Schedule Wv/srdtc-1 - Strategic Research And Development Tax Credit/itemization Of Property Purchased For Strategic Research And Development Tax Credit

ADVERTISEMENT

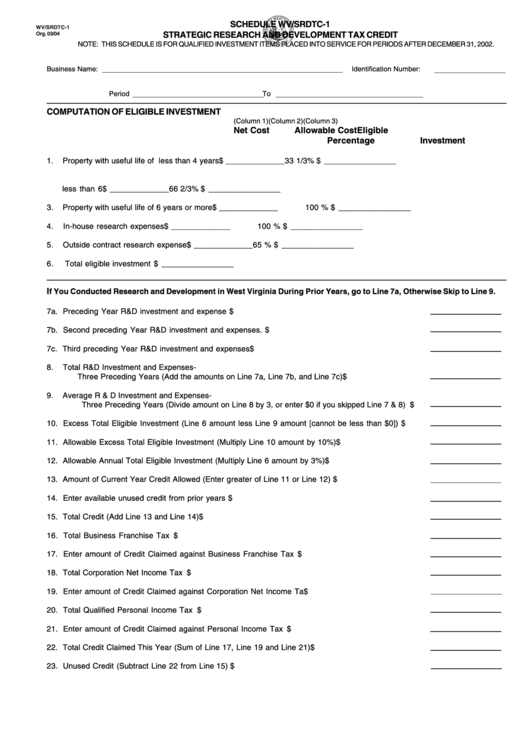

SCHEDULE WV/SRDTC-1

WV/SRDTC-1

Org. 03/04

STRATEGIC RESEARCH AND DEVELOPMENT TAX CREDIT

NOTE: THIS SCHEDULE IS FOR QUALIFIED INVESTMENT ITEMS PLACED INTO SERVICE FOR PERIODS AFTER DECEMBER 31, 2002.

Business Name:

Identification Number:

Period

To

COMPUTATION OF ELIGIBLE INVESTMENT

(Column 1)

(Column 2)

(Column 3)

Net Cost

Allowable Cost

Eligible

Percentage

Investment

1.

Property with useful life of less than 4 years

$ _____________

33 1/3%

$ ________________

2.

Property with useful life of 4 years or more but

less than 6

$ _____________

66 2/3%

$ ________________

3.

Property with useful life of 6 years or more

$ _____________

100 %

$ ________________

4.

In-house research expenses

$ _____________

100 %

$ ________________

5.

Outside contract research expense

$ _____________

65 %

$ ________________

6.

Total eligible investment

$ ________________

I

f You Conducted Research and Development in West Virginia During Prior Years, go to Line 7a, Otherwise Skip to Line 9.

7a. Preceding Year R&D investment and expense ......................................................................................... $

7b. Second preceding Year R&D investment and expenses .......................................................................... $

7c. Third preceding Year R&D investment and expenses .............................................................................. $

8.

Total R&D Investment and Expenses-

Three Preceding Years (Add the amounts on Line 7a, Line 7b, and Line 7c) ................................... $

9.

Average R & D Investment and Expenses-

Three Preceding Years (Divide amount on Line 8 by 3, or enter $0 if you skipped Line 7 & 8) ...... $

10. Excess Total Eligible Investment (Line 6 amount less Line 9 amount [cannot be less than $0]) ......... $

11. Allowable Excess Total Eligible Investment (Multiply Line 10 amount by 10%) ....................................... $

12. Allowable Annual Total Eligible Investment (Multiply Line 6 amount by 3%) ............................................ $

13. Amount of Current Year Credit Allowed (Enter greater of Line 11 or Line 12) .......................................... $

14. Enter available unused credit from prior years ......................................................................................... $

15. Total Credit (Add Line 13 and Line 14) ....................................................................................................... $

16. Total Business Franchise Tax .................................................................................................................... $

17. Enter amount of Credit Claimed against Business Franchise Tax .......................................................... $

18. Total Corporation Net Income Tax .............................................................................................................. $

19. Enter amount of Credit Claimed against Corporation Net Income Tax ................................................... $

20. Total Qualified Personal Income Tax ......................................................................................................... $

21. Enter amount of Credit Claimed against Personal Income Tax ............................................................... $

22. Total Credit Claimed This Year (Sum of Line 17, Line 19 and Line 21) ................................................... $

23. Unused Credit (Subtract Line 22 from Line 15) ........................................................................................ $

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3