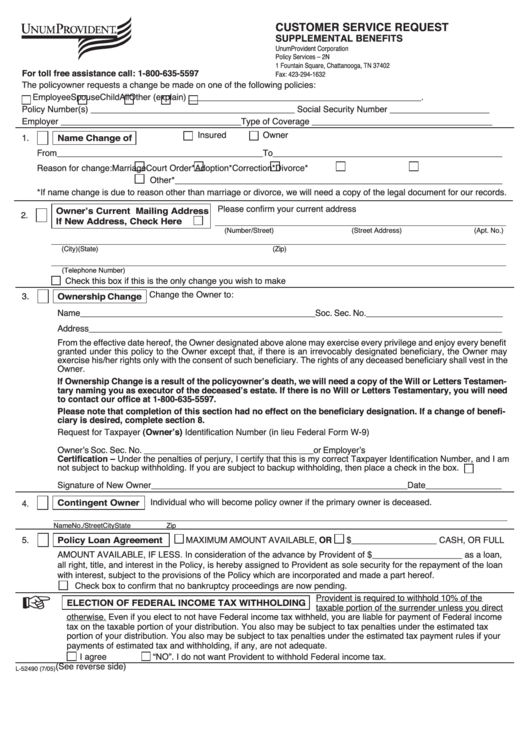

CUSTOMER SERVICE REQUEST

SUPPLEMENTAL BENEFITS

UnumProvident Corporation

Policy Services – 2N

1 Fountain Square, Chattanooga, TN 37402

For toll free assistance call: 1-800-635-5597

Fax: 423-294-1632

The policyowner requests a change be made on one of the following policies:

Employee

Spouse

Child

All

Other (explain) _________________________________________________.

Policy Number(s) ___________________________________________ Social Security Number _____________________

Employer ______________________________________Type of Coverage ______________________________________

Insured

Owner

1.

Name Change of

From____________________________________________To_________________________________________________

Reason for change:

Marriage

Court Order*

Adoption*

Correction*

Divorce*

Other*_____________________________________________________________________

*If name change is due to reason other than marriage or divorce, we will need a copy of the legal document for our records.

Please confirm your current address

Owner’s Current Mailing Address

2.

If New Address, Check Here

(Number/Street)

(Street Address)

(Apt. No.)

(City)

(State)

(Zip)

(Telephone Number)

Check this box if this is the only change you wish to make

Change the Owner to:

3.

Ownership Change

Name__________________________________________________Soc. Sec. No._____________________________

Address________________________________________________________________________________________

From the effective date hereof, the Owner designated above alone may exercise every privilege and enjoy every benefit

granted under this policy to the Owner except that, if there is an irrevocably designated beneficiary, the Owner may

exercise his/her rights only with the consent of such beneficiary. The rights of any deceased beneficiary shall vest in the

Owner.

If Ownership Change is a result of the policyowner’s death, we will need a copy of the Will or Letters Testamen-

tary naming you as executor of the deceased’s estate. If there is no Will or Letters Testamentary, you will need

to contact our office at 1-800-635-5597.

Please note that completion of this section had no effect on the beneficiary designation. If a change of benefi-

ciary is desired, complete section 8.

Request for Taxpayer (Owner’s) Identification Number (in lieu Federal Form W-9)

Owner’s Soc. Sec. No. ____________________________________or Employer’s I.D. Number___________________

Certification – Under the penalties of perjury, I certify that this is my correct Taxpayer Identification Number, and I am

not subject to backup withholding. If you are subject to backup withholding, then place a check in the box.

Signature of New Owner______________________________________________________Date________________

Individual who will become policy owner if the primary owner is deceased.

Contingent Owner

4.

Name

No./Street

City

State

Zip

5.

Policy Loan Agreement

MAXIMUM AMOUNT AVAILABLE, OR

$__________________ CASH, OR FULL

AMOUNT AVAILABLE, IF LESS. In consideration of the advance by Provident of $___________________ as a loan,

all right, title, and interest in the Policy, is hereby assigned to Provident as sole security for the repayment of the loan

with interest, subject to the provisions of the Policy which are incorporated and made a part hereof.

Check box to confirm that no bankruptcy proceedings are now pending.

☞

Provident is required to withhold 10% of the

ELECTION OF FEDERAL INCOME TAX WITHHOLDING

taxable portion of the surrender unless you direct

otherwise. Even if you elect to not have Federal income tax withheld, you are liable for payment of Federal income

tax on the taxable portion of your distribution. You also may be subject to tax penalties under the estimated tax

portion of your distribution. You also may be subject to tax penalties under the estimated tax payment rules if your

payments of estimated tax and withholding, if any, are not adequate.

I agree

“NO”. I do not want Provident to withhold Federal income tax.

(See reverse side)

L-52490 (7/05)

1

1 2

2