Form Pte-B - Allocated Nonbusiness Income Taxable To Owners - 2004

ADVERTISEMENT

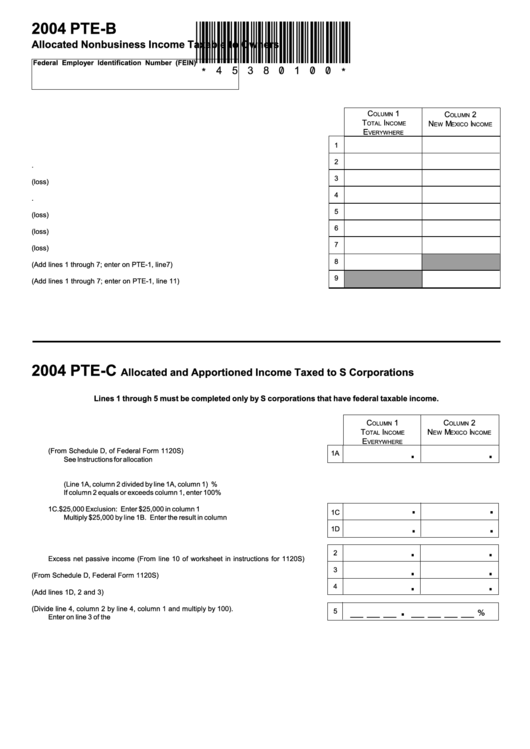

2004 PTE-B

*45380100*

Allocated Nonbusiness Income Taxable to Owners

Federal Employer Identification Number (FEIN)

C

1

C

2

OLUMN

OLUMN

T

I

N

M

I

OTAL

NCOME

EW

EXICO

NCOME

E

VERYWHERE

1

1.

Net nonbusiness dividends ...................................................................................................

2

2.

Net nonbusiness interest ......................................................................................................

3

3.

Net nonbusiness rents (loss) ................................................................................................

4

4.

Net nonbusiness royalties .....................................................................................................

5

5.

Net nonbusiness profit sale of assets (loss) .........................................................................

6

6.

Net nonbusiness partnership income (loss) ..........................................................................

7

7.

Other net nonbusiness income (loss) ...................................................................................

8

8.

Total allocated income (Add lines 1 through 7; enter on PTE-1, line7) ..............................

9

9.

Total New Mexico allocated income (Add lines 1 through 7; enter on PTE-1, line 11) ......

2004 PTE-C

Allocated and Apportioned Income Taxed to S Corporations

Lines 1 through 5 must be completed only by S corporations that have federal taxable income.

C

1

C

2

OLUMN

OLUMN

T

I

N

M

I

OTAL

NCOME

EW

EXICO

NCOME

E

.

.

1.

Capital Gains

VERYWHERE

1A. Net capital gains (From Schedule D, of Federal Form 1120S)

1A

See Instructions for allocation rules. .............................................................................

1B. Percentage of New Mexico capital gains

(Line 1A, column 2 divided by line 1A, column 1) ..................................... ________%

If column 2 equals or exceeds column 1, enter 100%

.

.

1C. $25,000 Exclusion: Enter $25,000 in column 1

1C

.

.

Multiply $25,000 by line 1B. Enter the result in column 2 .............................................

1D

1D. SUBTRACT line 1C from line 1A. ................................................................................

.

.

2.

Passive Income

2

Excess net passive income (From line 10 of worksheet in instructions for 1120S). .......

.

.

3

.

.

3.

Net recognized built-in gain (From Schedule D, Federal Form 1120S) ..............................

4

4.

Total (Add lines 1D, 2 and 3) ..............................................................................................

.

5.

New Mexico percentage (Divide line 4, column 2 by line 4, column 1 and multiply by 100).

5

___ ___ ___

___ ___ ___ ___ %

Enter on line 3 of the PTE ................................................................................

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2