Franchise Tax Computation Worksheet - Kansas Secretary Of State

ADVERTISEMENT

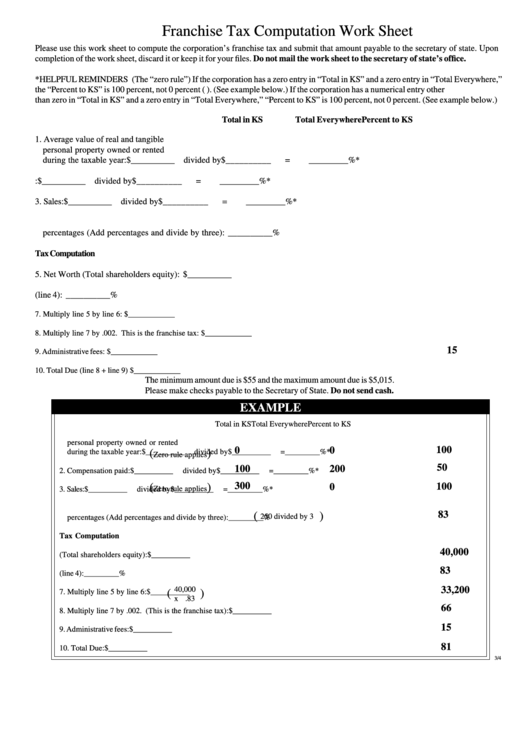

Franchise Tax Computation Work Sheet

Please use this work sheet to compute the corporation’s franchise tax and submit that amount payable to the secretary of state. Upon

completion of the work sheet, discard it or keep it for your files. Do not mail the work sheet to the secretary of state’s office.

*HELPFUL REMINDERS (The “zero rule”) If the corporation has a zero entry in “Total in KS” and a zero entry in “Total Everywhere,”

the “Percent to KS” is 100 percent, not 0 percent (K.S.A. 17-7501). (See example below.) If the corporation has a numerical entry other

than zero in “Total in KS” and a zero entry in “Total Everywhere,” “Percent to KS” is 100 percent, not 0 percent. (See example below.)

Total in KS

Total Everywhere

Percent to KS

1. Average value of real and tangible

personal property owned or rented

during the taxable year:

$__________

divided by

$__________

=

_________%*

2. Compensation paid:

$__________

divided by

$__________

=

_________%*

3. Sales:

$__________

divided by

$__________

=

_________%*

4. Average percentage of the three

percentages (Add percentages and divide by three):

__________%

Tax Computation

5. Net Worth (Total shareholders equity):

$__________

6. Average percent (line 4):

__________%

7. Multiply line 5 by line 6:

$____________

8. Multiply line 7 by .002. This is the franchise tax:

$____________

15

9. Administrative fees:

$____________

10. Total Due (line 8 + line 9)

$____________

The minimum amount due is $55 and the maximum amount due is $5,015.

Please make checks payable to the Secretary of State. Do not send cash.

EXAMPLE

Total in KS

Total Everywhere

Percent to KS

1. Average value of real and tangible

personal property owned or rented

100

0

0

during the taxable year:

(

)

$__________

divided by $__________

=

_________%*

Zero rule applies

50

100

200

2. Compensation paid:

$__________

divided by $__________

=

_________%*

300

100

(

)

0

Zero rule applies

3. Sales:

$__________

divided by $__________

=

_________%*

4. Average percentage of the three

83

(

)

250 divided by 3

percentages (Add percentages and divide by three):

_________%

Tax Computation

40,000

5. Net Worth (Total shareholders equity):

$__________

83

6. Average percent (line 4):

_________%

33,200

40,000

7. Multiply line 5 by line 6:

(

)

$__________

x .83

66

8. Multiply line 7 by .002. (This is the franchise tax):

$__________

15

9. Administrative fees:

$__________

81

10. Total Due:

$__________

3/4

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2