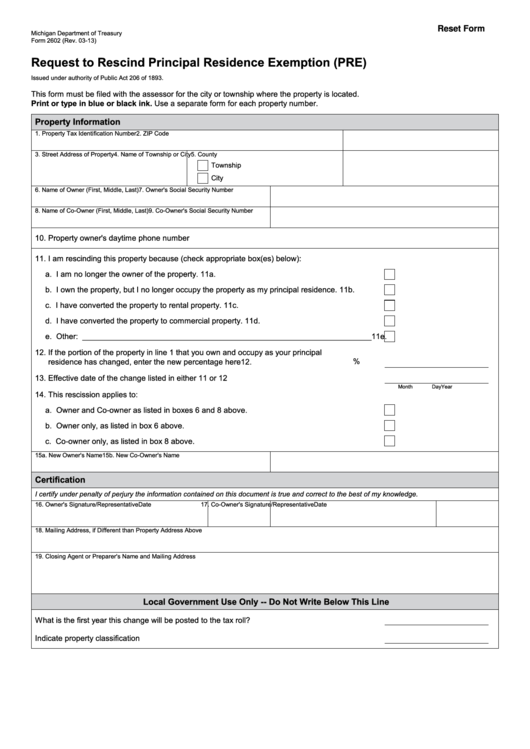

Reset Form

Michigan Department of Treasury

Form 2602 (Rev. 03-13)

Request to Rescind Principal Residence Exemption (PRE)

Issued under authority of Public Act 206 of 1893.

This form must be filed with the assessor for the city or township where the property is located.

Print or type in blue or black ink. Use a separate form for each property number.

Property Information

1. Property Tax Identification Number

2. ZIP Code

3. Street Address of Property

4. Name of Township or City

5. County

Township

City

6. Name of Owner (First, Middle, Last)

7. Owner's Social Security Number

8. Name of Co-Owner (First, Middle, Last)

9. Co-Owner's Social Security Number

10. Property owner's daytime phone number

11. I am rescinding this property because (check appropriate box(es) below):

a. I am no longer the owner of the property. ............................................................................. 11a.

b. I own the property, but I no longer occupy the property as my principal residence. ............. 11b.

c. I have converted the property to rental property. ...................................................................11c.

d. I have converted the property to commercial property. ........................................................ 11d.

e. Other: __________________________________________________________________ 11e.

12. If the portion of the property in line 1 that you own and occupy as your principal

%

residence has changed, enter the new percentage here .......................................................... 12.

13. Effective date of the change listed in either 11 or 12 ................................................................ 13.

Month

Day

Year

14. This rescission applies to:

a. Owner and Co-owner as listed in boxes 6 and 8 above. ...................................................... 14a.

b. Owner only, as listed in box 6 above. ................................................................................... 14b.

c. Co-owner only, as listed in box 8 above. .............................................................................. 14c.

15a. New Owner's Name

15b. New Co-Owner's Name

Certification

I certify under penalty of perjury the information contained on this document is true and correct to the best of my knowledge.

16. Owner's Signature/Representative

Date

17. Co-Owner's Signature/Representative

Date

18. Mailing Address, if Different than Property Address Above

19. Closing Agent or Preparer's Name and Mailing Address

Local Government Use Only -- Do Not Write Below This Line

What is the first year this change will be posted to the tax roll? ..................................................... 20.

Indicate property classification ....................................................................................................... 21.

1

1 2

2