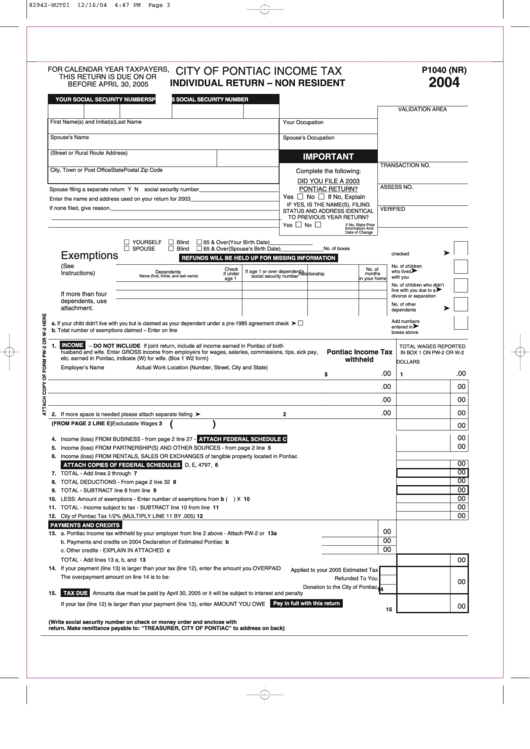

Form P1040 (Nr) - City Of Pontiac Income Tax, Individual Return - Non Resident - 2004

ADVERTISEMENT

82942-NUT01

12/16/04

4:47 PM

Page 3

FOR CALENDAR YEAR TAXPAYERS,

CITY OF PONTIAC INCOME TAX

P1040 (NR)

THIS RETURN IS DUE ON OR

2004

INDIVIDUAL RETURN – NON RESIDENT

BEFORE APRIL 30, 2005

YOUR SOCIAL SECURITY NUMBER

SPOUSE'S SOCIAL SECURITY NUMBER

VALIDATION AREA

First Name(s) and Initial(s)

Last Name

Your Occupation

Spouse's Name

Spouse’s Occupation

(Street or Rural Route Address)

P.O. Box

IMPORTANT

TRANSACTION NO.

City, Town or Post Office

State

Postal Zip Code

Complete the following:

DID YOU FILE A 2003

ASSESS NO.

PONTIAC RETURN?

Spouse filing a separate return Y N

social security number __________________________

Yes □ No □ If No, Explain

Enter the name and address used on your return for 2003 _____________________________

IF YES, IS THE NAME(S), FILING

If none filed, give reason. _______________________________________________________

VERIFIED

STATUS AND ADDRESS IDENTICAL

___________________________________________________________________________

TO PREVIOUS YEAR RETURN?

□

□

Yes

No

If No, State Prior

Information And

Date of Change

□ YOURSELF

□ Blind

□ 65 & Over

(Your Birth Date)______________

□ SPOUSE

□ Blind

□ 65 & Over

(Spouse’s Birth Date)______________

No. of boxes

➤

Exemptions

checked

REFUNDS WILL BE HELD UP FOR MISSING INFORMATION

(See

No. of children

➤

Check

No. of

If age 1 or over dependent's

who lived

Dependents

Instructions)

if under

Relationship

months

social security number

Name (first, initial, and last name)

with you

age 1

in your home

No. of children who didn't

➤

live with you due to a

If more than four

divorce or separation

dependents, use

No. of other

➤

attachment.

dependents

a. If your child didn't live with you but is claimed as your dependent under a pre-1985 agreement check here ....................................................➤ □

Add numbers

➤

entered in

b. Total number of exemptions claimed – Enter on line 10 ............................................................................................................................................

boxes above

INCOME

1.

– DO NOT INCLUDE S.U.B. PAY If joint return, include all income earned in Pontiac of both

TOTAL WAGES REPORTED

Pontiac Income Tax

husband and wife. Enter GROSS income from employers for wages, salaries, commissions, tips, sick pay,

IN BOX 1 ON PW-2 OR W-2

etc. earned in Pontiac, indicate (W) for wife. (Box 1 W2 form)

withheld

DOLLARS

Employer's Name

Actual Work Location (Number, Street, City and State)

.00

.00

$

1

.00

00

.00

00

.00

00

TOTALS ➤

2. If more space is needed please attach separate listing sheet.

2

(

)

3. LESS EXCLUDABLE PORTION OF WAGES IN LINE 1 EARNED OUTSIDE PONTIAC (FROM PAGE 2 LINE E)

Excludable Wages 3

00

00

4. Income (loss) FROM BUSINESS - from page 2 line 27 - ...............................................................................................................Business 4

ATTACH FEDERAL SCHEDULE C

00

5. Income (loss) FROM PARTNERSHIP(S) AND OTHER SOURCES - from page 2 line 31 ............................................Partnerships/Others 5

6. Income (loss) FROM RENTALS, SALES OR EXCHANGES of tangible property located in Pontiac

00

ATTACH COPIES OF FEDERAL SCHEDULES

D, E, 4797, ETC.......................................................................Property Sales/Rentals 6

00

7. TOTAL - Add lines 2 through 6 ...................................................................................................................................................... Sub Total 7

00

8. TOTAL DEDUCTIONS - From page 2 line 32 ............................................................................................................................ Deductions 8

00

9. TOTAL - SUBTRACT line 8 from line 7 .......................................................................................................................................................... 9

00

10. LESS: Amount of exemptions - Enter number of exemptions from b (

) X 600.00 ................................................................ Exemptions 10

00

11. TOTAL - Income subject to tax - SUBTRACT line 10 from line 9 ................................................................................................... Taxable 11

00

12. City of Pontiac Tax 1/2% (MULTIPLY LINE 11 BY .005) ...................................................................................................................... Tax 12

PAYMENTS AND CREDITS

00

13. a. Pontiac income tax withheld by your employer from line 2 above - Attach PW-2 or W-2 ..................... 13a

00

b. Payments and credits on 2004 Declaration of Estimated Pontiac Tax ..................................................... b

00

c. Other credits - EXPLAIN IN ATTACHED STATEMENT............................................................................ c

00

TOTAL - Add lines 13 a, b, and c..................................................................................................................................................................13

14. If your payment (line 13) is larger than your tax (line 12), enter the amount you OVERPAID

Applied to your 2005 Estimated Tax

The overpayment amount on line 14 is to be:

Refunded To You

00

Donation to the City of Pontiac

14

15.

TAX DUE

Amounts due must be paid by April 30, 2005 or it will be subject to interest and penalty

Pay in full with this return

If your tax (line 12) is larger than your payment (line 13), enter AMOUNT YOU OWE

00

15

(Write social security number on check or money order and enclose with

return. Make remittance payable to: “TREASURER, CITY OF PONTIAC” to address on back)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2